Get the free - Insurance Coverage - Prior Authorization ...

Show details

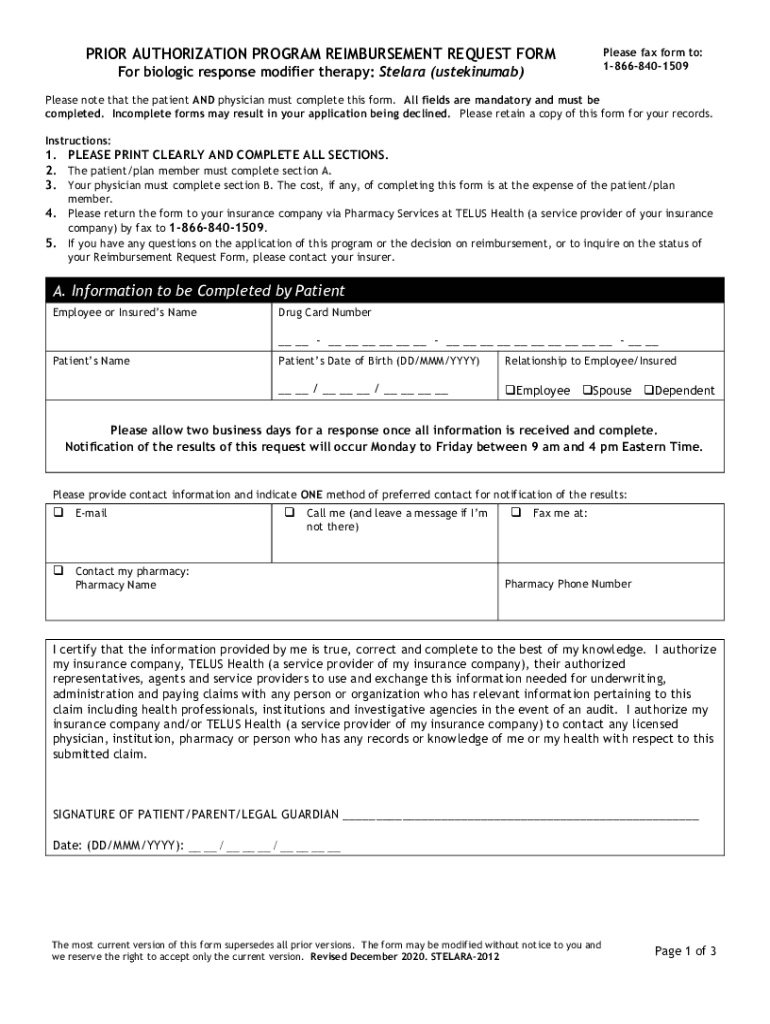

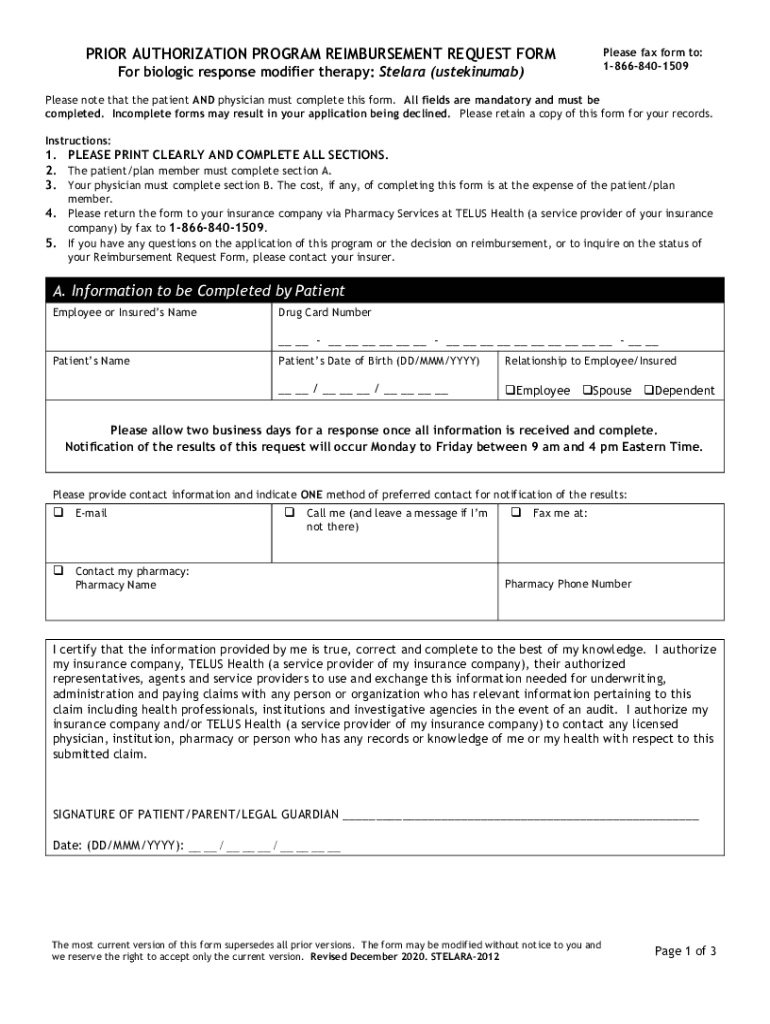

PRIOR AUTHORIZATION PROGRAM REIMBURSEMENT REQUEST FORM For biologic response modifier therapy: ()Please fax form to: 18668401509Please note that the patient AND physician must complete this form.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance coverage

Edit your insurance coverage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance coverage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit insurance coverage online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit insurance coverage. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurance coverage

How to fill out insurance coverage

01

Gather all necessary information about your insurance policy, including policy number and contact information of your insurance provider.

02

Understand the different types of insurance coverage available and determine which ones you need based on your specific requirements.

03

Read the insurance policy document carefully to familiarize yourself with the coverage details, exclusions, and limitations.

04

Fill out the insurance coverage form accurately, providing all the required personal and policy information.

05

Include any additional information or documentation requested by the insurance provider, such as proof of prior coverage or medical records.

06

Double-check all the information provided to ensure accuracy and completeness.

07

Review the filled-out form to ensure you have selected the desired coverage options and excluded any unnecessary ones.

08

Sign and date the insurance coverage form.

09

Submit the completed form to your insurance provider through the preferred method, such as online submission, mail, or in-person.

10

Keep a copy of the filled-out form and any supporting documentation for your records.

Who needs insurance coverage?

01

Individuals who want financial protection against potential risks or losses should consider having insurance coverage.

02

People who own valuable assets, such as homes, vehicles, or businesses, can benefit from insurance coverage to safeguard against property damage, theft, or liability claims.

03

Individuals with dependents or family members who rely on them financially should have life insurance coverage to provide for their loved ones in case of an untimely death.

04

Health insurance coverage is essential for individuals seeking access to medical services and protection against high healthcare costs.

05

Professional liability insurance is necessary for professionals, such as doctors, lawyers, or architects, to protect against claims of professional negligence or malpractice.

06

Business owners should have insurance coverage to mitigate potential risks associated with operations, employees, and legal liabilities.

07

Insurance coverage can be valuable for travelers, protecting them against trip cancellation, lost baggage, or medical emergencies while abroad.

08

Homeowners or renters should have insurance coverage to protect their property and belongings against damage, theft, or natural disasters.

09

Auto insurance coverage is mandatory for drivers in many jurisdictions to provide financial protection in the event of accidents or vehicle damage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify insurance coverage without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including insurance coverage. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I make changes in insurance coverage?

With pdfFiller, the editing process is straightforward. Open your insurance coverage in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I sign the insurance coverage electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your insurance coverage in seconds.

What is insurance coverage?

Insurance coverage is a financial protection plan that provides compensation for specific risks or losses.

Who is required to file insurance coverage?

Individuals or organizations who have insurance policies are required to file insurance coverage.

How to fill out insurance coverage?

To fill out insurance coverage, you need to provide details about your insurance policy, including coverage limits, premiums, and policy number.

What is the purpose of insurance coverage?

The purpose of insurance coverage is to protect individuals or organizations from financial losses due to unexpected events.

What information must be reported on insurance coverage?

Information such as policy number, coverage limits, premiums, and insurer details must be reported on insurance coverage.

Fill out your insurance coverage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Coverage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.