Get the free IRA CHARITABLE ROLLOVER - campaign.dmu.edu

Show details

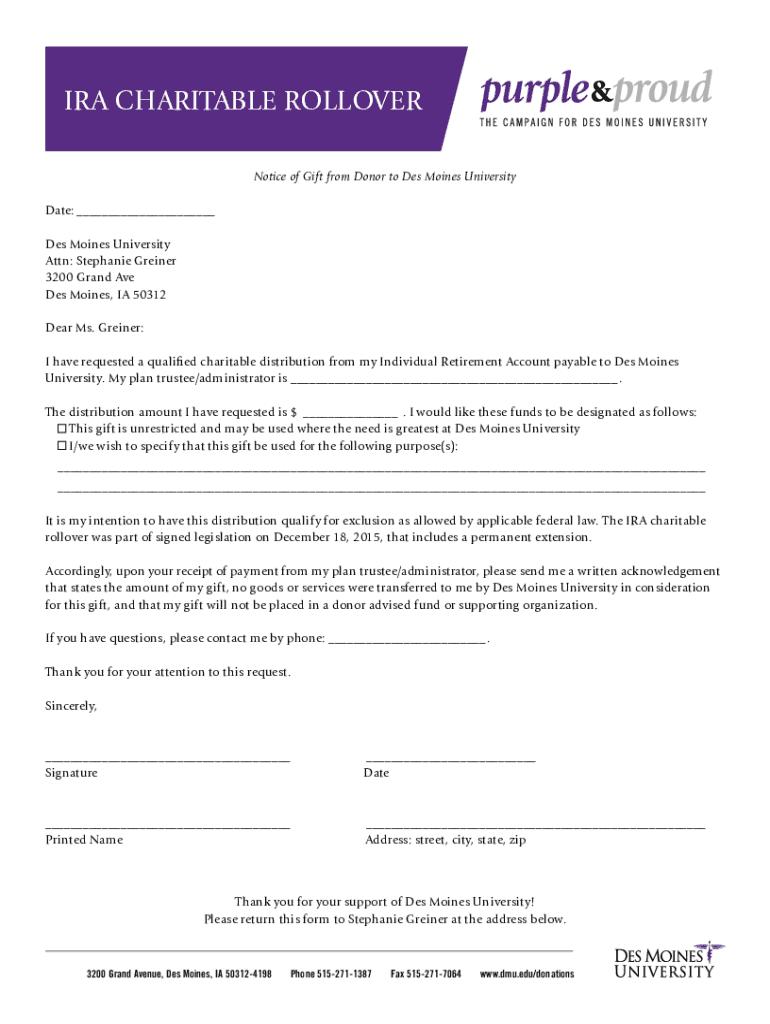

IRA CHARITABLE ROLLOVER Notice of Gift from Donor to Des Moines University Date: Des Moines University Attn: Stephanie Grader 3200 Grand Ave Des Moines, IA 50312 Dear Ms. Grader: I have requested

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ira charitable rollover

Edit your ira charitable rollover form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ira charitable rollover form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ira charitable rollover online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ira charitable rollover. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ira charitable rollover

How to fill out ira charitable rollover

01

To fill out an IRA charitable rollover, follow these steps:

02

Confirm eligibility: Make sure you are at least 70 ½ years old, and have a traditional IRA.

03

Check allowed charities: Ensure that the charitable organization you want to donate to is eligible to receive IRA rollover contributions.

04

Contact your IRA custodian: Get in touch with your IRA custodian and inform them of your intention to make a charitable rollover.

05

Provide necessary information: Give your custodian the essential details such as the amount you wish to donate and the charity you want to donate to.

06

Complete the required forms: Fill out any forms required by your IRA custodian to process the charitable rollover.

07

Initiate the transfer: Your custodian will transfer the specified amount directly to the charity.

08

Keep records: Maintain records of your donation for tax purposes, including receipts or acknowledgments from the charity.

09

Report the rollover: When filing your taxes, report the IRA charitable rollover as a qualified charitable distribution on Form 1040.

Who needs ira charitable rollover?

01

Individuals who have reached the age of 70 ½ and have a traditional IRA are eligible to utilize the IRA charitable rollover.

02

It can be beneficial for those who want to make charitable donations but do not need the income from their required minimum distributions (RMDs).

03

Additionally, individuals who wish to minimize their taxable income and take advantage of tax benefits associated with charitable giving may find the IRA charitable rollover advantageous.

04

Consulting a financial advisor or tax professional can help determine if the IRA charitable rollover is the right option for your specific financial situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ira charitable rollover online?

With pdfFiller, it's easy to make changes. Open your ira charitable rollover in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I sign the ira charitable rollover electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your ira charitable rollover in seconds.

Can I create an eSignature for the ira charitable rollover in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your ira charitable rollover and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is ira charitable rollover?

IRA charitable rollover is a provision that allows individuals age 70½ and older to donate up to $100,000 from their IRA directly to a qualified charity without counting the distribution as taxable income.

Who is required to file ira charitable rollover?

Individuals who are age 70½ or older and have an IRA account are eligible to participate in the IRA charitable rollover.

How to fill out ira charitable rollover?

To fill out an IRA charitable rollover, individuals should contact their IRA administrator to request a distribution directly to a qualified charity.

What is the purpose of ira charitable rollover?

The purpose of IRA charitable rollover is to allow older individuals to support charitable organizations while receiving tax benefits for their donations.

What information must be reported on ira charitable rollover?

The IRA charitable rollover must be reported to the IRS on Form 1099-R, and individuals should also keep records of the donation and acknowledgement from the charity.

Fill out your ira charitable rollover online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ira Charitable Rollover is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.