Get the free much to save

Show details

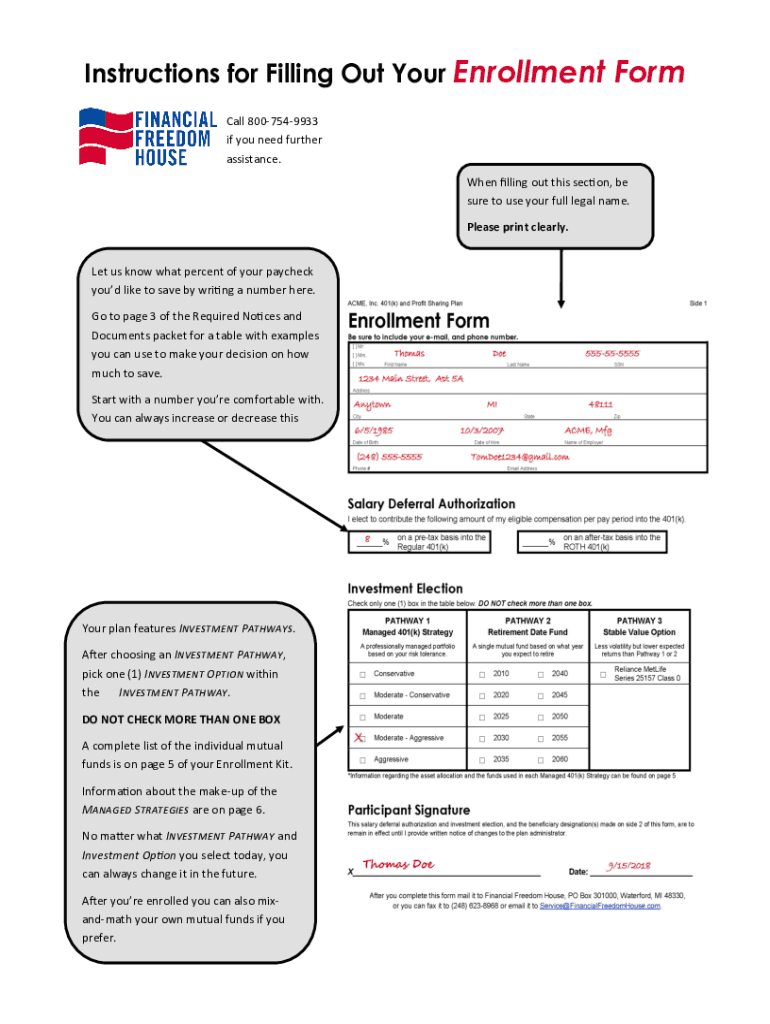

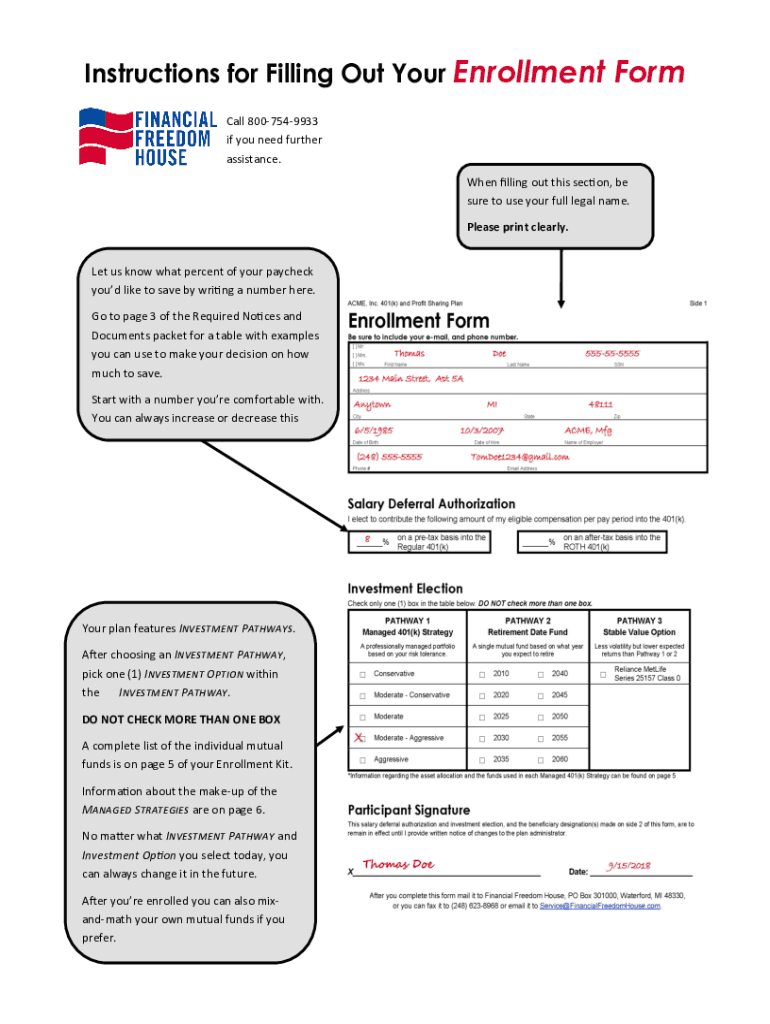

Instructions for Filling Out Your Enrollment Form Call 8007549933 if you need further assistance. When filling out this section, be sure to use your full legal name. Please print clearly. Let us know

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign much to save

Edit your much to save form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your much to save form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit much to save online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit much to save. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out much to save

How to fill out much to save

01

Determine your savings goal: Start by identifying how much money you want to save. It could be for a specific purchase, emergency fund, or long-term financial goal.

02

Analyze your current income and expenses: Take a close look at your income and expenses to understand your financial situation. This will help you identify how much you can realistically save each month.

03

Create a budget: Develop a budget that allocates a portion of your income towards savings. Prioritize savings and cut back on unnecessary expenses to maximize your savings potential.

04

Automate your savings: Set up automatic transfers from your checking account to a savings account. This ensures that a portion of your income is consistently saved without any effort.

05

Track your progress: Regularly monitor your savings to see if you are on track to reach your goals. Make adjustments to your budget and savings plan as needed.

06

Stay disciplined: Stick to your savings plan even when faced with temptations or unexpected expenses. Avoid unnecessary spending and prioritize your savings.

07

Explore additional saving strategies: Consider other savings options such as investing, saving with a higher interest rate account, or using apps that help you save effortlessly.

08

Review and adjust as needed: Periodically review your savings plan and make adjustments based on changes in your financial situation or goals.

Who needs much to save?

01

Everyone needs to save money regardless of their income level or financial situation.

02

Individuals with specific financial goals: People who have specific goals like buying a house, starting a business, or retiring comfortably need to save money to achieve these goals.

03

Individuals with variable income: Those who have irregular or fluctuating income should save money to create a financial safety net during low-income periods.

04

Individuals with debt: Saving money can help individuals pay off their debts faster and avoid falling into a deeper financial crisis.

05

Individuals planning for retirement: Saving money is crucial for building a retirement nest egg and ensuring a financially secure future.

06

Individuals preparing for emergencies: Having a savings buffer can provide a sense of security and help cover unexpected expenses like medical bills or car repairs.

07

Individuals wanting financial freedom: Saving money allows individuals to have more control over their financial lives, reduce stress, and have the freedom to make choices without being solely dependent on credit or loans.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send much to save for eSignature?

Once your much to save is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit much to save straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing much to save, you can start right away.

How do I complete much to save on an Android device?

On an Android device, use the pdfFiller mobile app to finish your much to save. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is much to save?

Much to save is a financial form that captures information about the savings and investments of an individual or entity.

Who is required to file much to save?

Individuals or entities with specific savings and investments are required to file much to save.

How to fill out much to save?

Much to save can be filled out by providing accurate information about savings accounts, investments, and other financial assets.

What is the purpose of much to save?

The purpose of much to save is to provide transparency and accountability regarding an individual or entity's finances.

What information must be reported on much to save?

Information such as account balances, investment details, and any other relevant financial holdings must be reported on much to save.

Fill out your much to save online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Much To Save is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.