Get the free Property Assessment & Tax ToolSaskatoon.ca

Show details

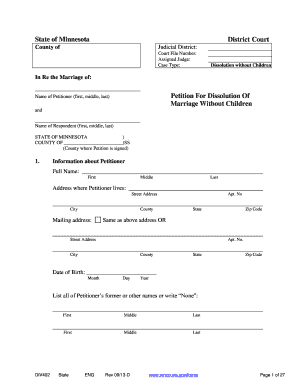

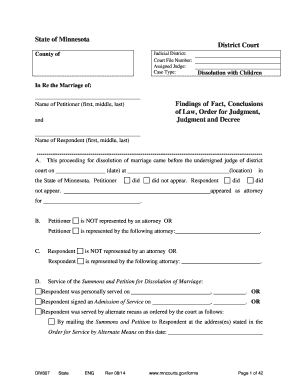

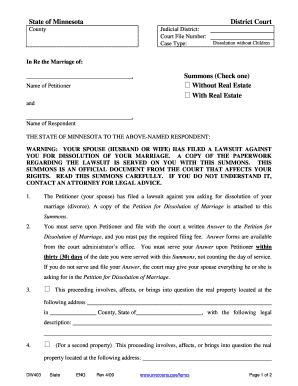

Authorization for Property Value SummaryRoll number: Property civic address: Legal description: Name of property owner: Property owners mailing address: Property owners daytime telephone number: I,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property assessment ampamp tax

Edit your property assessment ampamp tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property assessment ampamp tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit property assessment ampamp tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit property assessment ampamp tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property assessment ampamp tax

How to fill out property assessment ampamp tax

01

Gather all necessary documents such as property deed, previous assessment notices, and any relevant financial records.

02

Review the property assessment form and ensure that all sections are filled out accurately.

03

Provide detailed information about the property, including its address, size, and any improvements or additions made.

04

Include information about the property's current condition, such as the presence of any damages or necessary repairs.

05

Provide information about the property's use, whether it is used for residential, commercial, or industrial purposes.

06

Submit the completed property assessment form along with any required supporting documents to the appropriate tax authority.

07

Pay any applicable property taxes based on the assessed value of the property.

08

Keep copies of all submitted documents and receipts for future reference.

Who needs property assessment ampamp tax?

01

Property owners need property assessment and tax to fulfill their legal obligations and ensure accurate taxation.

02

Real estate investors need property assessment and tax information to make informed decisions about their investments and assess potential returns.

03

Tax authorities need property assessment and tax information to collect taxes and determine the fair market value of properties within their jurisdiction.

04

Financial institutions and lenders may require property assessment and tax information as part of the loan application or mortgage approval process.

05

Insurance companies may need property assessment and tax information to determine property values for insurance coverage and claims purposes.

06

Appraisers and real estate professionals use property assessment and tax information to evaluate properties and provide accurate market valuations.

07

Government agencies use property assessment and tax information to plan and allocate public resources and services.

08

Prospective buyers and sellers of properties may consult property assessment and tax information to negotiate fair purchase prices and evaluate potential costs.

09

Legal professionals and real estate agents may use property assessment and tax information for legal disputes, property transfers, or lease agreements.

10

Academics and researchers may utilize property assessment and tax data for various studies and analyses related to real estate markets and policy developments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my property assessment ampamp tax in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your property assessment ampamp tax as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I edit property assessment ampamp tax on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing property assessment ampamp tax.

How do I complete property assessment ampamp tax on an Android device?

Use the pdfFiller app for Android to finish your property assessment ampamp tax. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is property assessment ampamp tax?

Property assessment and tax refers to the process of evaluating a property's value for tax purposes and calculating the amount of tax owed on that property.

Who is required to file property assessment ampamp tax?

Property owners or individuals responsible for paying property taxes are required to file property assessment and tax forms.

How to fill out property assessment ampamp tax?

Property assessment and tax forms can typically be filled out online or submitted by mail, and require details about the property's value, location, and owner.

What is the purpose of property assessment ampamp tax?

The purpose of property assessment and tax is to fairly distribute the cost of public services among property owners based on the value of their properties.

What information must be reported on property assessment ampamp tax?

Property assessment and tax forms typically require information such as property value, ownership details, and any improvements made to the property.

Fill out your property assessment ampamp tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Assessment Ampamp Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.