Get the free Understanding Qualified vs. Non-qualified Dividends - Tax ...

Show details

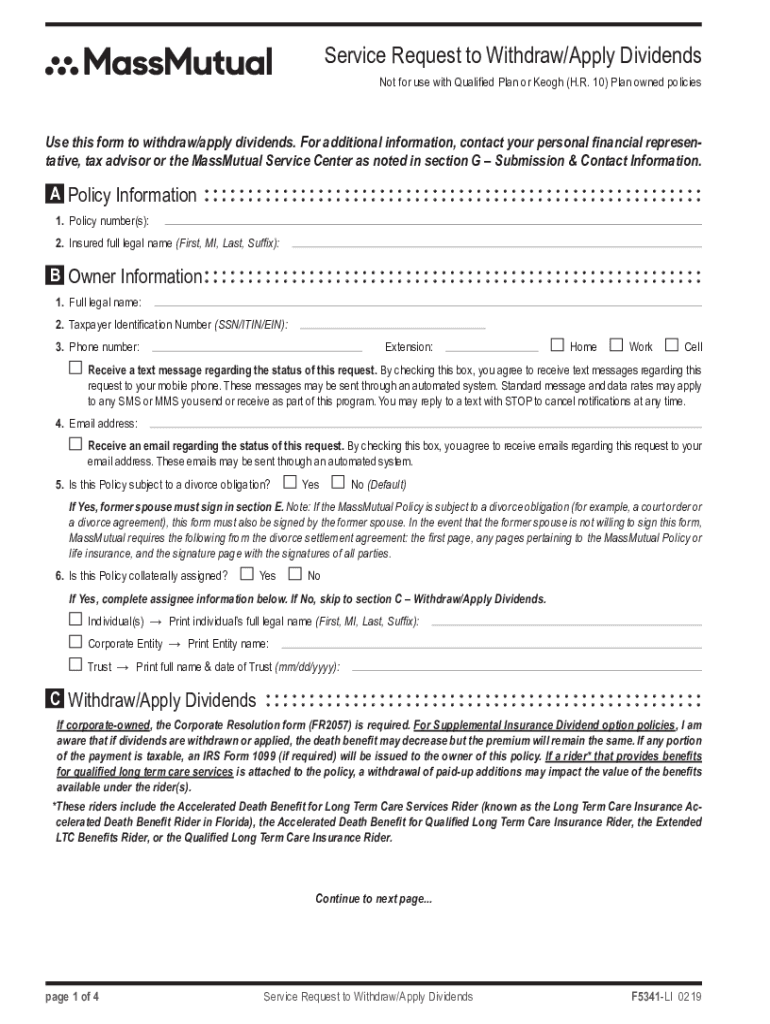

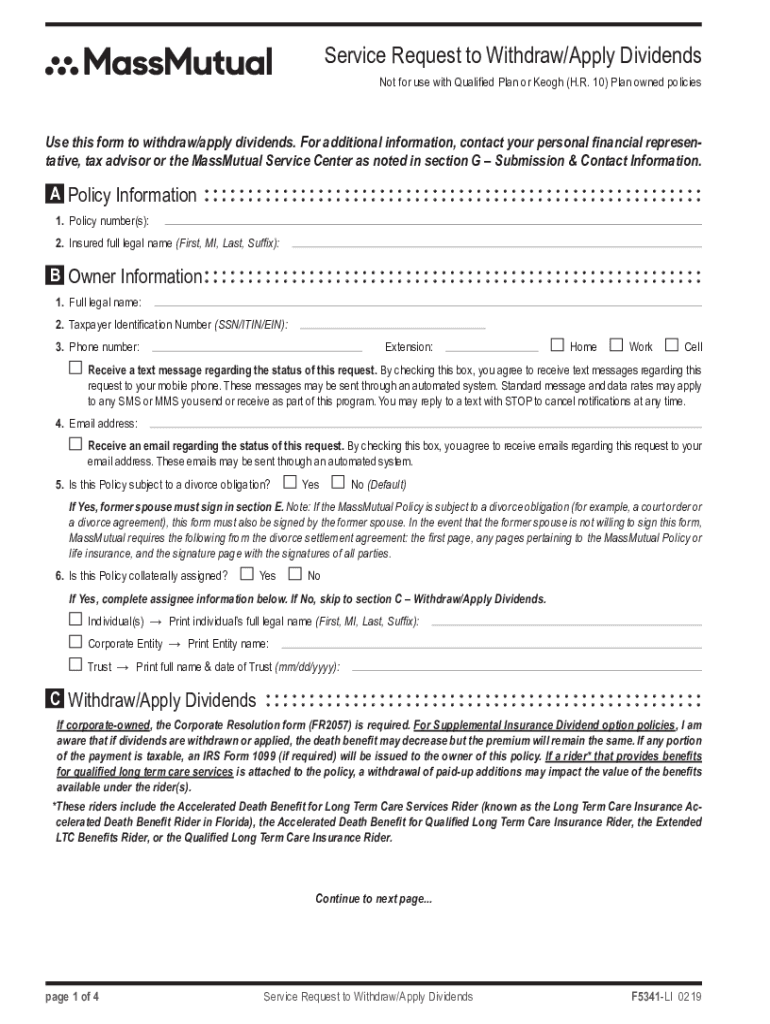

Service Request to Withdraw/Apply Dividends Not for use with Qualified Plan or Keogh (H.R. 10) Plan owned policies this form to withdraw/apply dividends. For additional information, contact your personal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign understanding qualified vs non-qualified

Edit your understanding qualified vs non-qualified form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your understanding qualified vs non-qualified form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing understanding qualified vs non-qualified online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit understanding qualified vs non-qualified. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out understanding qualified vs non-qualified

How to fill out understanding qualified vs non-qualified

01

To fill out understanding qualified vs non-qualified, follow these steps:

02

Start by defining what qualified and non-qualified mean in your specific context. For example, in finance, qualified may refer to a retirement plan that meets certain IRS requirements, while non-qualified may refer to a plan that does not.

03

Research the differences between qualified and non-qualified in your field or industry. This may involve reading relevant regulations, consulting experts, or studying industry best practices.

04

Make a list of the key criteria or characteristics that distinguish qualified from non-qualified. This could include factors such as eligibility requirements, tax treatment, contribution limits, withdrawal rules, or any other relevant features.

05

Evaluate specific plans, products, or services against the criteria you have identified to determine whether they are qualified or non-qualified. This may require reviewing plan documentation, consulting with providers, or seeking professional advice.

06

Fill out a comparison chart or table showing the differences between qualified and non-qualified options. Use this as a reference tool to better understand the implications and trade-offs of each choice.

07

Review and revise your understanding periodically as regulations, guidelines, or industry standards may change over time.

08

By following these steps, you will be able to effectively fill out understanding qualified vs non-qualified.

Who needs understanding qualified vs non-qualified?

01

Understanding qualified vs non-qualified is crucial for:

02

- Individuals planning for retirement and considering different retirement savings options

03

- Employers offering retirement benefits and deciding between qualified and non-qualified plans

04

- Financial advisors and consultants assisting clients with retirement planning

05

- Professionals working in tax or legal fields and dealing with retirement plan regulations

06

- Individuals or businesses seeking investment opportunities that come with tax advantages or other benefits

07

In summary, anyone involved in retirement planning, employee benefits, financial advising, taxation, or investment should have a good understanding of qualified vs non-qualified.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get understanding qualified vs non-qualified?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific understanding qualified vs non-qualified and other forms. Find the template you need and change it using powerful tools.

How do I fill out understanding qualified vs non-qualified using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign understanding qualified vs non-qualified and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit understanding qualified vs non-qualified on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share understanding qualified vs non-qualified on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is understanding qualified vs non-qualified?

Understanding qualified vs non-qualified refers to the classification of certain financial plans or transactions based on their compliance with regulatory standards that specify whether they meet qualifications for favorable tax treatment.

Who is required to file understanding qualified vs non-qualified?

Entities or individuals that have financial plans or agreements, such as retirement plans, must file according to whether their plans qualify as qualified or non-qualified under relevant tax regulations.

How to fill out understanding qualified vs non-qualified?

To fill out the understanding qualified vs non-qualified forms, one must gather the necessary financial data, categorize the plan as either qualified or non-qualified, and complete the required sections based on relevant guidelines before submission.

What is the purpose of understanding qualified vs non-qualified?

The purpose is to ensure compliance with tax laws and regulations, allowing for proper tax planning and management of benefits associated with different financial arrangements.

What information must be reported on understanding qualified vs non-qualified?

Information typically required includes details about the plan, including participant information, contribution amounts, benefit distributions, and any relevant compliance data.

Fill out your understanding qualified vs non-qualified online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Understanding Qualified Vs Non-Qualified is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.