Get the free What Are Tax-Exempt Organizations?ASU Lodestar Center ...

Show details

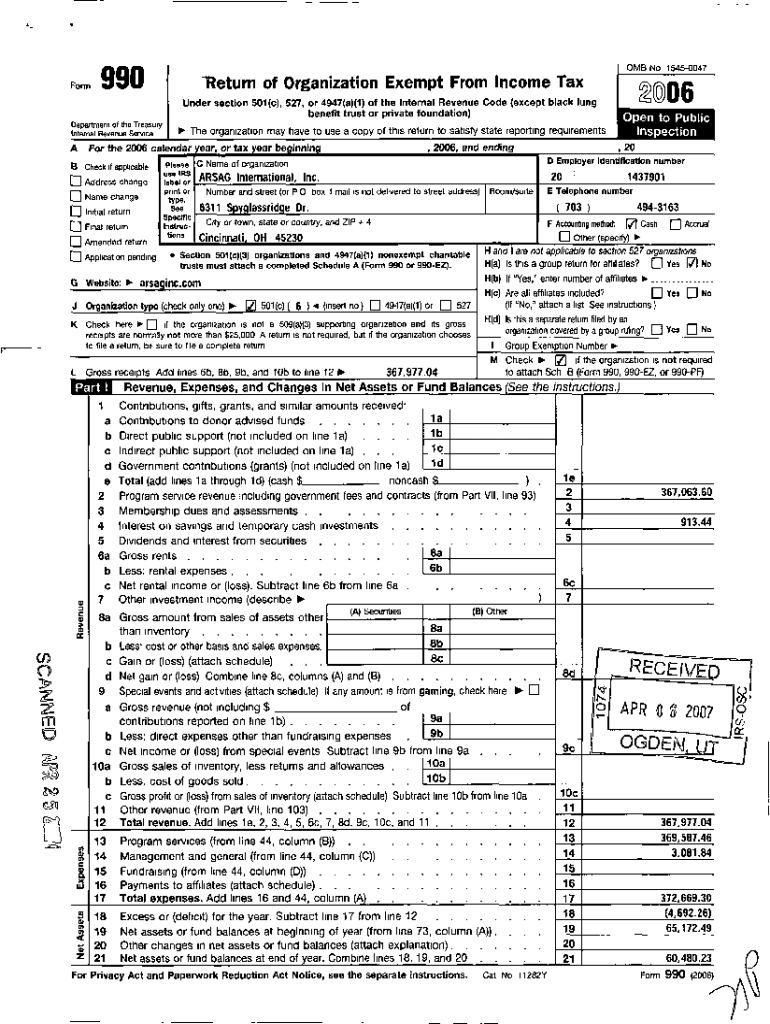

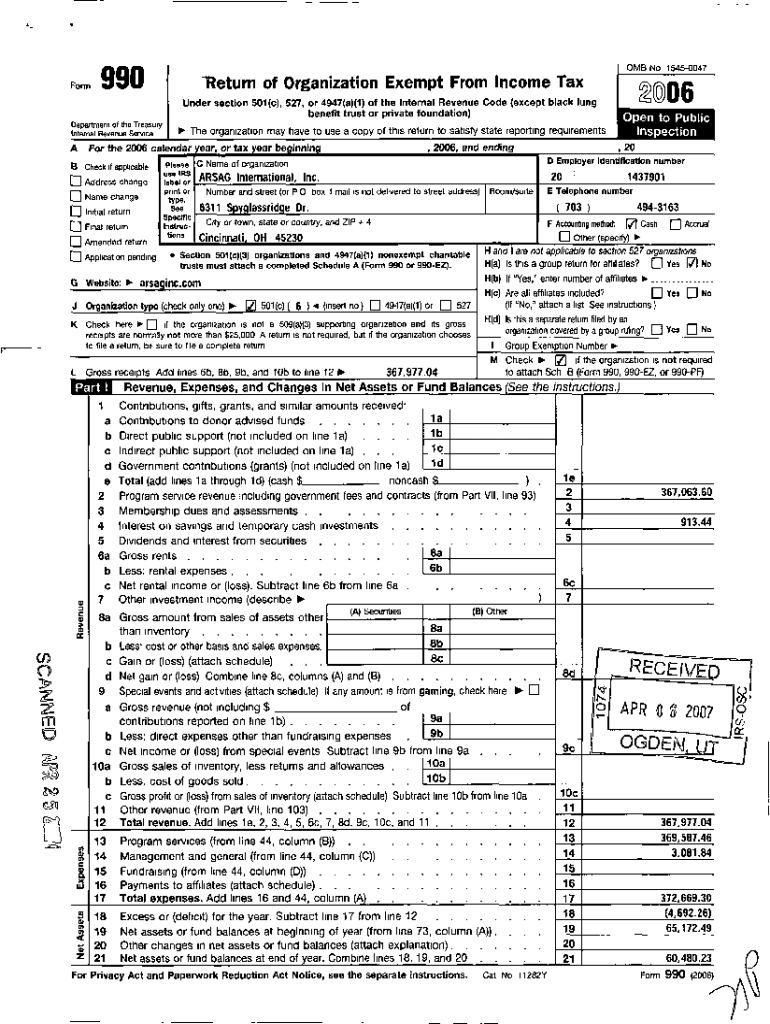

OMB No 15450047Form 990 'Return of Organization Exempt From Income Tax006Under section 501 (c), 527, or 4947 (a)(1) of the Internal Revenue Code (except black lung benefit trust or private foundation))apartment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign what are tax-exempt organizationsasu

Edit your what are tax-exempt organizationsasu form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your what are tax-exempt organizationsasu form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit what are tax-exempt organizationsasu online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit what are tax-exempt organizationsasu. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out what are tax-exempt organizationsasu

How to fill out what are tax-exempt organizationsasu

01

To fill out what are tax-exempt organizations, follow these steps:

02

Gather all the necessary documents and information, such as your organization's Employer Identification Number (EIN), Articles of Incorporation, and financial statements.

03

Determine your organization's eligibility for tax-exempt status by reviewing the IRS guidelines and regulations. This includes understanding the different types of tax exemptions available, such as 501(c)(3) for charitable organizations and 501(c)(4) for social welfare organizations.

04

Complete and submit Form 1023 or Form 1023-EZ, depending on your organization's size and eligibility criteria. These forms are required for organizations seeking recognition of exemption from federal income tax.

05

Provide detailed information about your organization's purpose, activities, governance structure, and financial management in the application.

06

Attach any required schedules, statements, or supporting documentation as specified by the IRS.

07

Pay the applicable filing fee, which varies based on your organization's gross receipts and the form you are submitting.

08

Double-check all the information provided and ensure that the application is accurate and complete.

09

Submit the filled-out application and supporting documents to the IRS either electronically or by mail.

10

Wait for the IRS to review your application. This process may take several months, and you may be contacted for additional information or clarification.

11

If approved, you will receive a determination letter from the IRS confirming your organization's tax-exempt status. If denied, you can appeal the decision or seek assistance from a tax professional.

Who needs what are tax-exempt organizationsasu?

01

Various entities and individuals may require tax-exempt organizations such as:

02

- Charitable organizations that aim to provide public benefit and support charitable causes.

03

- Social welfare organizations that work for the betterment of the community and promote social welfare activities.

04

- Religious organizations like churches, temples, or mosques that carry out religious activities and provide spiritual guidance.

05

- Educational institutions such as schools, colleges, and universities that operate for educational purposes.

06

- Scientific or research organizations focused on scientific advancements and research efforts.

07

- Associations and clubs that engage in social or recreational activities for the common interest of their members.

08

- Nonprofit healthcare organizations that provide medical services and support to individuals in need.

09

- Cultural or arts organizations that promote and preserve cultural heritage and artistic expressions.

10

- Advocacy groups or foundations that work towards specific causes like human rights, environmental conservation, or animal welfare.

11

These are just some examples, and the need for tax-exempt organizations can vary depending on the specific objectives and activities of various individuals, groups, or corporations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit what are tax-exempt organizationsasu online?

The editing procedure is simple with pdfFiller. Open your what are tax-exempt organizationsasu in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I make edits in what are tax-exempt organizationsasu without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your what are tax-exempt organizationsasu, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit what are tax-exempt organizationsasu straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing what are tax-exempt organizationsasu right away.

What is what are tax-exempt organizationsasu?

Tax-exempt organizations are entities that are not required to pay federal income tax because of their charitable, religious, or other tax-exempt status.

Who is required to file what are tax-exempt organizationsasu?

Non-profit organizations and charities that qualify for tax-exempt status are required to file tax-exempt organizationsasu.

How to fill out what are tax-exempt organizationsasu?

Tax-exempt organizationsasu can be filled out online through the IRS website or by mailing in a paper form.

What is the purpose of what are tax-exempt organizationsasu?

The purpose of tax-exempt organizationsasu is to report the financial activity and compliance of tax-exempt organizations to the IRS and the public.

What information must be reported on what are tax-exempt organizationsasu?

Tax-exempt organizationsasu must report their income, expenses, assets, and activities to ensure they are complying with IRS regulations.

Fill out your what are tax-exempt organizationsasu online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

What Are Tax-Exempt Organizationsasu is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.