Get the free non cash charitable contributions worksheet 2021

Show details

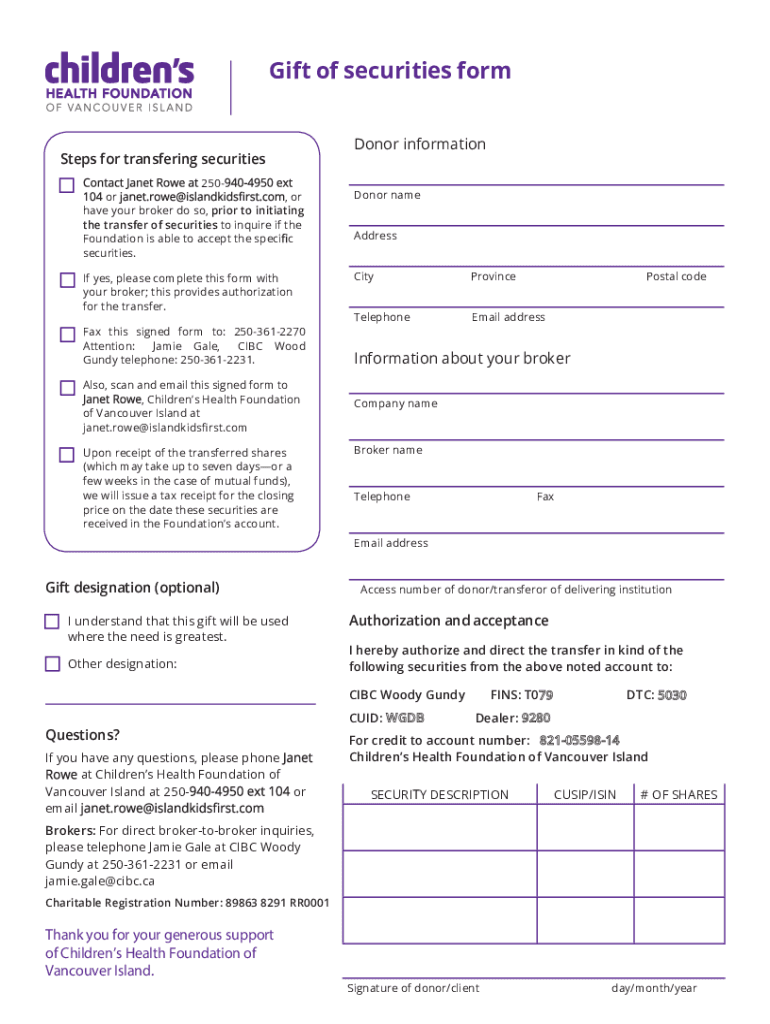

Gift of securities footsteps for transferring securities 250or, or have your broker do so, prior to initiating the transfer of securities to inquire if the Foundation is able to accept the spec c

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non cash charitable contributions

Edit your non cash charitable contributions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non cash charitable contributions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit non cash charitable contributions online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit non cash charitable contributions. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non cash charitable contributions

How to fill out non cash charitable contributions

01

To fill out non cash charitable contributions, follow these steps:

02

Gather all the necessary information: Make a list of the non cash items you are donating, including their description, quantity, and fair market value.

03

Determine the value: Use the fair market value of the items at the time of donation. It is recommended to consult a professional appraiser for high-value items.

04

Choose the correct tax form: Non cash contributions are usually reported on Form 8283, Section A for individuals or Form 1065 for partnerships and corporations.

05

Complete the form: Fill in the required information such as your name, address, and taxpayer identification number. Provide detailed descriptions of the donated items and their values.

06

Attach supporting documents: If your non cash contributions exceed $500, you need a qualified appraisal. Attach the appraisal report to your tax form.

07

File your tax return: Submit the filled-out tax form along with your regular tax return, ensuring that all relevant schedules and documents are included.

08

Keep records: Retain copies of your tax returns, the completed Form 8283, and all supporting documents for at least three years.

09

Seek professional advice: If you have any uncertainties or complex non cash contributions, it is advisable to consult a tax professional for guidance.

Who needs non cash charitable contributions?

01

Non cash charitable contributions are beneficial for:

02

- Individuals who want to support charitable organizations by donating items such as clothing, furniture, or electronics.

03

- Businesses or corporations that wish to contribute goods or assets to non-profit organizations.

04

- Donors who want to reduce their taxable income by claiming deductions for non cash contributions.

05

- Non-profit organizations that rely on non cash donations to support their programs and provide services to their communities.

06

- Foundations and trusts that distribute assets, securities, or other non cash contributions to charitable causes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit non cash charitable contributions from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including non cash charitable contributions, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I get non cash charitable contributions?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific non cash charitable contributions and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit non cash charitable contributions on an iOS device?

Create, edit, and share non cash charitable contributions from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is non cash charitable contributions?

Non cash charitable contributions refer to donations of non-monetary items such as clothing, household goods, or stock shares to an eligible charitable organization.

Who is required to file non cash charitable contributions?

Individuals who have made non cash charitable contributions totaling more than $500 during the tax year are required to file Form 8283 with their tax return.

How to fill out non cash charitable contributions?

To fill out non cash charitable contributions, individuals need to complete Form 8283 detailing the description, fair market value, and other relevant information of the donated items.

What is the purpose of non cash charitable contributions?

The purpose of non cash charitable contributions is to encourage individuals to donate valuable items to charitable organizations in need.

What information must be reported on non cash charitable contributions?

On Form 8283, individuals must report detailed information about the donated items, including the description, fair market value, and the name of the charitable organization receiving the donation.

Fill out your non cash charitable contributions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non Cash Charitable Contributions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.