Get the free FATCA and CRS Explained With Frequently Asked QuestionsFATCA and CRS Explained With ...

Show details

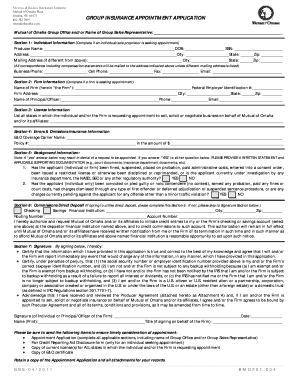

Confirmation of tax information ENTITIESGUIDE TO COMPLETING THIS FORM is required for any entity that is required to confirm: a) Its FATWA status (FATWA Foreign Account Tax Compliance Act), b) Its

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fatca and crs explained

Edit your fatca and crs explained form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fatca and crs explained form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fatca and crs explained online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fatca and crs explained. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fatca and crs explained

How to fill out fatca and crs explained

01

Begin by gathering all the necessary information and documents required to fill out the FATCA and CRS forms. This may include your personal identification details, tax identification number, income information, and details of financial accounts held.

02

Understand the terminology and guidelines outlined in the FATCA and CRS regulations. Familiarize yourself with the definitions of foreign financial institutions (FFIs), reportable accounts, and other relevant terms.

03

Determine your tax residency status. This will determine whether you need to complete the FATCA or CRS form, or both. Consult with a tax advisor if you are unsure about your residency status.

04

Complete the necessary sections of the forms accurately and provide all the required information. Be sure to double-check your inputs and ensure they match the supporting documents.

05

Submit the filled-out forms to the appropriate tax authority or financial institution, as instructed.

06

Keep a copy of the completed forms and any supporting documentation for your records.

07

In case of any changes to your financial or tax status, review and update your FATCA and CRS forms accordingly.

08

Regularly review any updates or changes to the FATCA and CRS regulations to ensure compliance.

09

Consider seeking professional advice from a tax specialist or accountant to ensure accuracy and compliance with FATCA and CRS requirements.

Who needs fatca and crs explained?

01

Individuals who hold foreign financial accounts or assets may need FATCA and CRS explained to understand their reporting obligations.

02

Financial institutions and organizations that operate internationally or have dealings with foreign entities are also required to understand FATCA and CRS regulations.

03

Tax advisors, accountants, and professionals in the financial industry who provide guidance on tax compliance and reporting must have a thorough understanding of FATCA and CRS.

04

Government tax authorities and regulatory bodies responsible for monitoring and enforcing tax compliance rely on FATCA and CRS regulations to identify and prevent tax evasion and money laundering.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete fatca and crs explained online?

With pdfFiller, you may easily complete and sign fatca and crs explained online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for signing my fatca and crs explained in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your fatca and crs explained and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How can I edit fatca and crs explained on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing fatca and crs explained right away.

What is fatca and crs explained?

FATCA (Foreign Account Tax Compliance Act) is a U.S. law aimed at preventing tax evasion by U.S. persons holding accounts outside the United States. CRS (Common Reporting Standard) is a global standard for the automatic exchange of financial account information, developed by the OECD, to combat tax evasion and ensure tax compliance.

Who is required to file fatca and crs explained?

U.S. taxpayers, including individuals and entities, are required to file FATCA if they have foreign financial assets exceeding certain thresholds. Financial institutions in participating countries must report information on non-resident account holders under the CRS.

How to fill out fatca and crs explained?

To fill out FATCA forms, U.S. taxpayers must provide information about their foreign financial accounts on IRS Form 8938, reporting income, gains, and account balances. For CRS, financial institutions must collect and report information about account holders, including their tax residency and taxpayer identification numbers.

What is the purpose of fatca and crs explained?

The purpose of FATCA is to ensure U.S. taxpayers are reporting all offshore income and assets to prevent tax evasion. CRS aims to promote international cooperation to improve tax compliance by enabling countries to exchange financial account information.

What information must be reported on fatca and crs explained?

Under FATCA, taxpayers must report their foreign financial assets, including account balances and income. Under CRS, financial institutions must report account holders' details, including names, addresses, taxpayer identification numbers, account balances, and income generated.

Fill out your fatca and crs explained online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fatca And Crs Explained is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.