Get the free Claims - Motor Insurance (Macau)MSIG Hong Kong

Show details

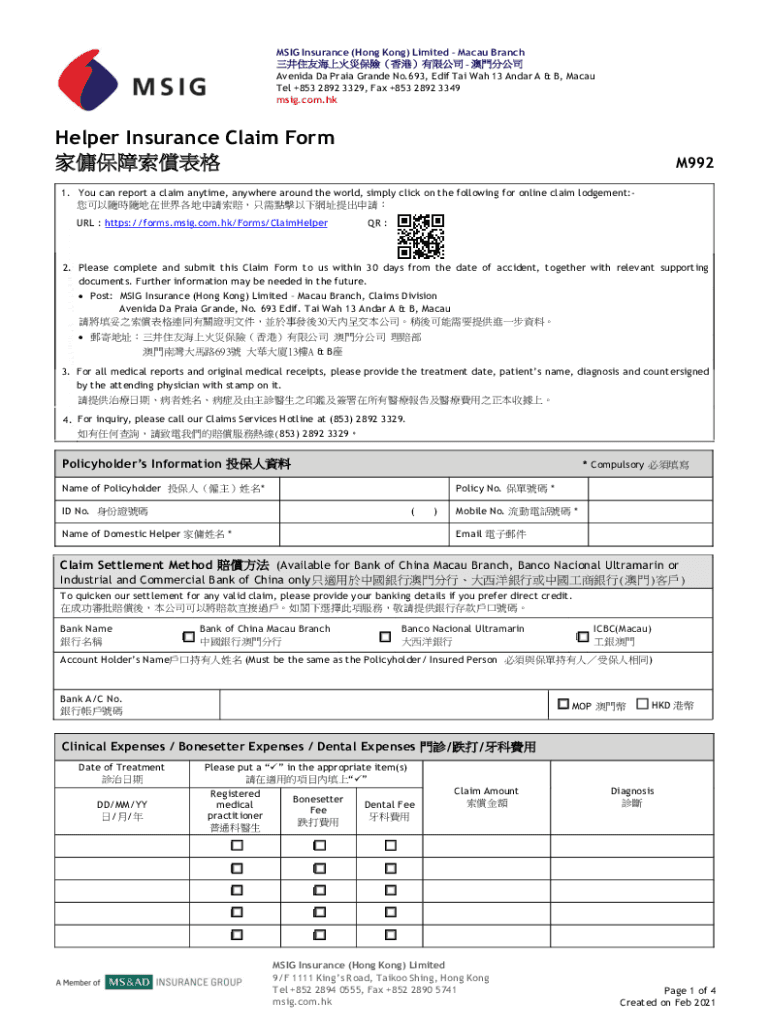

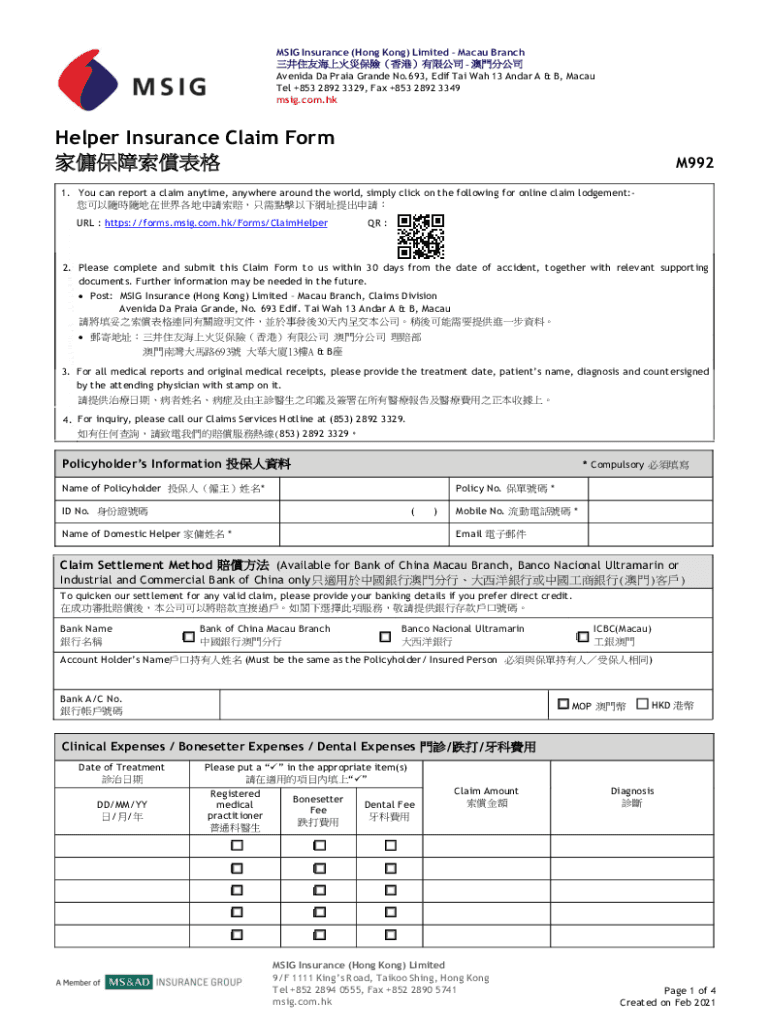

MSI Insurance (Hong Kong) Limited Macau Branch Agenda The Praia Grande No.693, Edit Tai Was 13 Adar A & B, Macau Tel +853 2892 3329, Fax +853 2892 3349 msig.com.helper Insurance Claim Form M9921.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claims - motor insurance

Edit your claims - motor insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claims - motor insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing claims - motor insurance online

Follow the steps down below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit claims - motor insurance. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out claims - motor insurance

How to fill out claims - motor insurance

01

Start by gathering all the necessary information and documentation related to your motor insurance claim. This may include the policy number, date and time of the incident, details of the accident or damage, and any photographs or evidence.

02

Contact your motor insurance provider or broker to inform them about the claim and request a claims form. They will guide you through the process and provide any additional instructions.

03

Fill out the claims form accurately and completely. Make sure to provide all the required information and attach any supporting documents as requested. Double-check for any errors or missing details before submitting the form.

04

If there were any other parties involved in the incident, such as other drivers or witnesses, gather their contact information and include it in the claims form. This will help with the claims investigation process.

05

Submit the completed claims form and all supporting documents to your motor insurance provider. They will review your claim and may conduct an investigation if necessary.

06

Follow up with your insurance provider regularly to check the progress of your claim. They should keep you updated on any developments or decisions regarding your claim.

07

If your claim is approved, your insurance provider will provide you with the necessary assistance or compensation as per your policy terms. If it is denied, you may have the option to appeal or seek alternative solutions.

08

It is important to keep records of all communication, including phone calls and written correspondence, related to your motor insurance claim. This will help in case of any issues or disputes.

Who needs claims - motor insurance?

01

Anyone who owns a motor vehicle and wants financial protection against potential damages, accidents, or liabilities may need motor insurance. This includes car owners, motorcycle owners, and other motor vehicle owners.

02

Motor insurance is especially important for individuals who rely on their vehicles for daily transportation or livelihood, as it provides coverage for repairs, replacements, medical expenses, and legal liabilities.

03

Additionally, motor insurance may be legally required by some jurisdictions or as a condition for vehicle financing. Therefore, anyone who falls under such obligations needs motor insurance.

04

Furthermore, motor insurance is also beneficial for those who want peace of mind and financial security in case of unexpected incidents or accidents involving their vehicles.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send claims - motor insurance to be eSigned by others?

Once your claims - motor insurance is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an eSignature for the claims - motor insurance in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your claims - motor insurance and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Can I edit claims - motor insurance on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share claims - motor insurance on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is claims - motor insurance?

Claims in motor insurance refer to the process of reporting an incident to an insurance company in order to receive compensation for damages to a vehicle or injuries sustained in a car accident.

Who is required to file claims - motor insurance?

Anyone who has been involved in a car accident and has a motor insurance policy is required to file a claim with their insurance provider.

How to fill out claims - motor insurance?

To fill out a claim for motor insurance, policyholders must contact their insurance company, provide details of the incident, complete the necessary claim forms, and submit any supporting documentation such as police reports or repair estimates.

What is the purpose of claims - motor insurance?

The purpose of claims in motor insurance is to provide policyholders with financial protection in the event of a car accident or other covered incident, by reimbursing them for damages to their vehicle or injuries sustained.

What information must be reported on claims - motor insurance?

Information that must be reported on claims for motor insurance may include details of the incident, contact information for all parties involved, policy information, and any supporting documentation such as photos or witness statements.

Fill out your claims - motor insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claims - Motor Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.