Get the free CUSTOMER DUE DILIGENCE GUIDE - Compliance Commission

Show details

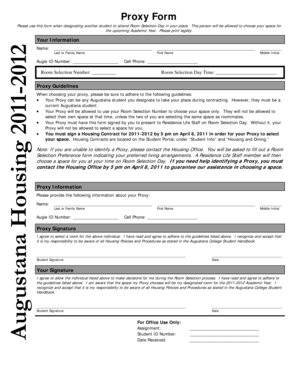

CUSTOMER DUE DILIGENCE GUIDE A Risk Based ApproachForDNFBPs SUPERVISED BY THE COMPLIANCE COMMISSION OF THE BAHAMASEffective Date: August 9th, 2019CONTENTS 1. Introduction...3 2. Purpose of this Guide....3

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign customer due diligence guide

Edit your customer due diligence guide form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your customer due diligence guide form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit customer due diligence guide online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit customer due diligence guide. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out customer due diligence guide

How to fill out customer due diligence guide

01

Step 1: Start by gathering all relevant information about the customer, such as their name, address, and contact details.

02

Step 2: Verify the customer's identity by requesting documents such as a passport or driver's license.

03

Step 3: Conduct a risk assessment to determine the level of due diligence required. This may involve evaluating factors such as the customer's location, business activities, and industry.

04

Step 4: Verify the source of funds or wealth by requesting supporting documents.

05

Step 5: Continuously monitor the customer's activities for any suspicious or unusual behavior.

06

Step 6: Document all the steps taken during the customer due diligence process, including any red flags or actions taken.

07

Step 7: Follow any specific regulatory requirements or guidelines applicable to your industry or jurisdiction.

Who needs customer due diligence guide?

01

Financial institutions such as banks and insurance companies.

02

Companies involved in high-risk industries such as gambling, cryptocurrency, or weapons trading.

03

Professionals like lawyers, accountants, and real estate agents who handle large transactions or deal with high-net-worth individuals.

04

Government agencies involved in law enforcement or anti-money laundering efforts.

05

Any organization or individual who wants to ensure compliance with regulatory requirements and mitigate the risk of financial crimes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send customer due diligence guide to be eSigned by others?

To distribute your customer due diligence guide, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for signing my customer due diligence guide in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your customer due diligence guide directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out the customer due diligence guide form on my smartphone?

Use the pdfFiller mobile app to fill out and sign customer due diligence guide on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is customer due diligence guide?

Customer due diligence guide is a set of procedures that financial institutions must follow to verify the identity of their customers and assess potential risks for money laundering and terrorist financing.

Who is required to file customer due diligence guide?

Financial institutions such as banks, credit unions, and money service businesses are required to file customer due diligence guide.

How to fill out customer due diligence guide?

To fill out customer due diligence guide, financial institutions need to collect information about customers' identity, assess risks, and keep updated records.

What is the purpose of customer due diligence guide?

The purpose of customer due diligence guide is to prevent money laundering, terrorist financing, and other financial crimes by ensuring that financial institutions know their customers and monitor their transactions.

What information must be reported on customer due diligence guide?

The information reported on customer due diligence guide includes customers' identity, address, occupation, and source of funds.

Fill out your customer due diligence guide online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Customer Due Diligence Guide is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.