Get the free What is a Collateral MortgagePros and ConsHow to Record a Mortgage on a PropertySapl...

Show details

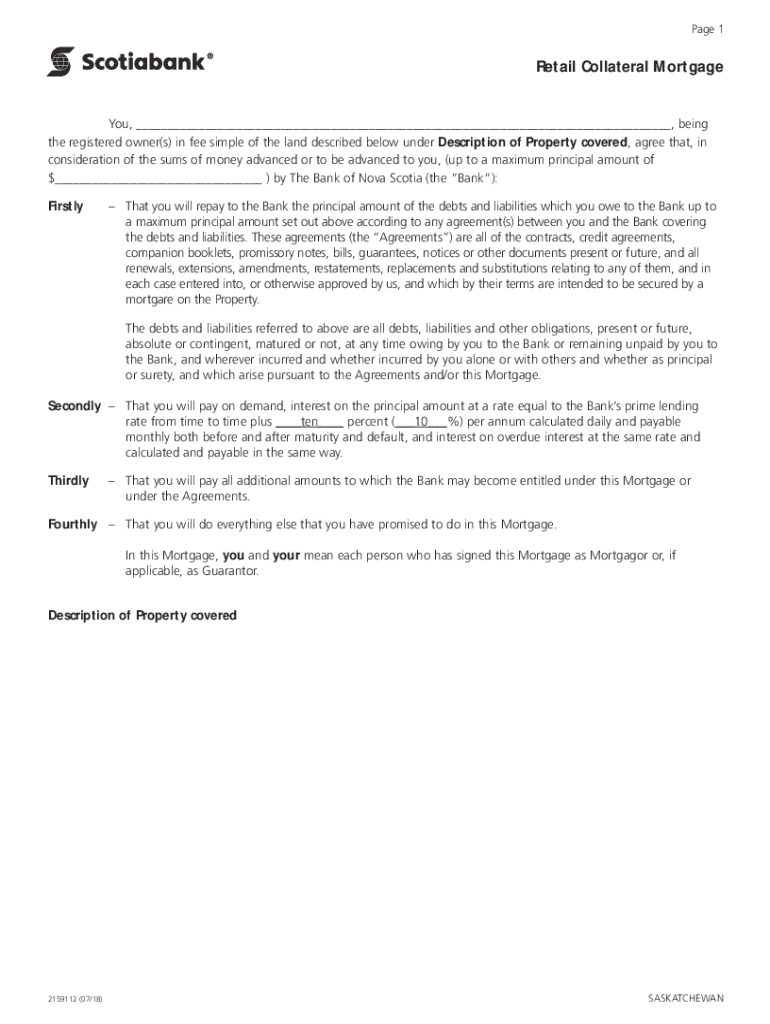

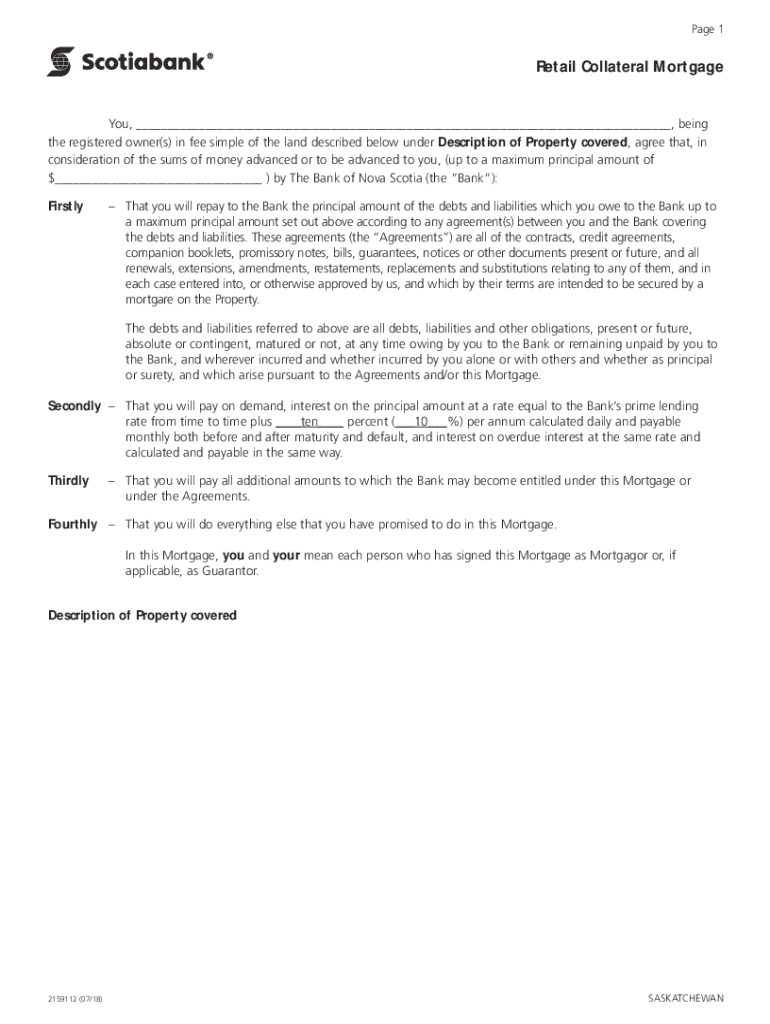

Page 1Retail Collateral Mortgage, being the registered owner(s) in fee simple of the land described below under Description of Property covered, agree that, in consideration of the sums of money advanced

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign what is a collateral

Edit your what is a collateral form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your what is a collateral form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing what is a collateral online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit what is a collateral. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out what is a collateral

How to fill out what is a collateral

01

To fill out what is a collateral, follow these steps:

02

Start by clearly understanding what a collateral is. A collateral is an asset that a borrower pledges to a lender as security for a loan. It helps reduce the risk for the lender in case the borrower defaults on the loan.

03

Gather all the necessary information about the collateral. This may include details such as the type of asset, its value, and any related documents or certifications.

04

Carefully read and understand the loan agreement or application form. Look for specific instructions or fields related to collateral.

05

Provide accurate information about the collateral in the designated sections. This may involve describing the asset, providing its estimated value, or attaching supporting documentation.

06

If required, consult with a professional appraiser or expert to determine the precise value of the collateral. This can help ensure that you provide an accurate assessment.

07

Double-check all the provided information before submitting the form. Ensure that all details related to the collateral are accurate and complete.

08

Submit the form or application to the lender as per their instructions. Keep a copy of the submitted form for your records.

09

If you have any doubts or questions, don't hesitate to reach out to the lender or seek professional advice.

10

Remember, accurately filling out the collateral information is essential to establish a clear understanding between the borrower and the lender.

Who needs what is a collateral?

01

Various individuals and entities may need to understand what a collateral is, including:

02

- Borrowers: Individuals or businesses seeking loans from financial institutions or lenders need to understand what collateral is and its importance. They must assess the assets they can offer as collateral to secure a loan.

03

- Lenders: Financial institutions, banks, or other lending entities need to understand collateral to manage the risks associated with lending. They rely on collateral to secure their loans and reduce the chance of financial losses.

04

- Lawyers and Legal Professionals: Attorneys and legal professionals dealing with loan agreements, contracts, or bankruptcy cases need to understand collateral to protect their clients' interests and ensure legal compliance.

05

- Investors: Investors or potential investors who evaluate investment opportunities, such as bonds or secured loans, need to understand collateral to assess the security and potential risks involved.

06

- Insurance Companies: Insurance companies may need to understand collateral when issuing policies that involve pledged assets as security or dealing with claims related to collateralized assets.

07

- Financial Advisors: Financial advisors or consultants who assist clients with managing their assets and debts must understand collateral to provide informed advice and make appropriate recommendations.

08

- Real Estate Professionals: Real estate agents, brokers, or property evaluators need to understand collateral when dealing with mortgage loans and property valuation.

09

- Regulators: Regulatory authorities or government agencies overseeing the financial sector need to understand collateral to establish guidelines, monitor compliance, and ensure stability in the market.

10

Understanding what a collateral is can benefit a wide range of parties involved in financial transactions and legal proceedings.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify what is a collateral without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including what is a collateral, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I complete what is a collateral online?

pdfFiller has made it simple to fill out and eSign what is a collateral. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit what is a collateral online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your what is a collateral to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

What is what is a collateral?

Collateral is an asset or property that a borrower offers to a lender as security for a loan. If the borrower fails to repay the loan, the lender can seize the collateral to recoup their losses.

Who is required to file what is a collateral?

Borrowers who are obtaining a loan and offering collateral to secure the loan are required to file information about the collateral with the lender.

How to fill out what is a collateral?

To fill out information about collateral, borrowers must provide details about the asset or property being offered as security, including its value, description, and any relevant documentation.

What is the purpose of what is a collateral?

The purpose of collateral is to reduce the lender's risk of lending money by having an asset to fall back on if the borrower defaults on the loan.

What information must be reported on what is a collateral?

Information that must be reported on collateral includes the type of asset or property, its value, description, ownership details, and any documentation supporting its value.

Fill out your what is a collateral online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

What Is A Collateral is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.