Get the free Canada Life Insured Benefits Change - OPTrust

Show details

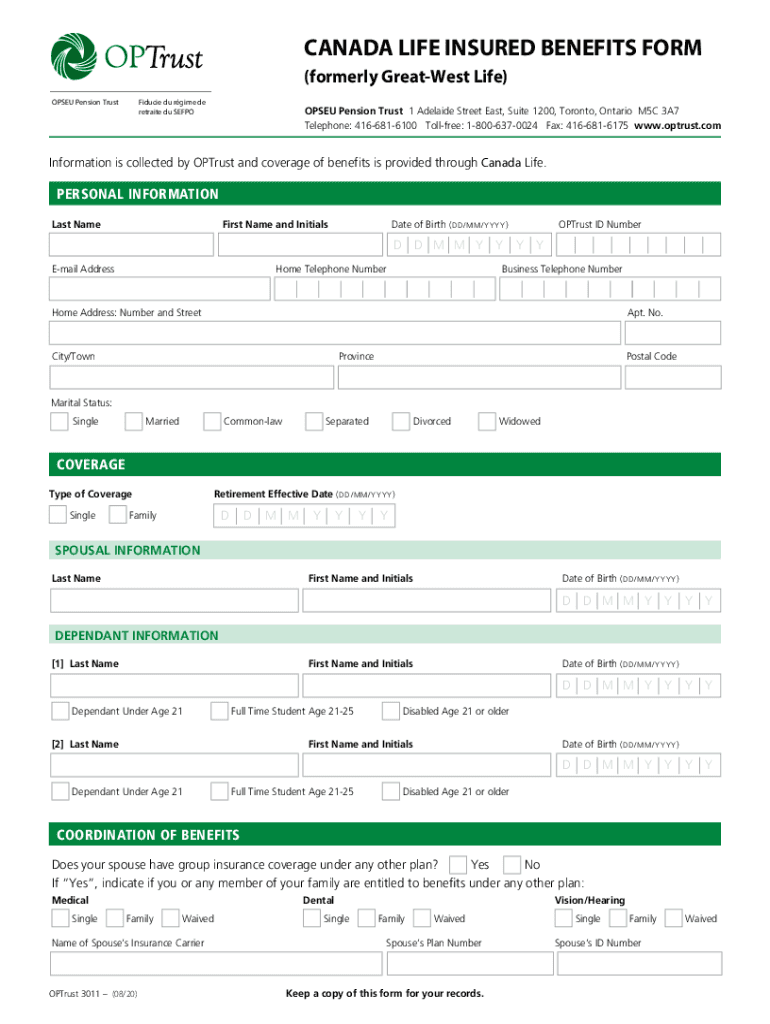

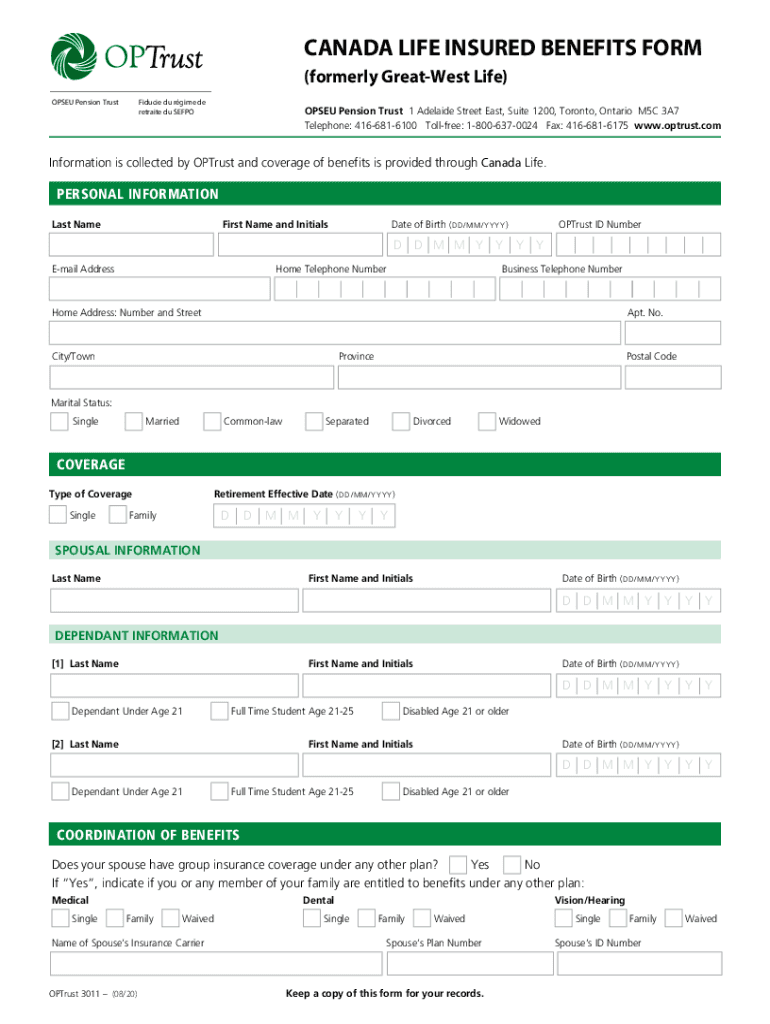

CANADA LIFE INSURED BENEFITS FORM (formerly The Greatest Life) OP SEU Pension TrustFiducie Du regime DE retrieve Du SEFPOOPSEU Pension Trust 1 Adelaide Street East, Suite 1200, Toronto, Ontario M5C

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign canada life insured benefits

Edit your canada life insured benefits form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your canada life insured benefits form via URL. You can also download, print, or export forms to your preferred cloud storage service.

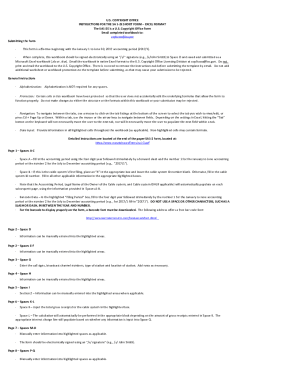

Editing canada life insured benefits online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit canada life insured benefits. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out canada life insured benefits

How to fill out canada life insured benefits

01

To fill out Canada Life insured benefits, follow these steps:

02

Obtain a copy of the benefits form from Canada Life or their website.

03

Provide your personal information such as name, address, and contact details.

04

Fill in the details of the insured person, including their name, date of birth, and relationship to you.

05

Specify the type of benefits you are claiming, such as life insurance, accidental death benefits, or critical illness benefits.

06

Provide any supporting documentation required, such as medical records or death certificates.

07

Complete the beneficiary information, including their name, relationship to the insured, and contact details.

08

Review the form carefully to ensure all information is accurate and complete.

09

Sign and date the form, acknowledging that the information provided is true and accurate.

10

Submit the completed form to Canada Life through their designated channels, such as mail or online submission.

11

Keep a copy of the filled-out form for your records.

Who needs canada life insured benefits?

01

Canada Life insured benefits can be beneficial for individuals who wish to provide financial protection for themselves or their loved ones in the event of death, critical illness, or accidental injury.

02

Specifically, the following individuals may need Canada Life insured benefits:

03

- Policyholders who have purchased life insurance policies and want to ensure their beneficiaries receive the designated benefits.

04

- Individuals who have dependents or family members who rely on their income and want to secure their financial well-being in case of unexpected events.

05

- Workers or individuals with higher-risk occupations who wish to protect their income or provide additional compensation in case of accidental injuries or disability.

06

- Those who have a history of critical illnesses and want to have financial coverage for medical expenses and ongoing care.

07

- Business owners who want to provide key employee insurance or protection for their employees in case of tragedy.

08

It is important to review the specific terms and conditions of the Canada Life insured benefits to determine the suitability and eligibility criteria for each individual.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in canada life insured benefits without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing canada life insured benefits and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How can I edit canada life insured benefits on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing canada life insured benefits.

Can I edit canada life insured benefits on an iOS device?

Use the pdfFiller mobile app to create, edit, and share canada life insured benefits from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is canada life insured benefits?

Canada life insured benefits refer to the financial protection provided to individuals or their beneficiaries in case of death, disability, or critical illness. This can include life insurance, disability insurance, and critical illness insurance.

Who is required to file canada life insured benefits?

Employers are typically responsible for filing canada life insured benefits on behalf of their employees. However, individuals who have purchased individual life insurance policies may also need to file a claim in the event of a covered event.

How to fill out canada life insured benefits?

To fill out canada life insured benefits, you will need to obtain the necessary forms from the insurance provider or employer, complete them with accurate information regarding the insured individual, the event being claimed (death, disability, critical illness), and any other requested details. The forms can then be submitted to the insurance provider for processing.

What is the purpose of canada life insured benefits?

The purpose of canada life insured benefits is to provide financial protection and support to individuals or their beneficiaries in the event of death, disability, or critical illness. This can help alleviate the financial burden during difficult times and ensure that loved ones are taken care of.

What information must be reported on canada life insured benefits?

The information that must be reported on canada life insured benefits includes the insured individual's personal details, the type of insurance coverage, the policy number, the date of the covered event (death, disability, critical illness), and any other relevant information requested by the insurance provider or employer.

Fill out your canada life insured benefits online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada Life Insured Benefits is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.