Get the free CHECK ORDER REQUEST

Show details

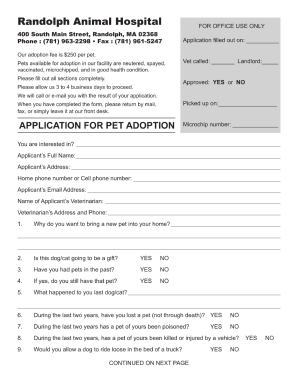

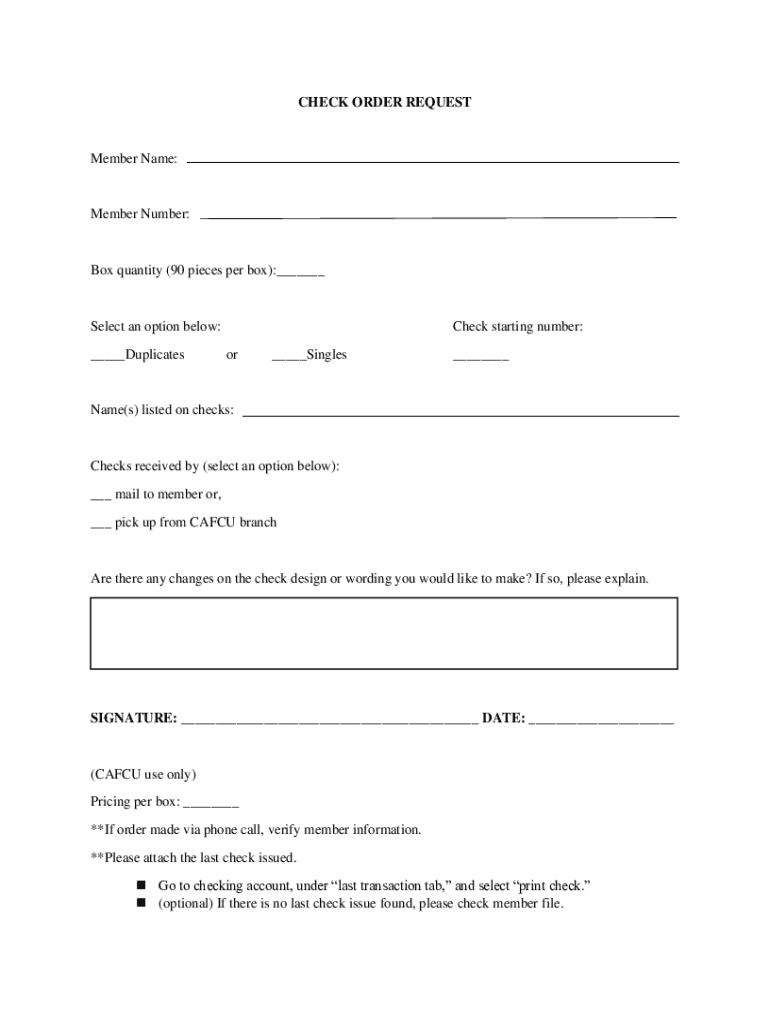

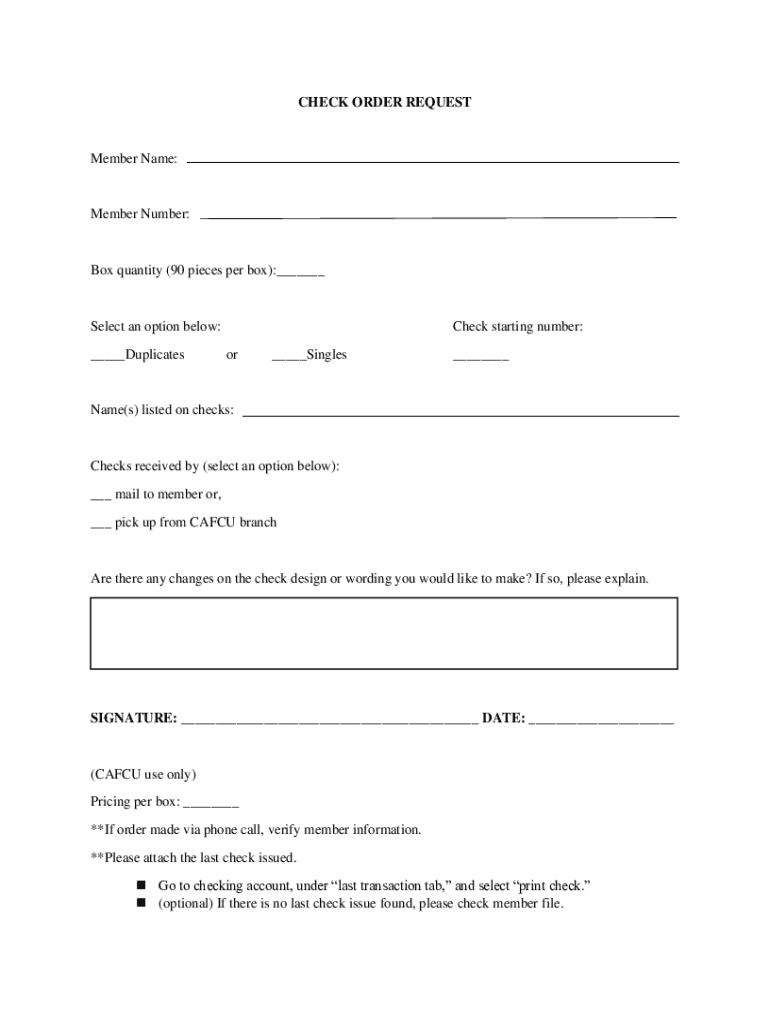

CHECK ORDER REQUESTMember Name:Member Number:Box quantity (90 pieces per box): Select an option below: DuplicatesCheck starting number: or Singles Name(s) listed on checks:Checks received by (select

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign check order request

Edit your check order request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your check order request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit check order request online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit check order request. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out check order request

How to fill out check order request

01

Start by gathering all the necessary information for the check order request, such as the account number, the recipient's name, and the amount to be paid.

02

Make sure to have enough funds in your account to cover the check payment.

03

Locate the check order request form either online or at your bank's branch.

04

Fill in the required fields on the form accurately and legibly. Include your personal details, account information, and the recipient's details.

05

Double-check all the entered information to ensure accuracy and avoid potential errors or delays.

06

If needed, attach any additional documentation or supporting materials as requested by the bank.

07

Review the terms and conditions associated with the check order request.

08

Sign the form and date it, as required.

09

Submit the check order request form to your bank by either handing it over at the branch or following the online submission process.

10

Keep a copy of the check order request form for your records.

11

Wait for confirmation from your bank regarding the processing of your check order request.

Who needs check order request?

01

Anyone who wishes to make a payment by check and does not have pre-printed checks available.

02

Individuals who do not have a checking account but have a savings account at a bank.

03

Businesses or organizations that need to issue checks for various purposes, such as payroll, vendor payments, or bill payments.

04

Individuals or businesses who prefer using checks as a payment method for specific transactions.

05

Customers who want to send a check payment for a specific service or product.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send check order request to be eSigned by others?

When you're ready to share your check order request, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I sign the check order request electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I edit check order request on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share check order request on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is check order request?

A check order request is a formal request made to a bank or financial institution to stop payment on a specific check.

Who is required to file check order request?

Anyone who has written a check that needs to be stopped or canceled is required to file a check order request.

How to fill out check order request?

To fill out a check order request, you need to provide details such as your account number, the check number, the amount of the check, and the reason for stopping the payment.

What is the purpose of check order request?

The purpose of a check order request is to prevent a specific check from being cashed or deposited if it has been lost, stolen, or written incorrectly.

What information must be reported on check order request?

The information that must be reported on a check order request includes the account number, check number, amount of the check, reason for stopping payment, and any relevant details.

Fill out your check order request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Check Order Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.