UT TC-843 2020 free printable template

Show details

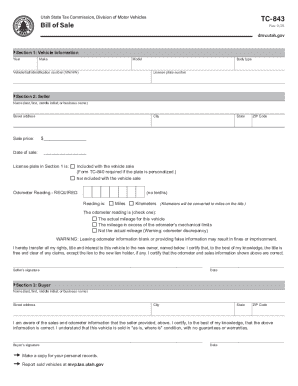

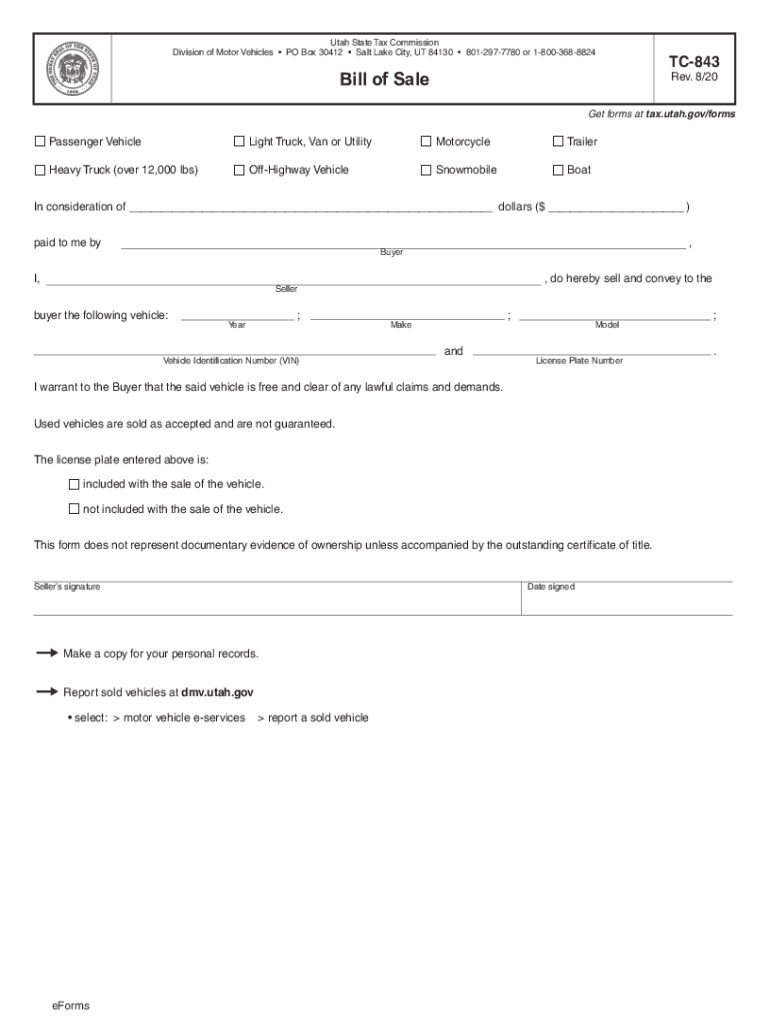

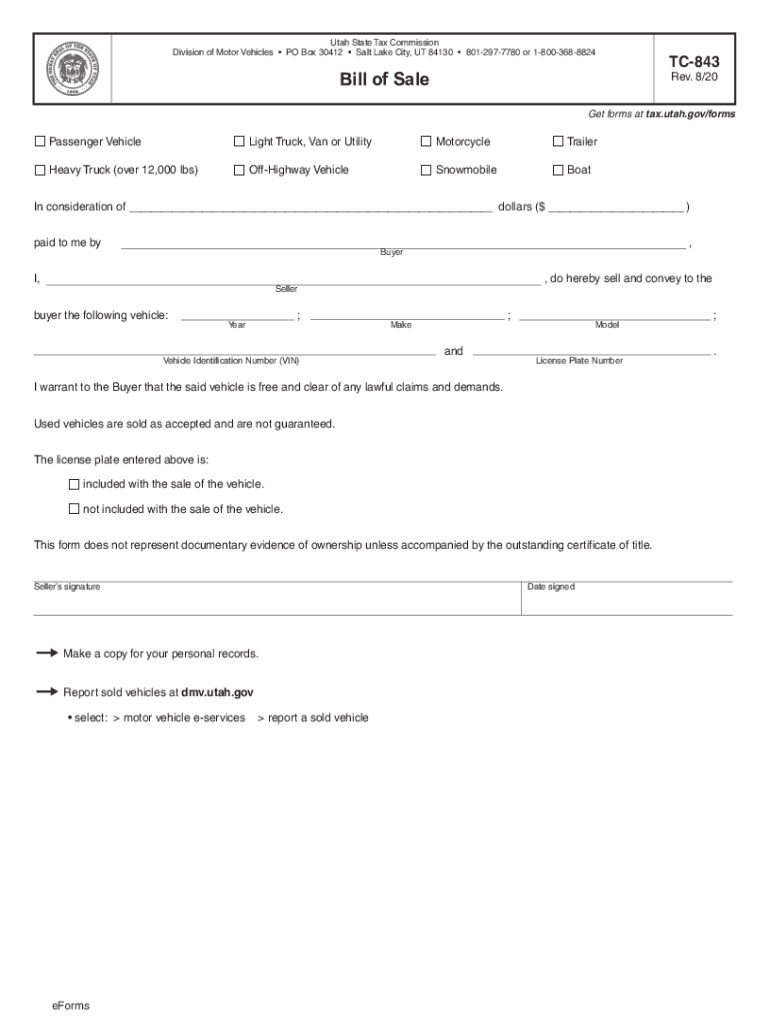

Clear form Utah State Tax Commission Division of Motor Vehicles PO Box 30412 Salt Lake City, UT 84130 8012977780 or 18003688824Bill of SaleTC843 Rev. 8/20Get forms at tax.utah.gov/forms Passenger

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT TC-843

Edit your UT TC-843 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT TC-843 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UT TC-843 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit UT TC-843. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-843 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT TC-843

How to fill out UT TC-843

01

Obtain the UT TC-843 form from the Texas Comptroller's website or local office.

02

Fill in the top section with your name, address, and the date.

03

Provide the vehicle identification information, including make, model, year, and VIN.

04

Specify the type of transaction (e.g., registration, title transfer).

05

Include the sales price of the vehicle, if applicable, and any trade-in information.

06

Complete any necessary sections regarding the seller and buyer information.

07

Sign and date the form as required.

08

Submit the completed form to your local county tax office or motor vehicle department along with any required fees.

Who needs UT TC-843?

01

Anyone purchasing a vehicle in Texas who needs to register or transfer the title of the vehicle.

02

Individuals or businesses involved in sales transactions of motor vehicles.

03

New residents in Texas who have recently purchased a vehicle.

Fill

form

: Try Risk Free

People Also Ask about

Will a bill of sale work as a title in Utah?

Although not legally required, the Utah DMV advises and provides private sellers with a bill of sale (form TC-843) to use when selling your car on your own. The bill of sale provides proof the seller has legally transferred ownership of the vehicle to the buyer.

How do you fill out a title when selling a car in Utah?

1:15 2:52 How to transfer a car title in Utah - YouTube YouTube Start of suggested clip End of suggested clip Fill out the date of sale here. And the purchase. Price. Here next print your full name here. And inMoreFill out the date of sale here. And the purchase. Price. Here next print your full name here. And in this field write your entire. Address including street address city state and zip.

How to fill out Utah State Tax Commission bill of sale?

The bill of sale should contain: name and address of the buyer; name, address and signature of the seller; complete vehicle description, including the Vehicle Identification Number (VIN); description of trade-in, if any; purchase price of the vehicle; trade-in allowance, if applicable; and. net purchase price.

Can I register with a bill of sale in Utah?

To register and title in Utah for the first time, an Application to Register/Title must be completed and required documenta- tion provided. Required documentation may include a vehicle title, bill of sale, previous registration, emission certificate or safety certificate where required.

Does a Utah bill of sale need to be notarized?

While some states require bills of sale to be witnessed by a notary public, in Utah, two private parties can sign a valid bill of sale on their own.

Does a bill of sale need to be notarized in Utah?

No. A vehicle bill of sale for a private party transfer does not need to be notarized.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my UT TC-843 in Gmail?

UT TC-843 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I complete UT TC-843 online?

pdfFiller has made filling out and eSigning UT TC-843 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make edits in UT TC-843 without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing UT TC-843 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

What is UT TC-843?

UT TC-843 is a tax form used in the State of Utah for reporting and paying taxes related to various transactions, such as sales and use taxes.

Who is required to file UT TC-843?

Businesses and individuals who engage in taxable transactions or who are liable for sales and use taxes in Utah are required to file UT TC-843.

How to fill out UT TC-843?

To fill out UT TC-843, provide your identifying information, report the total sales or use tax liability, and list any exemptions, deductions, or credits claimed before submitting it to the appropriate tax authority.

What is the purpose of UT TC-843?

The purpose of UT TC-843 is to allow taxpayers to report their tax liabilities accurately and to facilitate the collection of taxes owed to the state.

What information must be reported on UT TC-843?

Information that must be reported on UT TC-843 includes the taxpayer's identification details, total gross receipts, taxable sales, use tax liability, applicable exemptions, and any credits claimed.

Fill out your UT TC-843 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT TC-843 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.