Get the free Non-retirement investing: What to invest in - U.S. Bank

Show details

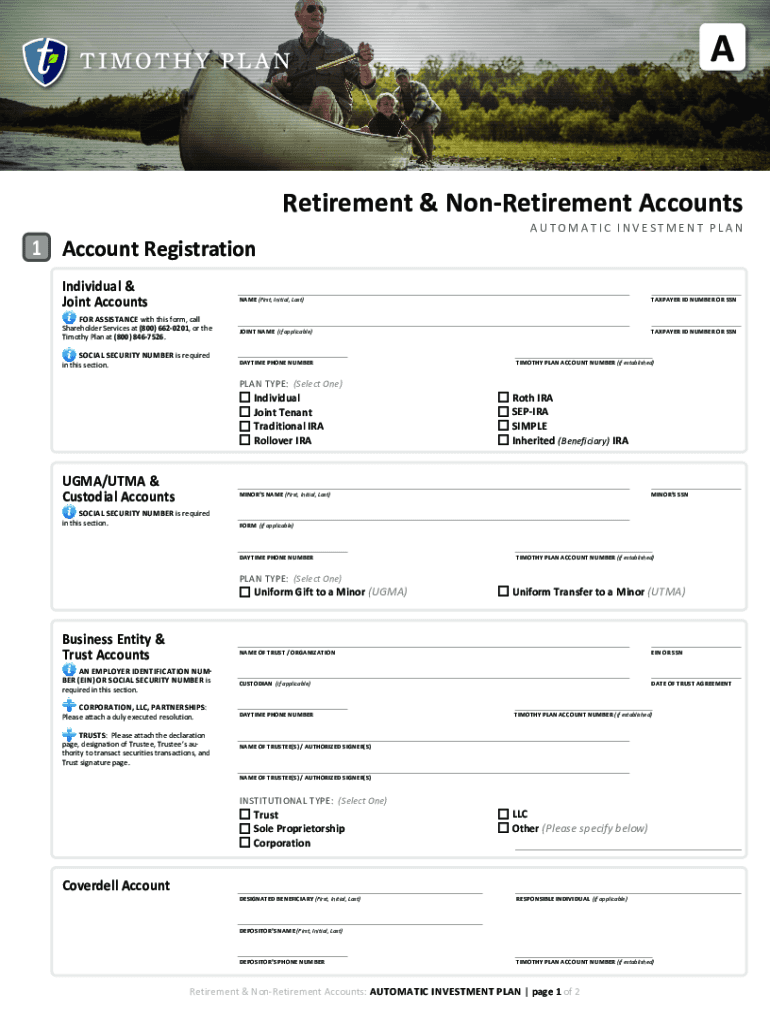

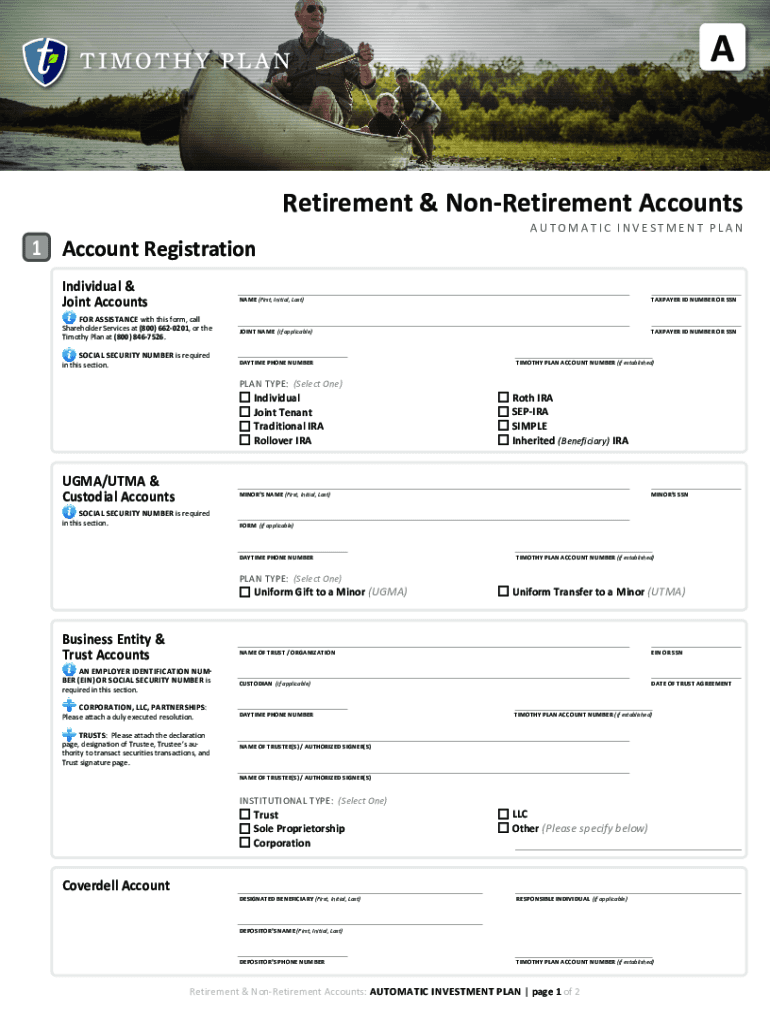

Retirement & Retirement Accounts AUTOMATIC INVESTMENT PLAN1 Account Registration Individual & Joint Accounts ASSISTANCE with this form, call Shareholder Services at (800) 6620201, or the Timothy Plan

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-retirement investing what to

Edit your non-retirement investing what to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-retirement investing what to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit non-retirement investing what to online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit non-retirement investing what to. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-retirement investing what to

How to fill out non-retirement investing what to

01

Determine your investment goals: Before filling out a non-retirement investing form, clarify your financial goals and what you hope to achieve through investing. Are you aiming for long-term growth, income generation, or a combination of both?

02

Research different investment options: Non-retirement investing offers a wide range of investment opportunities such as stocks, bonds, mutual funds, real estate, and more. Look into these options and consider their risks, potential returns, and suitability for your goals.

03

Assess your risk tolerance: Understand your comfort level with taking risks. This will help you choose investments that align with your risk appetite.

04

Choose a brokerage or investment provider: Identify a reputable brokerage firm or investment provider through which you will invest. Consider factors like fees, customer service, technology platforms, and investment options offered.

05

Fill out the non-retirement investing form: Obtain the required form from your chosen brokerage or investment provider. Carefully fill out the form, providing accurate personal and financial information as requested.

06

Seek professional advice if needed: If you are uncertain about certain investment concepts or need guidance with filling out the form, it is advisable to consult a financial advisor or investment professional.

07

Review and submit the form: Double-check all the information you have provided on the form for accuracy and completeness. Once satisfied, submit the filled-out form to the brokerage or investment provider.

08

Monitor and manage your investments: After completing the form, regularly monitor your investments to track their performance and make adjustments if necessary. Stay informed about market trends and seek updates from your brokerage or investment provider.

09

Review and update periodically: Periodically reassess your investment goals, risk tolerance, and overall financial situation. Consider making adjustments to your non-retirement investment strategy as needed.

Who needs non-retirement investing what to?

01

Anyone who is seeking to grow their wealth or generate additional income beyond retirement savings may benefit from non-retirement investing. This type of investing can be suitable for individuals who have already maximized contributions to retirement accounts or have specific financial goals outside of retirement, such as purchasing a home or funding education.

02

Furthermore, non-retirement investing may appeal to people who have a higher tolerance for risk and are looking for potentially higher returns compared to traditional savings options. It can also be suitable for those who want to diversify their investment portfolio and explore different asset classes and investment strategies.

03

However, it is important to note that non-retirement investing involves risks, and individuals should carefully consider their financial situation, goals, and risk tolerance before engaging in such activities. Consulting a financial advisor can provide personalized guidance based on individual circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute non-retirement investing what to online?

pdfFiller has made it simple to fill out and eSign non-retirement investing what to. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make edits in non-retirement investing what to without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your non-retirement investing what to, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I edit non-retirement investing what to on an Android device?

The pdfFiller app for Android allows you to edit PDF files like non-retirement investing what to. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is non-retirement investing what to?

Non-retirement investing refers to investing money in various assets such as stocks, bonds, real estate, etc., outside of retirement accounts like 401(k) or IRA.

Who is required to file non-retirement investing what to?

Individuals who have non-retirement investments and earn income from them are required to file non-retirement investing information.

How to fill out non-retirement investing what to?

To fill out non-retirement investing information, you need to report details of your non-retirement investments and the income generated from them.

What is the purpose of non-retirement investing what to?

The purpose of reporting non-retirement investing information is to ensure accurate tax reporting and compliance with investment regulations.

What information must be reported on non-retirement investing what to?

You must report details of your non-retirement investment accounts, types of assets held, income earned, and any capital gains or losses.

Fill out your non-retirement investing what to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Retirement Investing What To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.