VA 26-1817 2019 free printable template

Show details

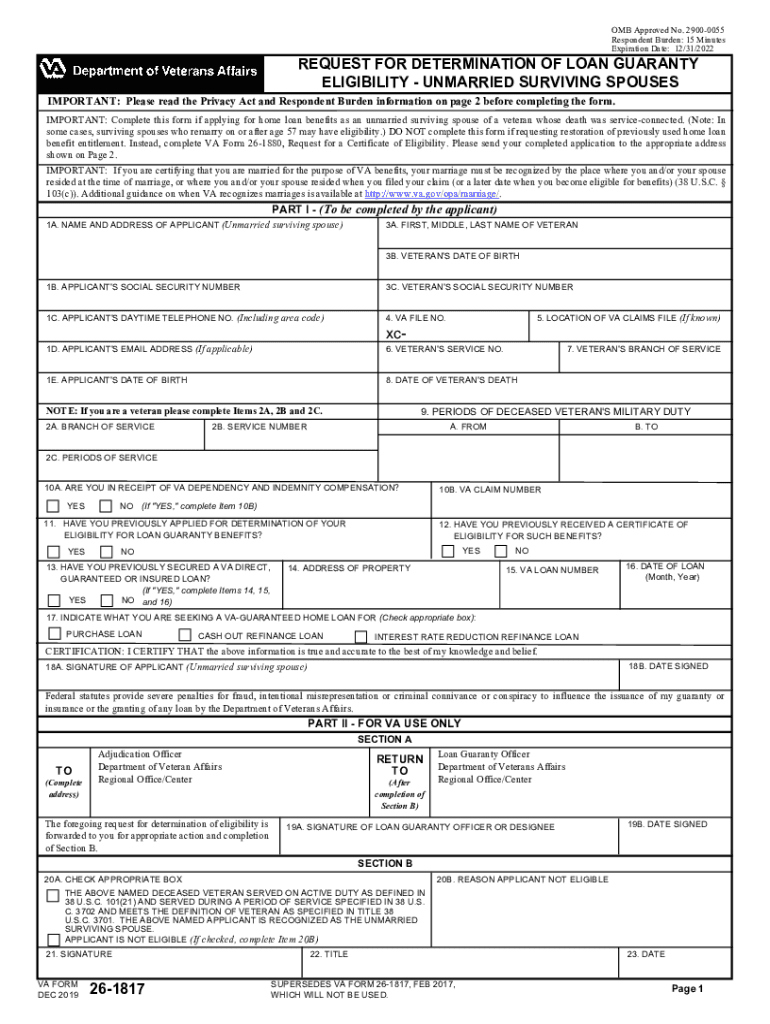

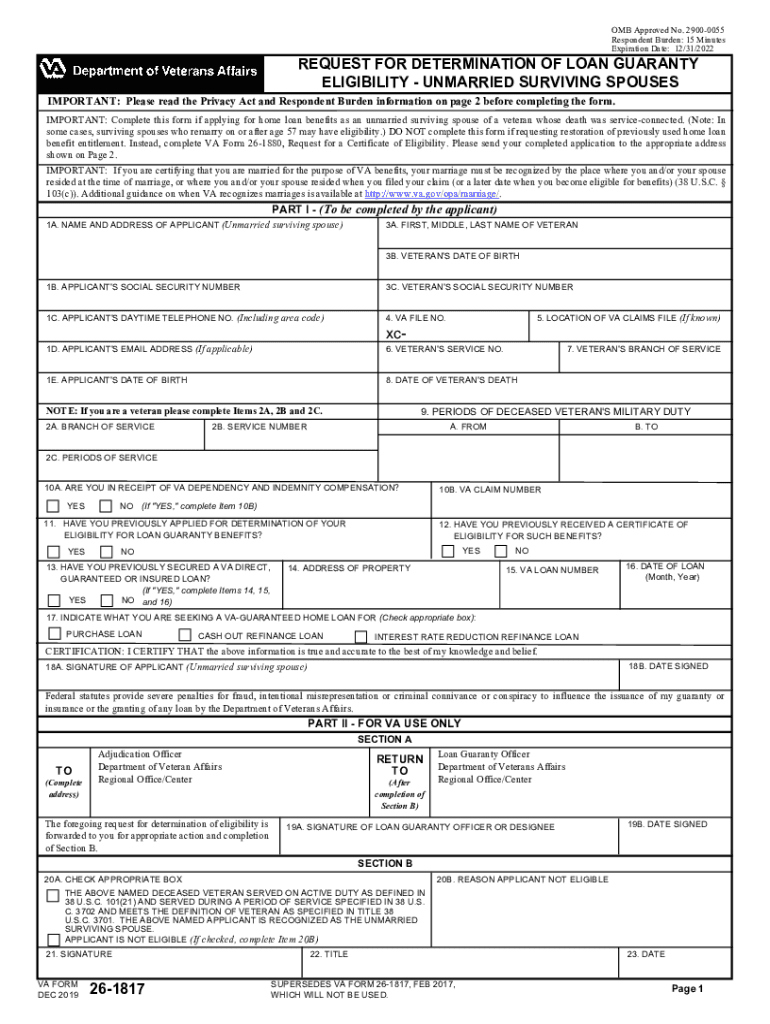

OMB Approved No. 29000055 Respondent Burden: 15 Minutes Expiration Date: 12/31/2022REQUEST FOR DETERMINATION OF LOAN GUARANTY ELIGIBILITY UNMARRIED SURVIVING SPOUSESIMPORTANT: Please read the Privacy

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign VA 26-1817

Edit your VA 26-1817 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VA 26-1817 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing VA 26-1817 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit VA 26-1817. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA 26-1817 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VA 26-1817

How to fill out VA 26-1817

01

Obtain the VA Form 26-1817 from the VA website or local VA office.

02

Fill out your personal information at the top of the form, including your name, address, and social security number.

03

Provide details about your military service, including the dates of service and branch of the military.

04

Indicate the type of loan you are applying for and the purpose of the loan.

05

Complete the financial information section, providing details about your income, debts, and other financial obligations.

06

Review the completed form for accuracy and ensure all required fields are filled out.

07

Sign and date the form before submitting it to the appropriate VA office.

Who needs VA 26-1817?

01

The VA Form 26-1817 is needed by veterans and active duty service members who are applying for a VA-guaranteed home loan.

Fill

form

: Try Risk Free

People Also Ask about

What is Form 26 1817 for the VA?

The VA Form 26-1817 is submitted by an unmarried surviving spouse of a veteran whose death was service-connected for determination of eligibility for VA home loan benefits as authorized by 38 U.S.C. 3701(b)(2).

What is VA Form 26-1880 used for?

Use VA Form 26-1880 to apply for a VA home loan Certificate of Eligibility (COE). You'll need to bring the COE to your lender to prove that you qualify for a VA home loan.

What does VA mean in banking?

What Is a VA Loan? A VA loan is a mortgage loan available through a program established by the U.S. Department of Veterans Affairs (VA) (previously the Veterans Administration).

What is VA Form 1817?

IMPORTANT: Complete this form if applying for home loan benefits as an unmarried surviving spouse of a veteran whose death was service-connected. (Note: In some cases, surviving spouses who remarry on or after age 57 may have eligibility.)

What is the VA surviving spouse form?

Use VA Form 21P-534 if you prefer to provide evidence at a later time to support your claim. You can use this form if you're a surviving spouse or child of a Veteran who has died and want to begin the process of applying for VA benefits or money that we owe the Veteran but did not pay prior to his or her death.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send VA 26-1817 for eSignature?

Once your VA 26-1817 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I complete VA 26-1817 online?

pdfFiller has made it easy to fill out and sign VA 26-1817. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I fill out the VA 26-1817 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign VA 26-1817. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is VA 26-1817?

VA Form 26-1817 is the 'Interest Rate Reduction Refinancing Loan (IRRRL) Application' used by veterans to apply for a VA-backed loan that simplifies the refinancing process.

Who is required to file VA 26-1817?

Veterans and active-duty service members who wish to refinance an existing VA loan to a lower interest rate or streamline their current loan are required to file VA Form 26-1817.

How to fill out VA 26-1817?

To fill out VA Form 26-1817, applicants should provide their personal information, details of the current loan, any property information, and the new loan terms they are seeking. It's crucial to read the instructions thoroughly and have all necessary documentation ready.

What is the purpose of VA 26-1817?

The purpose of VA Form 26-1817 is to facilitate the process of refinancing existing VA loans by streamlining loan applications, allowing veterans to take advantage of lower interest rates.

What information must be reported on VA 26-1817?

Information that must be reported on VA Form 26-1817 includes the borrower's name, address, Social Security number, current loan information, property details, and the proposed loan information, including the interest rate and loan amount.

Fill out your VA 26-1817 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VA 26-1817 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.