Get the free $100 4305 french foreign legion & infantry uniform ...

Show details

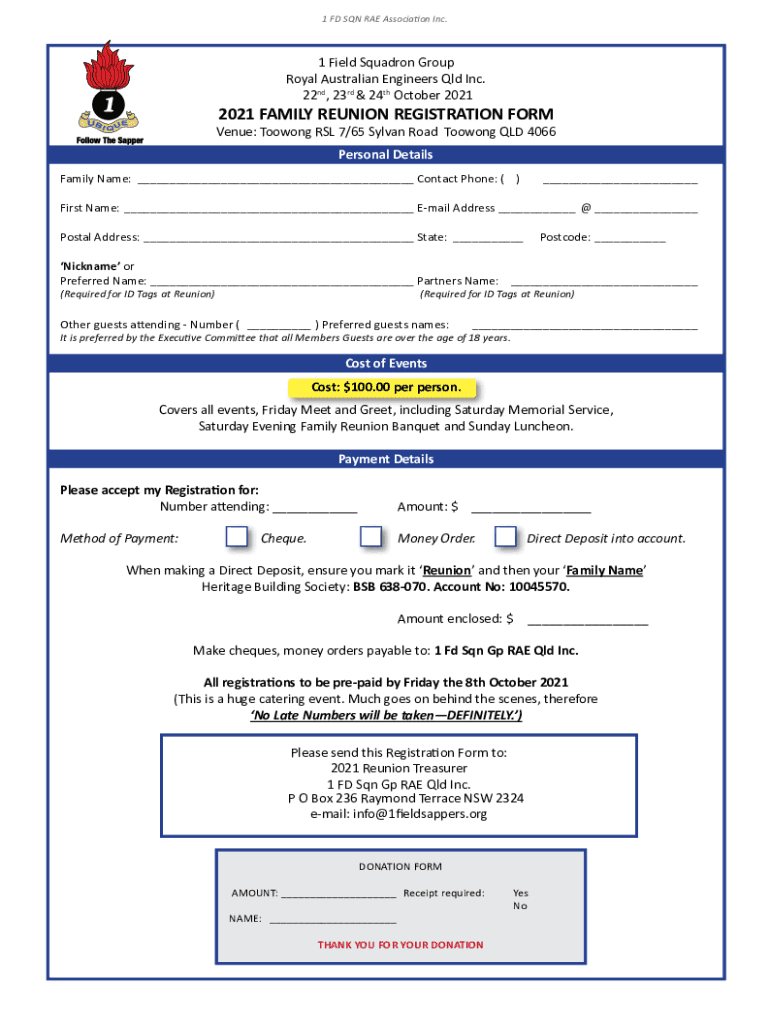

1 FD SON RAE Association Inc.1 Field Squadron Group Royal Australian Engineers QLD Inc. 22nd, 23rd & 24th October 20212021 FAMILY REUNION REGISTRATION Revenue: Towing SL 7/65 Sylvan Road Towing QLD

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 100 4305 french foreign

Edit your 100 4305 french foreign form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 100 4305 french foreign form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 100 4305 french foreign online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 100 4305 french foreign. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 100 4305 french foreign

How to fill out 100 4305 french foreign

01

To fill out 100 4305 french foreign, follow these steps:

02

Start by gathering all the necessary information and documents such as your personal details, identification documents, and any supporting documents required.

03

Begin by entering your personal information accurately in the relevant sections of the form. This could include your full name, date of birth, address, contact information, etc.

04

Proceed to provide the specific details required for the foreign transaction you are undertaking. This may include details about the funds, their purpose, destination country, etc.

05

Attach any necessary supporting documents as required by the form. These could include identification documents, proof of income, proof of residence, etc.

06

Double-check all the information you have entered to ensure it is accurate and complete.

07

Sign and date the form in the designated areas.

08

Submit the filled-out form along with any required supporting documents to the relevant authority or institution as instructed.

09

Keep a copy of the filled-out form and any submitted documents for your records.

Who needs 100 4305 french foreign?

01

Individuals who are involved in foreign transactions and require documentation related to the 100 4305 French foreign form will need it. This could include individuals who are sending or receiving funds internationally, businesses engaging in foreign transactions, or individuals involved in international investments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 100 4305 french foreign in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your 100 4305 french foreign and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I edit 100 4305 french foreign from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your 100 4305 french foreign into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I edit 100 4305 french foreign on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing 100 4305 french foreign right away.

What is 100 4305 french foreign?

The 100 4305 french foreign form is a form that must be filed by individuals who have foreign financial accounts with a balance exceeding $10,000 at any time during the calendar year.

Who is required to file 100 4305 french foreign?

Any U.S. person who has a financial interest in or signature authority over foreign financial accounts must file the 100 4305 french foreign form.

How to fill out 100 4305 french foreign?

The 100 4305 french foreign form can be filled out electronically through the FinCEN website or by mailing a paper form to the address provided on the form.

What is the purpose of 100 4305 french foreign?

The purpose of the 100 4305 french foreign form is to report foreign financial accounts to the U.S. government in order to combat tax evasion and money laundering.

What information must be reported on 100 4305 french foreign?

The 100 4305 french foreign form requires information about the account holder, the financial institution where the account is held, and details about the account balance.

Fill out your 100 4305 french foreign online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

100 4305 French Foreign is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.