Get the free Charitable Gifts of Publicly Traded SecuritiesThe New ...Charitable Gifts: Date of D...

Show details

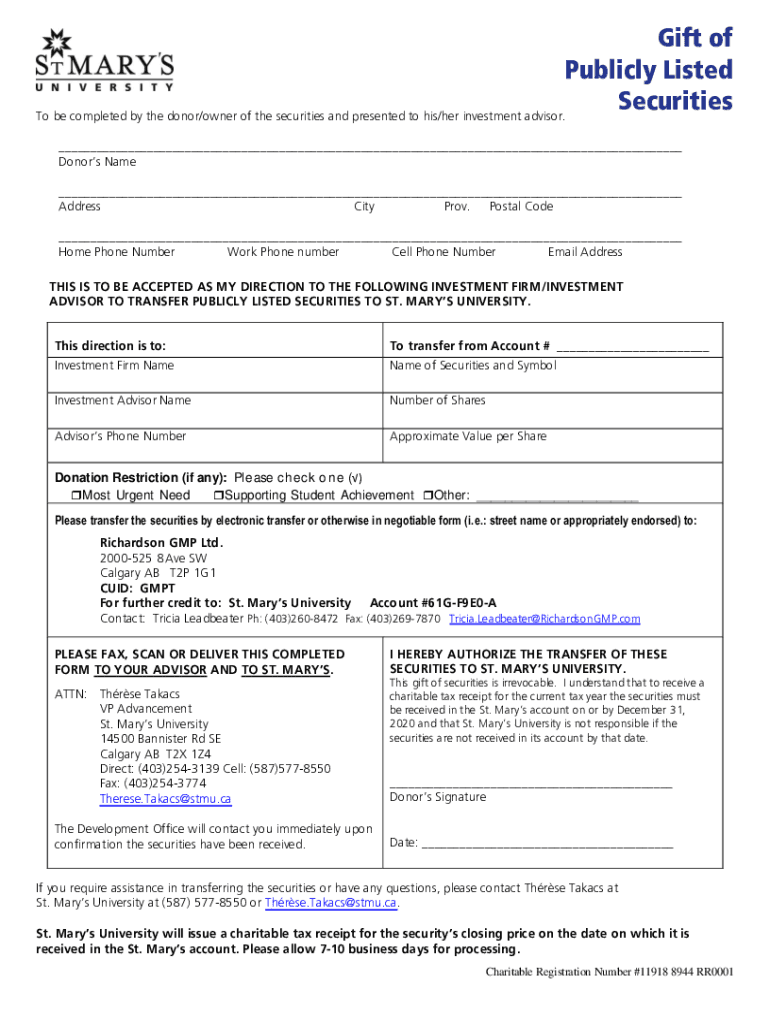

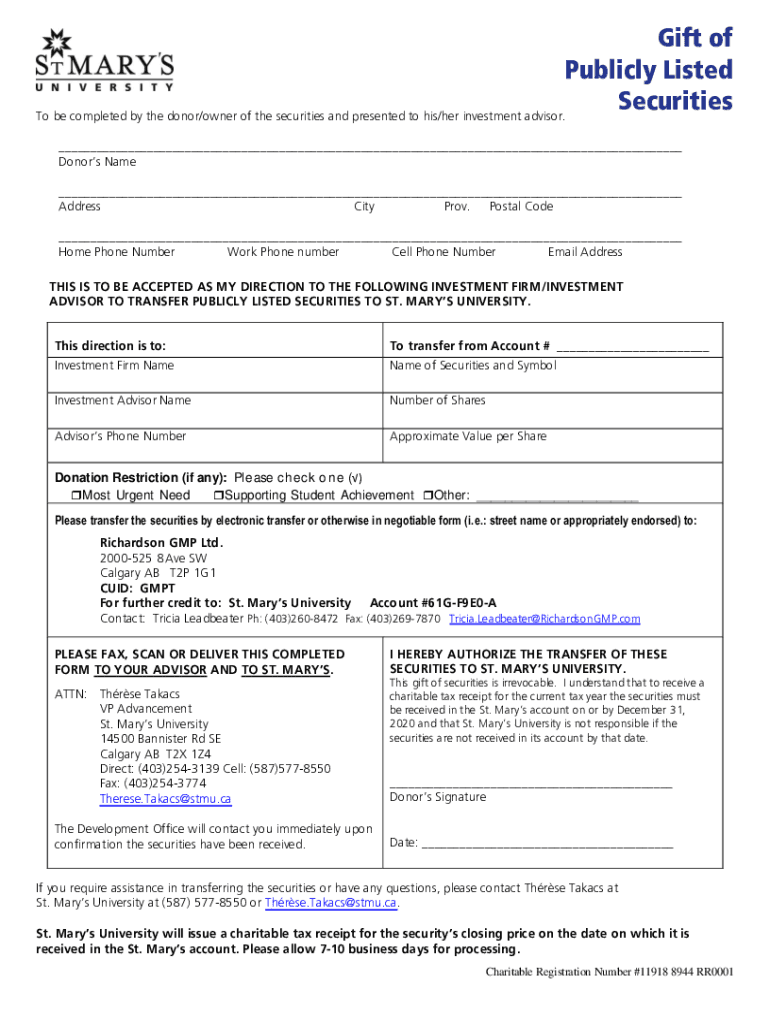

Gift of Publicly Listed Securities To be completed by the donor/owner of the securities and presented to his/her investment advisor. Donors Name Address City Prov. Postal Code Home Phone Number Work

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable gifts of publicly

Edit your charitable gifts of publicly form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable gifts of publicly form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing charitable gifts of publicly online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit charitable gifts of publicly. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charitable gifts of publicly

How to fill out charitable gifts of publicly

01

Research and identify the charitable organization or public cause that you want to support.

02

Determine the donation method accepted by the organization. This could include cash donations, checks, credit card payments, or online transfers.

03

Obtain the necessary donation forms or receipts from the organization.

04

Provide your personal information, such as your name, address, and contact details, on the donation form.

05

Specify the amount or type of donation you wish to make.

06

If making a cash donation, enclose the money in an envelope or write a check payable to the organization.

07

Complete any additional sections on the donation form, such as indicating if the gift is in honor or memory of someone.

08

Double-check all the information provided on the form for accuracy.

09

Submit the completed form and donation to the organization using the preferred method, such as mailing it or delivering it in person.

10

Keep a copy of the donation form and any receipts for your records and for potential tax deductions.

Who needs charitable gifts of publicly?

01

Charitable gifts of publicly can benefit various individuals and organizations, including:

02

- Non-profit organizations that rely on public donations to fund their operations and fulfill their mission.

03

- The less fortunate individuals and families who are in need of financial support, food, clothing, shelter, education, healthcare, or other basic necessities.

04

- Public schools, colleges, and universities that require funding for scholarships, research, infrastructure development, or educational programs.

05

- Community development projects aimed at improving the livelihoods of people in disadvantaged areas.

06

- Medical research institutions and hospitals seeking funding for research, treatments, and patient care.

07

- Environmental conservation organizations working towards preserving natural resources and protecting the planet.

08

- Arts and cultural institutions that promote creativity, education, and entertainment for the community.

09

- Animal shelters and rescue centers that provide care, shelter, and adoption services for abandoned or abused animals.

10

Overall, anyone who wishes to make a positive impact and contribute to the betterment of society can benefit from charitable gifts of publicly.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my charitable gifts of publicly in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your charitable gifts of publicly and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I fill out charitable gifts of publicly using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign charitable gifts of publicly and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I complete charitable gifts of publicly on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your charitable gifts of publicly. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is charitable gifts of publicly?

Charitable gifts of publicly are donations made by individuals or organizations to charitable causes that are disclosed to the public.

Who is required to file charitable gifts of publicly?

Nonprofit organizations and other entities that receive charitable donations are required to file charitable gifts of publicly.

How to fill out charitable gifts of publicly?

Charitable gifts of publicly can be filled out by providing detailed information about the donations received, including the amount, donor information, and purpose of the donation.

What is the purpose of charitable gifts of publicly?

The purpose of charitable gifts of publicly is to provide transparency and accountability in the charitable sector, ensuring that donations are being used for their intended purposes.

What information must be reported on charitable gifts of publicly?

Information such as the amount of the donation, the name and contact information of the donor, and the purpose of the donation must be reported on charitable gifts of publicly.

Fill out your charitable gifts of publicly online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Gifts Of Publicly is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.