Get the free CMA Inter Indirect Tax Suggested Answer June 2019.pdf ...

Show details

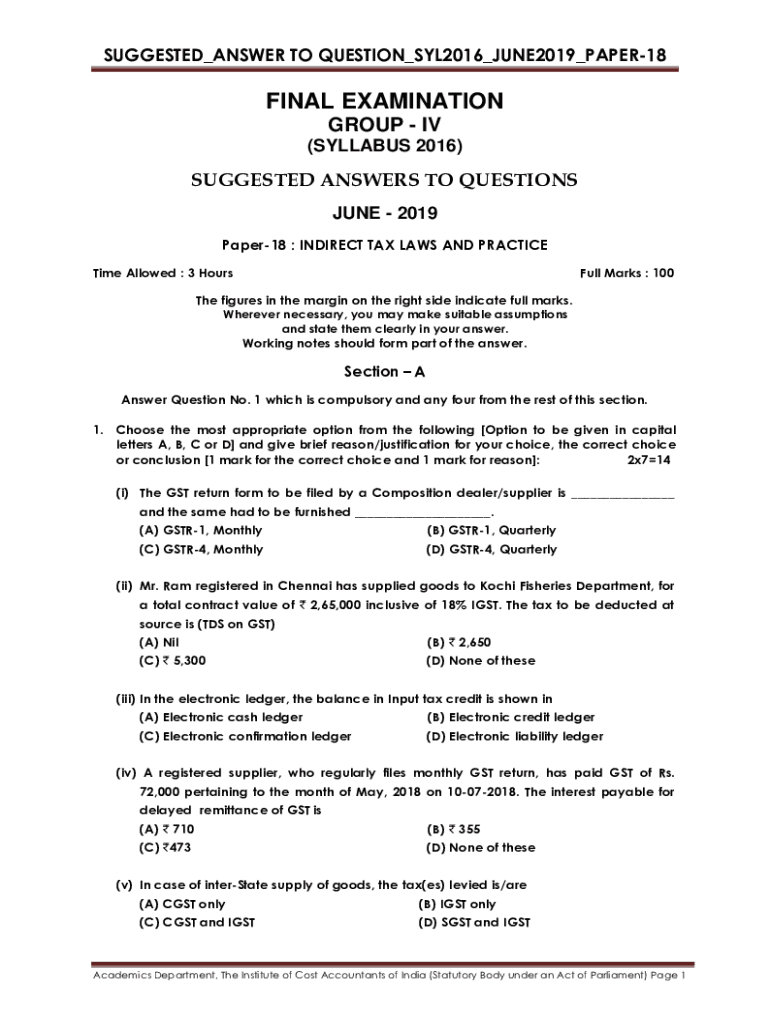

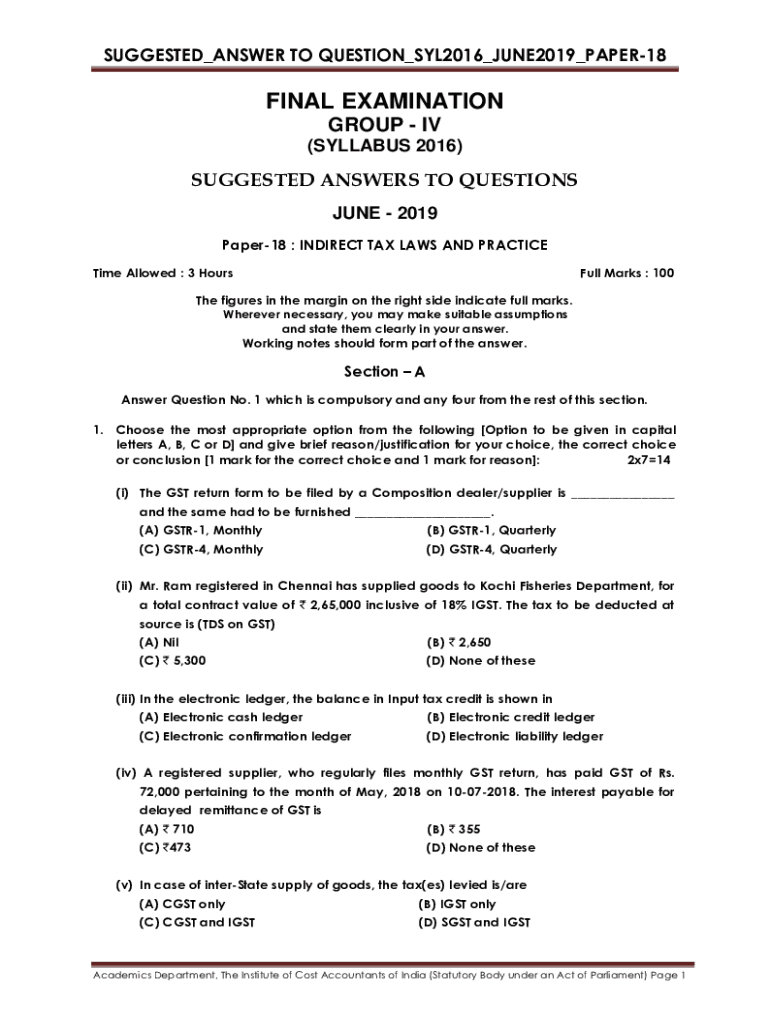

SUGGESTED_ANSWER TO QUESTION_SYL2016_JUNE2019_PAPER18FINAL EXAMINATION GROUP IV (SYLLABUS 2016)SUGGESTED ANSWERS TO QUESTIONS JUNE 2019 Paper18 : INDIRECT TAX LAWS AND PRACTICE Time Allowed : 3 Hurtful

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cma inter indirect tax

Edit your cma inter indirect tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cma inter indirect tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cma inter indirect tax online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit cma inter indirect tax. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cma inter indirect tax

How to fill out cma inter indirect tax

01

To fill out CMA Inter Indirect Tax, follow these steps:

02

Understand the basic concepts and principles of indirect taxes, such as GST, customs duties, and excise duties.

03

Gather all the necessary documents and information related to the transactions and activities subject to indirect taxes.

04

Identify the applicable indirect tax laws and regulations for each transaction or activity.

05

Calculate the amount of indirect tax payable or reclaimable for each transaction.

06

Record the details of the transactions and the corresponding indirect tax amounts in the appropriate accounting or tax forms.

07

Review and reconcile the indirect tax records to ensure accuracy and compliance with the applicable laws and regulations.

08

Prepare the necessary supporting documents, such as invoices, tax returns, and payment receipts.

09

Submit the completed indirect tax forms and supporting documents to the relevant tax authorities within the specified deadlines.

10

Keep proper records and documentation of all indirect tax-related transactions for future reference and auditing purposes.

11

Stay updated with any changes or updates in the indirect tax laws and regulations to ensure ongoing compliance.

Who needs cma inter indirect tax?

01

CMA Inter Indirect Tax is typically needed by individuals or organizations involved in financial and accounting roles, such as:

02

- Management accountants

03

- Financial analysts

04

- Tax consultants

05

- Accountants

06

- Tax managers

07

- Business owners

08

- Finance managers

09

- Compliance officers

10

Anyone responsible for managing and reporting indirect taxes in an organization can benefit from CMA Inter Indirect Tax knowledge and skills.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my cma inter indirect tax directly from Gmail?

cma inter indirect tax and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I edit cma inter indirect tax from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your cma inter indirect tax into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit cma inter indirect tax in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your cma inter indirect tax, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is cma inter indirect tax?

CMA Inter Indirect Tax refers to the coursework and examination subjects related to indirect taxes that are part of the CMA Intermediate program in India. It includes topics such as GST, customs duty, and other indirect tax regulations.

Who is required to file cma inter indirect tax?

Students enrolled in the CMA Intermediate program are required to file CMA Inter Indirect Tax as part of their academic requirements.

How to fill out cma inter indirect tax?

To fill out CMA Inter Indirect Tax, candidates must study the relevant syllabus, complete the assigned practical problems, and follow the guidelines provided by the Institute of Cost Accountants of India (ICAI) before submitting their examinations.

What is the purpose of cma inter indirect tax?

The purpose of CMA Inter Indirect Tax is to equip students with comprehensive knowledge and skills related to indirect taxation, enabling them to effectively manage and comply with tax regulations in their future professional roles.

What information must be reported on cma inter indirect tax?

Students must report relevant details such as computation of indirect tax liabilities, knowledge of compliance requirements, and practical applications of tax laws in their CMA Inter Indirect Tax assignments and examinations.

Fill out your cma inter indirect tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cma Inter Indirect Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.