Get the free Investment planning made easy with experts advice by Stockholding

Show details

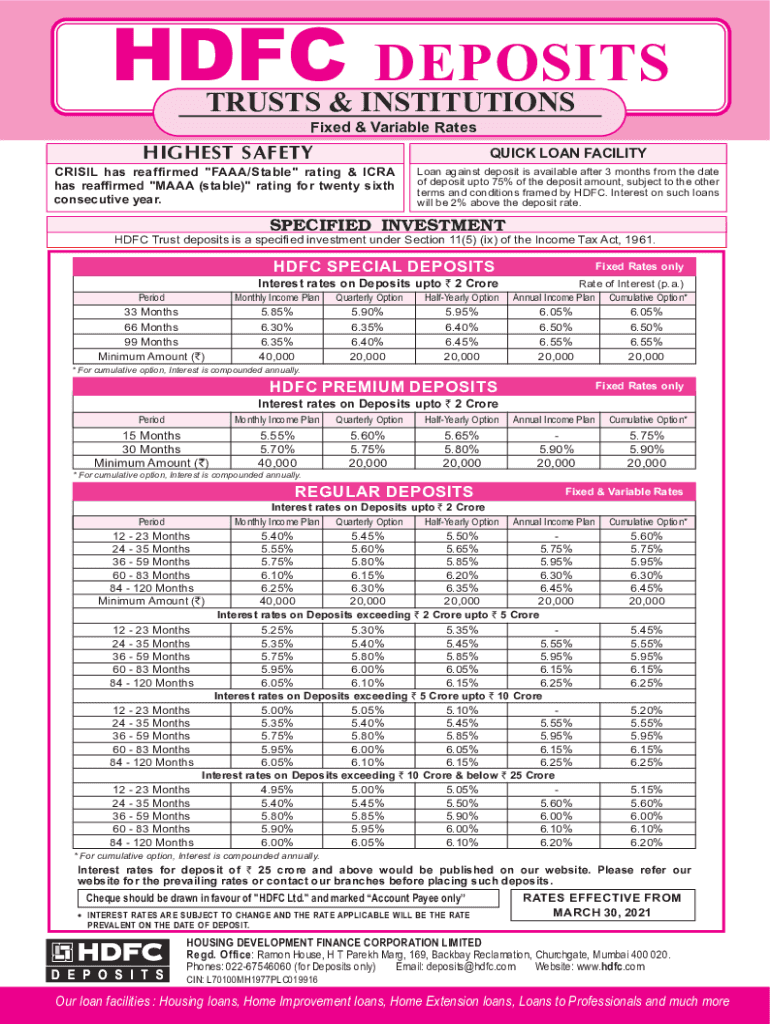

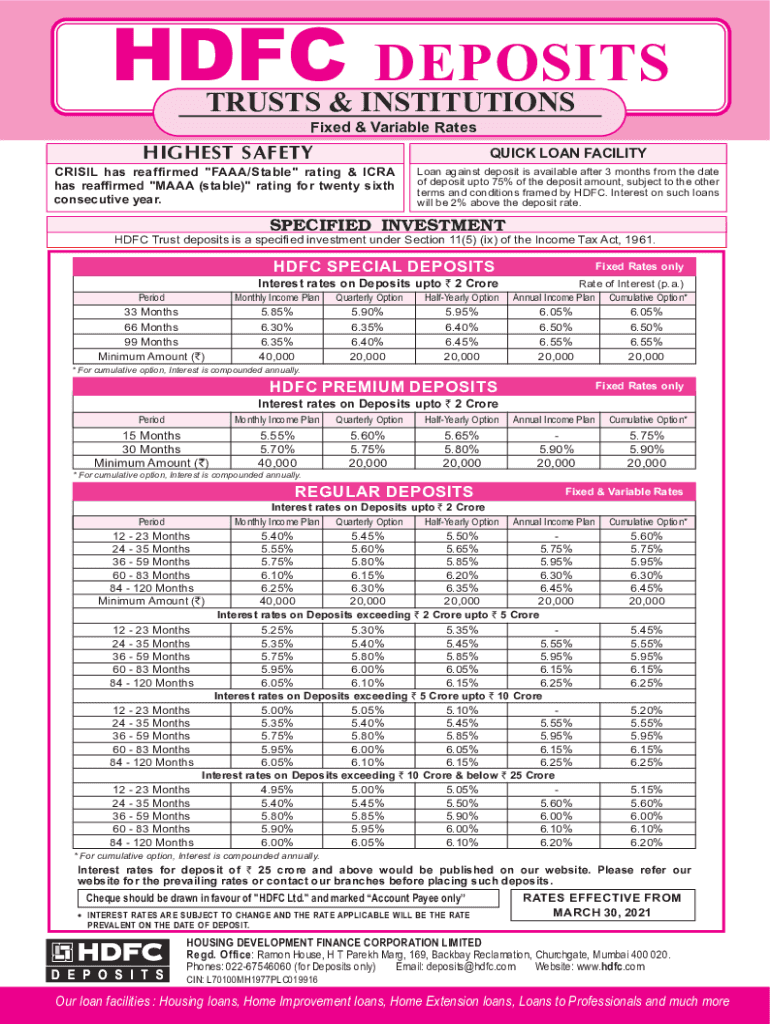

HDFCDEPOSITSTRUSTS & INSTITUTIONS Fixed & Variable RatesHIGHEST SAFETYQUICK LOAN FACILITYCRISIL has reaffirmed “AAA/Stable rating & ICRA has reaffirmed “MAYA (stable) rating for twenty-sixth consecutive

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign investment planning made easy

Edit your investment planning made easy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your investment planning made easy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit investment planning made easy online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit investment planning made easy. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out investment planning made easy

How to fill out investment planning made easy

01

Start by setting your financial goals. Determine what you want to achieve through your investments, whether it's saving for retirement, buying a house, or funding your children's education.

02

Assess your risk tolerance. Understanding how much risk you are willing to take is important in determining the right investment strategy for you.

03

Determine your investment time horizon. Consider how long you can hold your investments before needing the money.

04

Research and educate yourself about different investment options. Learn about stocks, bonds, mutual funds, real estate, and other assets to make informed decisions.

05

Create a diversified investment portfolio. Spread your investments across different asset classes to reduce risk.

06

Set a budget and determine how much you can invest regularly. Consistency is key in achieving long-term investment goals.

07

Monitor your investments regularly. Stay updated with market trends and make necessary adjustments to your portfolio as needed.

08

Consider seeking professional help. Financial advisors can provide guidance and expertise to help you make informed investment decisions.

09

Stay disciplined and stick to your plan. Avoid making impulsive decisions based on short-term market fluctuations.

10

Periodically review and reassess your investment plan. Life circumstances and financial goals may change over time, so it's important to adjust your plan accordingly.

Who needs investment planning made easy?

01

Anyone who wants to secure their financial future and achieve their financial goals

02

Individuals who are new to investing and need a simplified approach

03

Individuals who want to make informed investment decisions based on their risk tolerance and investment goals

04

Anyone who wants to take control of their finances and build wealth for the long term

05

People who want to retire comfortably and maintain their lifestyle

06

Individuals who want to plan for major life events such as buying a house or starting a family

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my investment planning made easy directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your investment planning made easy as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send investment planning made easy for eSignature?

Once you are ready to share your investment planning made easy, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Where do I find investment planning made easy?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the investment planning made easy in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

What is investment planning made easy?

Investment planning made easy is a simplified process to help individuals or businesses create a financial plan for investing their money.

Who is required to file investment planning made easy?

Any individual or organization that wants to create a comprehensive investment strategy may choose to use investment planning made easy.

How to fill out investment planning made easy?

To fill out investment planning made easy, one must input their financial goals, risk tolerance, investment preferences, and other relevant information into the provided template or tool.

What is the purpose of investment planning made easy?

The purpose of investment planning made easy is to assist users in creating a structured and effective investment plan that aligns with their financial objectives.

What information must be reported on investment planning made easy?

On investment planning made easy, users may need to report their financial goals, current financial situation, investment horizon, risk appetite, and desired asset allocation.

Fill out your investment planning made easy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Investment Planning Made Easy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.