Get the free TAX ABATEMENT AGRKEMF.NT fjQ - Hunt County, Texas

Show details

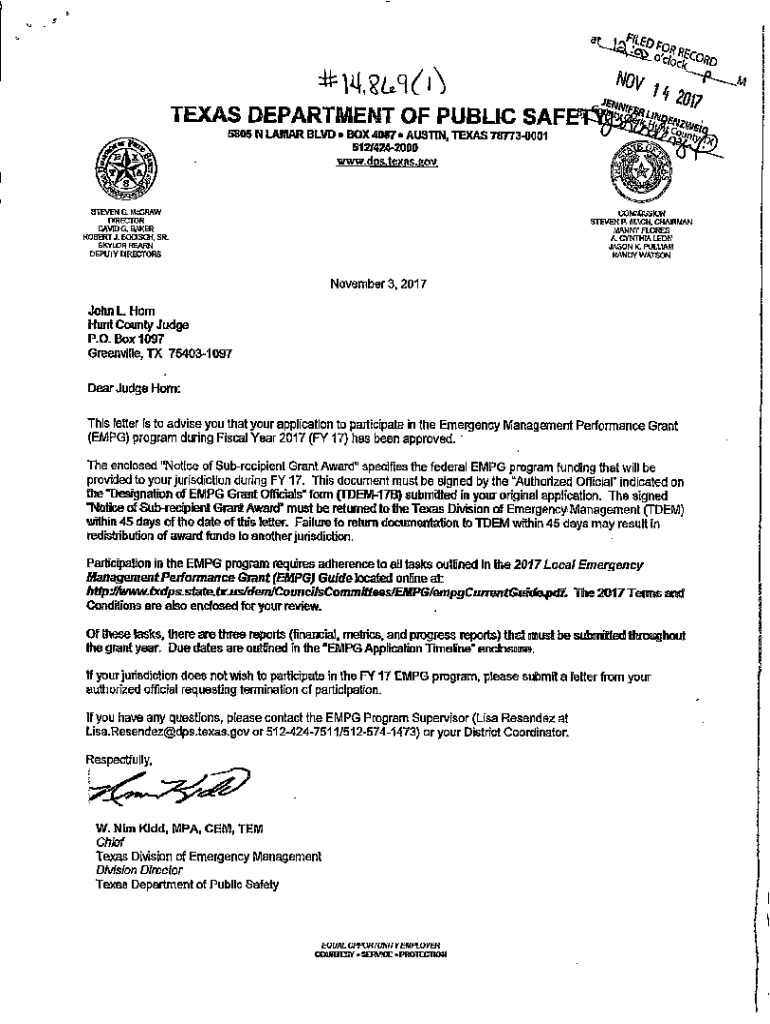

TEXAS DEPARTMENT OF CUBIC SAP* 5805 N LAMAR BLVD BOX 4087 AUSTIN. TEXAS 787730001 512H242DOO www.dps.texas.govSTEVEN C. MeCRAWCOMMISSIONDIRECTORSTEVENP. MACH, CHAIRMANDAVID O. BAKER ROBERT. Branch,

We are not affiliated with any brand or entity on this form

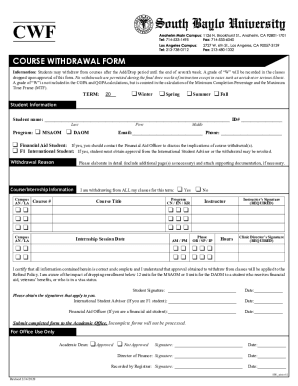

Get, Create, Make and Sign tax abatement agrkemfnt fjq

Edit your tax abatement agrkemfnt fjq form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax abatement agrkemfnt fjq form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax abatement agrkemfnt fjq online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax abatement agrkemfnt fjq. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax abatement agrkemfnt fjq

How to fill out tax abatement agrkemfnt fjq

01

To fill out a tax abatement agreement, follow these steps:

1. Obtain the tax abatement agreement form from the relevant government agency or website.

02

Read the instructions carefully to understand the eligibility criteria and requirements for the tax abatement.

03

Gather all necessary documentation, such as proof of property ownership, income details, and any other information required by the form.

04

Complete each section of the form accurately and truthfully. Provide all requested information and applicable supporting documents.

05

Double-check the form for any errors or missing information before submitting it.

06

Sign and date the tax abatement agreement as required.

07

Submit the completed form and supporting documents to the designated government office or online portal.

08

Follow up with the government agency to ensure the receipt and processing of your tax abatement agreement.

09

Keep copies of the submitted form and supporting documents for your records.

10

Await the decision or approval of your tax abatement application.

Who needs tax abatement agrkemfnt fjq?

01

Tax abatement agreements are typically sought by individuals or entities who meet certain criteria and wish to reduce their tax liability.

02

Potential beneficiaries of tax abatement agreements may include:

03

- Property owners or developers who are undertaking eligible projects that qualify for tax incentives.

04

- Businesses or industries that stimulate economic growth or create employment opportunities.

05

- Non-profit organizations or institutions engaged in activities that provide public benefits.

06

- Individuals or families meeting specific income thresholds or residing in certain designated areas with tax relief programs.

07

It is important to check the specific requirements and regulations in your jurisdiction to determine if you qualify for a tax abatement agreement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete tax abatement agrkemfnt fjq online?

Easy online tax abatement agrkemfnt fjq completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit tax abatement agrkemfnt fjq on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share tax abatement agrkemfnt fjq from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I complete tax abatement agrkemfnt fjq on an Android device?

Use the pdfFiller mobile app and complete your tax abatement agrkemfnt fjq and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

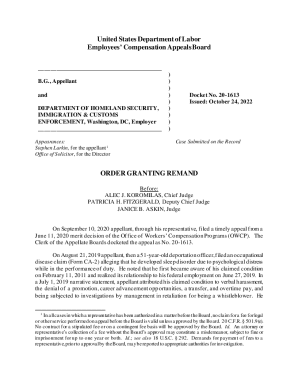

What is tax abatement agreement fjq?

Tax abatement agreement fjq is a legal agreement between a local government and a property owner where the property owner agrees to certain conditions in exchange for a reduction or elimination of property taxes for a specified period of time.

Who is required to file tax abatement agreement fjq?

Property owners who want to take advantage of tax abatement benefits are required to file a tax abatement agreement fjq with the local government.

How to fill out tax abatement agreement fjq?

Tax abatement agreement fjq can be filled out by providing detailed information about the property, the proposed improvements, and the terms of the agreement.

What is the purpose of tax abatement agreement fjq?

The purpose of tax abatement agreement fjq is to encourage property owners to make improvements to their properties by providing them with a financial incentive in the form of reduced or eliminated property taxes.

What information must be reported on tax abatement agreement fjq?

Information such as property details, proposed improvements, and the agreed upon terms must be reported on tax abatement agreement fjq.

Fill out your tax abatement agrkemfnt fjq online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Abatement Agrkemfnt Fjq is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.