Get the free Mortgage Assistance Application - FHFA

Show details

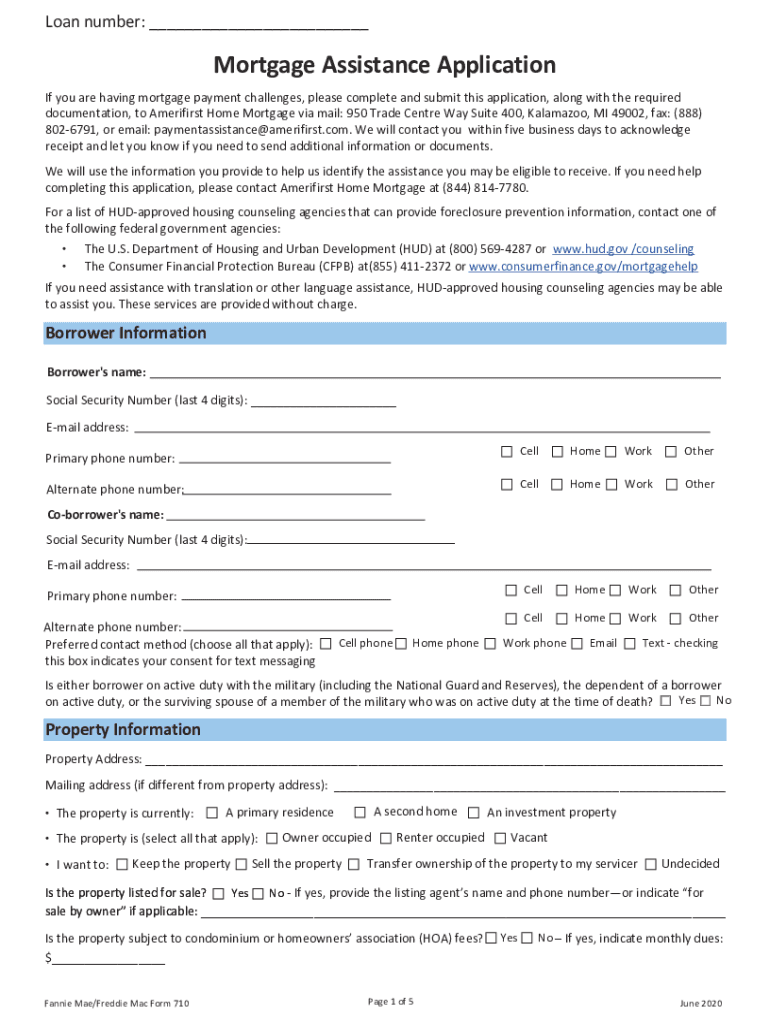

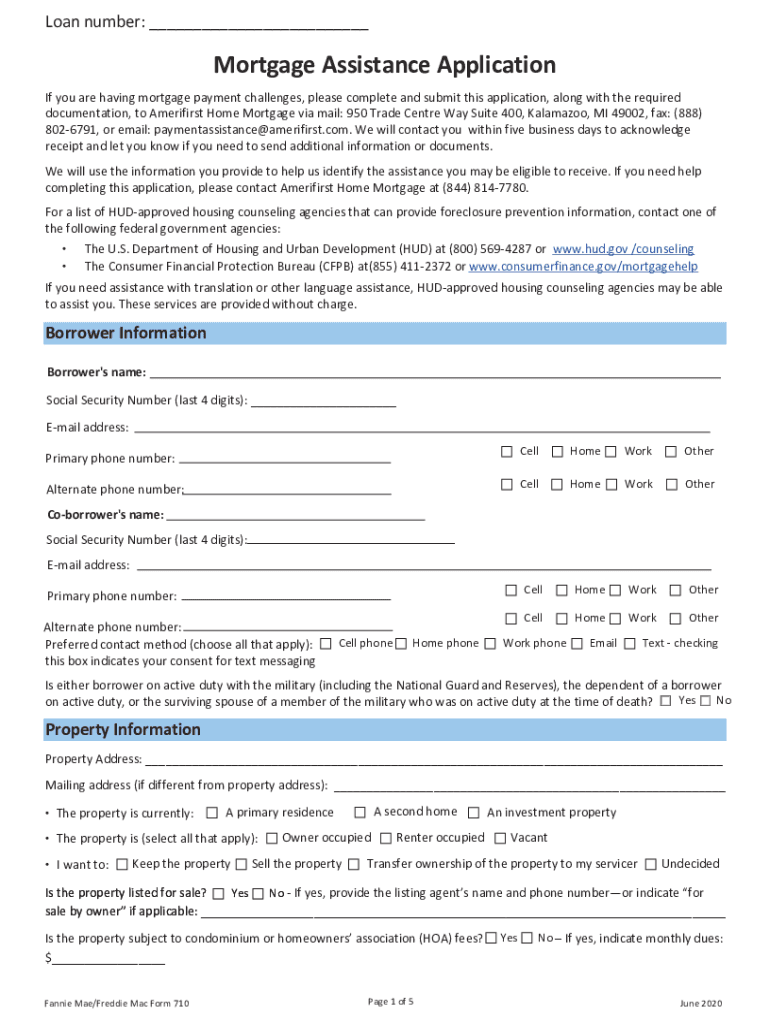

Loan number: Mortgage Assistance Application If you are having mortgage payment challenges, please complete and submit this application, along with the required documentation, to Amerifirst Home Mortgage

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage assistance application

Edit your mortgage assistance application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage assistance application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage assistance application online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mortgage assistance application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage assistance application

How to fill out mortgage assistance application

01

Start by gathering all the necessary documents required for the mortgage assistance application, such as proof of income, bank statements, tax returns, and any supporting documents related to your financial hardship.

02

Carefully complete all the sections of the application form, providing accurate and up-to-date information. Make sure to include all the required details, such as your personal information, employment history, monthly expenses, and the reason for seeking mortgage assistance.

03

If there are any sections or questions that you are uncertain about, seek clarification from the mortgage assistance program representative or consult with a housing counselor for guidance.

04

Double-check all the information provided before submitting the application. Ensure there are no missing or incomplete sections, as this could delay the processing of your request.

05

Attach any necessary supporting documents as requested by the mortgage assistance program. These may include pay stubs, proof of income or unemployment benefits, utility bills, and bank statements.

06

Review the application one final time to ensure accuracy and completeness. Make copies of the entire application and all supporting documents for your records.

07

Submit the completed application along with all the required documents to the designated office or organization responsible for processing mortgage assistance applications. You may need to submit the application by mail, email, or through an online portal, depending on the program's guidelines.

08

Once your application is received, you may receive a confirmation or acknowledgment from the mortgage assistance program. Keep this document safe for future reference.

09

Be patient while waiting for the review and processing of your mortgage assistance application. The timeline will vary depending on the program and the volume of applications received.

10

If additional information or documentation is required, promptly provide the requested materials to avoid any delays in the evaluation of your application.

11

Keep track of any communication or correspondence regarding your application, such as emails, letters, or phone calls. It is important to stay informed about the status of your application and any additional steps you may need to take.

12

If your application is approved, carefully review the terms and conditions of the mortgage assistance offered. Seek clarification on any aspects that you do not understand before proceeding.

13

If your application is denied, explore alternative options or reach out to other housing assistance programs or organizations for further support and guidance.

14

Stay proactive in your communication with the mortgage assistance program throughout the application process. Keep them informed of any changes in your contact information or financial situation that may affect your application.

15

After receiving mortgage assistance, continue to fulfill your obligations and responsibilities as outlined in the program's terms and conditions. This may include regular payments, attendance at homeowner education workshops, or providing updates on your financial situation.

Who needs mortgage assistance application?

01

Individuals or families who are facing financial hardships and are at risk of not being able to make their mortgage payments on time may need to fill out a mortgage assistance application.

02

These individuals may have experienced a sudden loss of income, such as job loss or reduction in work hours, or encountered unforeseen circumstances that have negatively impacted their ability to meet their mortgage obligations.

03

Mortgage assistance applications are typically required by various housing assistance programs, lenders, and government agencies to evaluate the eligibility of applicants for financial aid or modifications to their mortgage terms.

04

It is important for those struggling to make their mortgage payments to explore mortgage assistance options as early as possible to prevent foreclosure or worsening financial difficulties.

05

Consulting with a housing counselor or reaching out to the appropriate mortgage assistance programs can provide guidance on the application process and potential assistance available to meet the specific needs of each individual or family.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my mortgage assistance application directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your mortgage assistance application and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I sign the mortgage assistance application electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your mortgage assistance application in seconds.

Can I create an electronic signature for signing my mortgage assistance application in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your mortgage assistance application and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is mortgage assistance application?

A mortgage assistance application is a document submitted by homeowners seeking financial aid or modification options to help manage their mortgage payments and avoid foreclosure.

Who is required to file mortgage assistance application?

Homeowners who are struggling to make their mortgage payments or are at risk of defaulting are typically required to file a mortgage assistance application.

How to fill out mortgage assistance application?

To fill out a mortgage assistance application, homeowners should gather necessary financial documents, complete the application form accurately, provide details about their income and expenses, and submit it to their lender or relevant assistance program.

What is the purpose of mortgage assistance application?

The purpose of a mortgage assistance application is to request financial assistance, loan modification, or other support to help homeowners manage their mortgage obligations and prevent foreclosure.

What information must be reported on mortgage assistance application?

Homeowners must report personal identification information, details about their mortgage, income sources, monthly expenses, and any financial hardships they are experiencing on the mortgage assistance application.

Fill out your mortgage assistance application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Assistance Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.