Get the free NON-STATE FILED BUSINESS - TAMIU

Show details

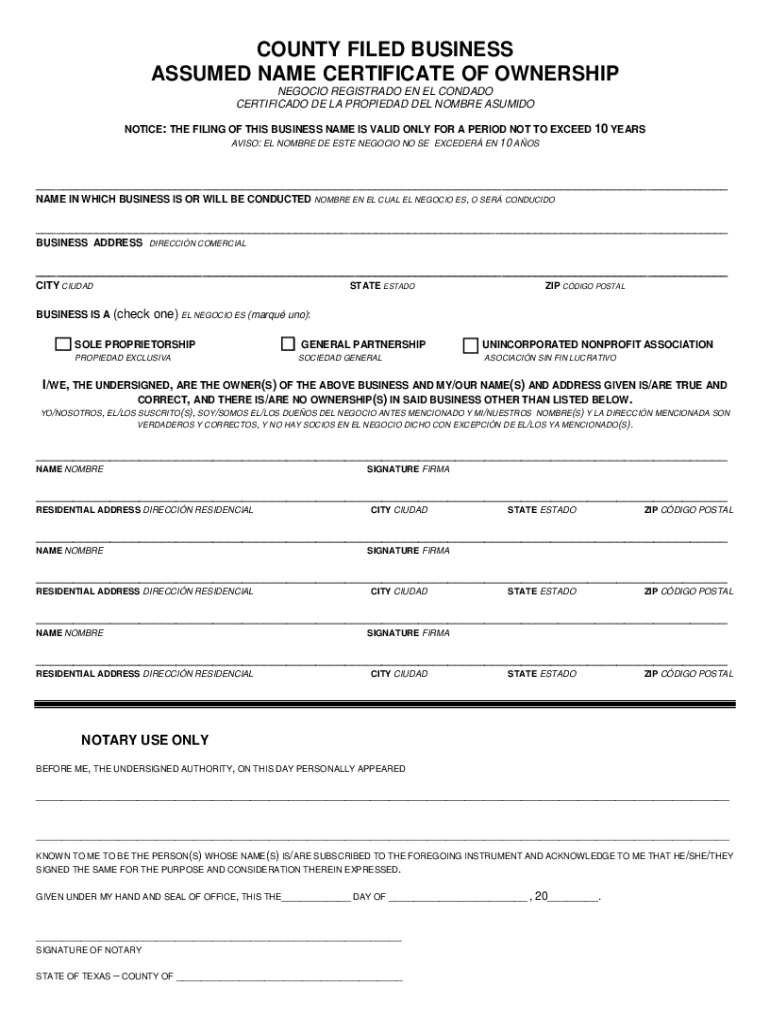

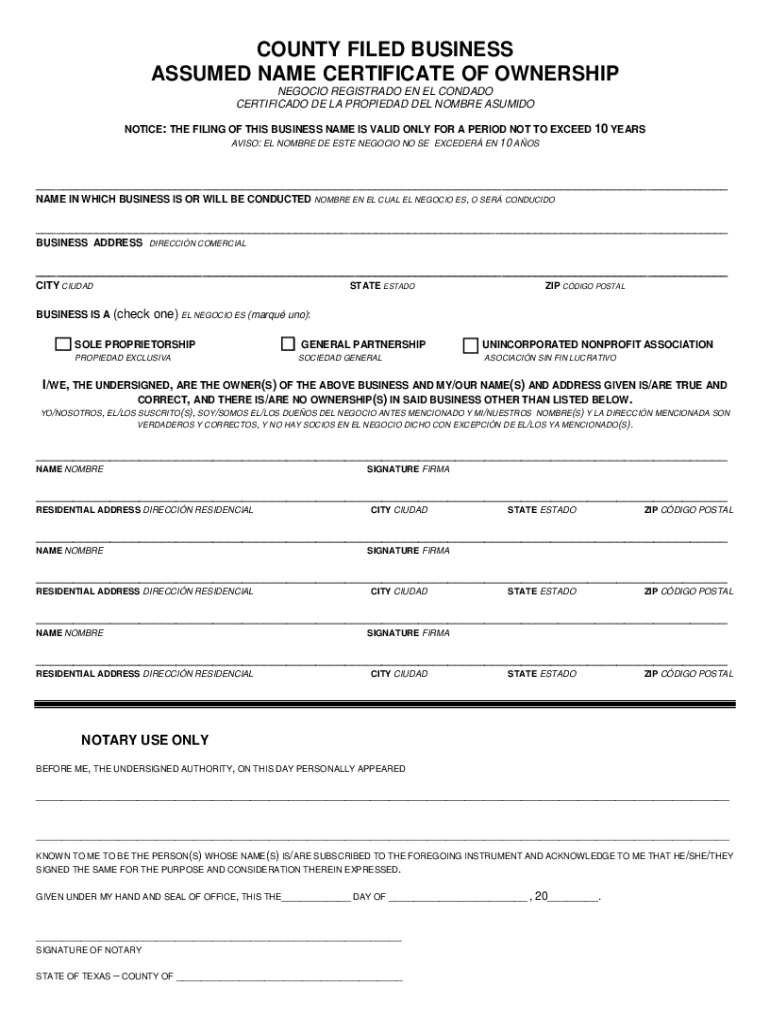

COUNTY FILED BUSINESS ASSUMED NAME CERTIFICATE OF OWNERSHIP NEGATION REGISTRAR EN EL CONRAD CERTIFICATE DE LA PROVIDED DEL HOMBRE ASSUMED NOTICE: THE FILING OF THIS BUSINESS NAME IS VALID ONLY FOR

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-state filed business

Edit your non-state filed business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-state filed business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing non-state filed business online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit non-state filed business. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-state filed business

How to fill out non-state filed business

01

To fill out a non-state filed business, follow these steps:

02

Research the requirements for establishing a non-state filed business in your jurisdiction.

03

Decide on the legal structure of your business, such as sole proprietorship, partnership, or corporation.

04

Choose a name for your business that is unique and not already registered by another entity.

05

Register your business with the appropriate government agency or department.

06

Obtain any necessary licenses or permits required for your specific industry or business activity.

07

Determine the tax obligations of your non-state filed business and ensure compliance with tax laws.

08

Develop a comprehensive business plan outlining your products or services, marketing strategies, and financial projections.

09

Secure funding or investment if needed to start and operate your non-state filed business.

10

Set up a system for record keeping, accounting, and reporting to maintain transparency and accuracy.

11

Hire necessary employees or contractors, if applicable, and establish appropriate employment contracts or agreements.

12

Promote your non-state filed business through various marketing channels and build a customer base.

13

Continuously monitor and evaluate the performance of your non-state filed business, making necessary adjustments and improvements as needed.

14

Remember that the specific requirements and procedures may vary depending on your jurisdiction and the type of non-state filed business you wish to establish. It is recommended to consult with a legal or business professional for personalized guidance and advice.

Who needs non-state filed business?

01

Non-state filed businesses can be advantageous for individuals or entities who:

02

- Want to start a small business without the complexities of registering it with the state.

03

- Prefer to operate as a sole proprietorship or partnership without the need for formal legal recognition.

04

- Wish to engage in certain low-risk or low-scale business activities that do not require state registration.

05

- Are testing a new business concept or idea on a small scale before committing to full state registration.

06

- Have specific legal or tax reasons for avoiding state registration, which may vary depending on jurisdiction.

07

It is important to understand the legal implications and limitations of operating a non-state filed business, as it may lack certain legal protections and benefits provided to formally registered businesses. Consulting with a legal or business professional can help determine if this type of business structure is suitable for your specific needs and circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit non-state filed business online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your non-state filed business to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out non-state filed business using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign non-state filed business and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How can I fill out non-state filed business on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your non-state filed business, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is non-state filed business?

Non-state filed business refers to businesses that are not registered with the state government.

Who is required to file non-state filed business?

Any individual or entity operating a business that is not registered with the state government is required to file non-state filed business.

How to fill out non-state filed business?

To fill out non-state filed business, one must gather all relevant financial and operational information about the business and submit it to the appropriate governing body.

What is the purpose of non-state filed business?

The purpose of non-state filed business is to ensure that unregistered businesses are accounted for and follow proper regulations and reporting requirements.

What information must be reported on non-state filed business?

Information such as revenue, expenses, assets, liabilities, and ownership details must be reported on non-state filed business.

Fill out your non-state filed business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-State Filed Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.