Get the free Tax Lien Sale NYC: What homeowners need to knowLien Sale - New York CityTax Lien Sal...

Show details

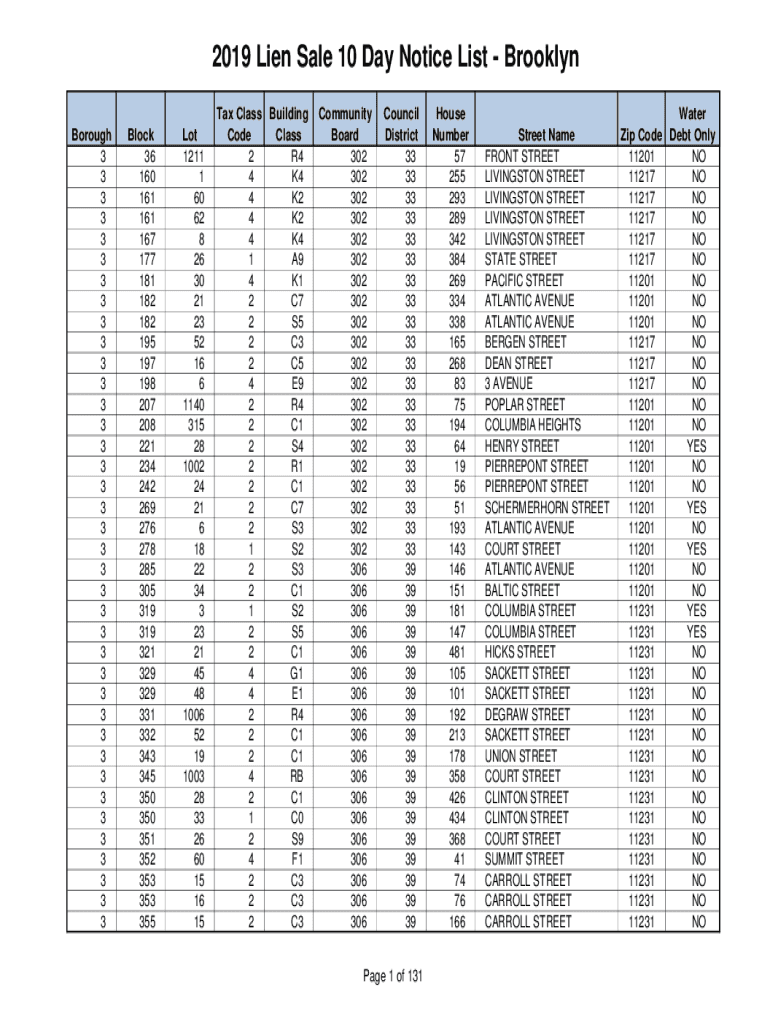

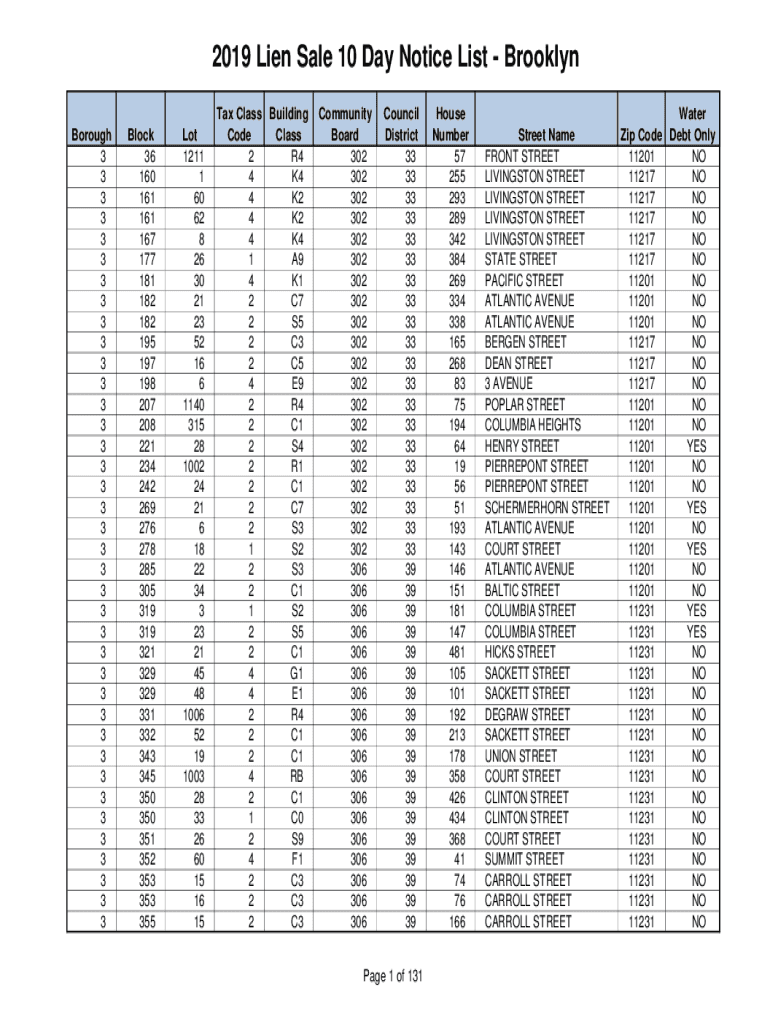

2019 Lien Sale 10 Day Notice List Brooklyn Borough 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3Block 36 160 161 161 167 177 181 182 182 195 197 198 207 208 221 234 242

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax lien sale nyc

Edit your tax lien sale nyc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax lien sale nyc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax lien sale nyc online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax lien sale nyc. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax lien sale nyc

How to fill out tax lien sale nyc

01

Obtain the tax lien sale list from the NYC Department of Finance.

02

Review the list and identify the properties of interest.

03

Attend the tax lien sale auction in person or online.

04

Register as a bidder and obtain a bidder number.

05

Conduct thorough research on the properties you wish to bid on, including any outstanding taxes or liens.

06

Determine your bidding strategy and set your maximum bid limit.

07

Participate in the auction by bidding on the properties you are interested in.

08

If successful, pay the winning bid amount and any additional fees.

09

Receive the tax lien certificate and start the lien redemption process.

10

Monitor the status of the tax lien and follow up on the redemption or foreclosure proceedings.

Who needs tax lien sale nyc?

01

Investors looking for potential real estate opportunities at a discounted price.

02

Individuals or companies interested in purchasing tax liens as an investment.

03

Property owners who have not paid their property taxes and are at risk of having a tax lien placed on their property.

04

Municipalities or government agencies aiming to collect unpaid property taxes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete tax lien sale nyc online?

pdfFiller makes it easy to finish and sign tax lien sale nyc online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How can I fill out tax lien sale nyc on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your tax lien sale nyc, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I complete tax lien sale nyc on an Android device?

Use the pdfFiller mobile app to complete your tax lien sale nyc on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is tax lien sale nyc?

A tax lien sale in NYC is a process where the city sells tax liens on properties with unpaid property taxes to collect the debt.

Who is required to file tax lien sale nyc?

Property owners who have unpaid property taxes are required to file tax lien sale in NYC.

How to fill out tax lien sale nyc?

To fill out tax lien sale in NYC, property owners must submit the necessary forms and documentation to the Department of Finance.

What is the purpose of tax lien sale nyc?

The purpose of tax lien sale in NYC is to collect unpaid property taxes and generate revenue for the city.

What information must be reported on tax lien sale nyc?

Property owners must report their property details, outstanding taxes, and contact information on tax lien sale in NYC.

Fill out your tax lien sale nyc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Lien Sale Nyc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.