Get the free Endowments and Planned Gifts Work Hand-in-Hand ...EndowmentsNational Council of Nonp...

Show details

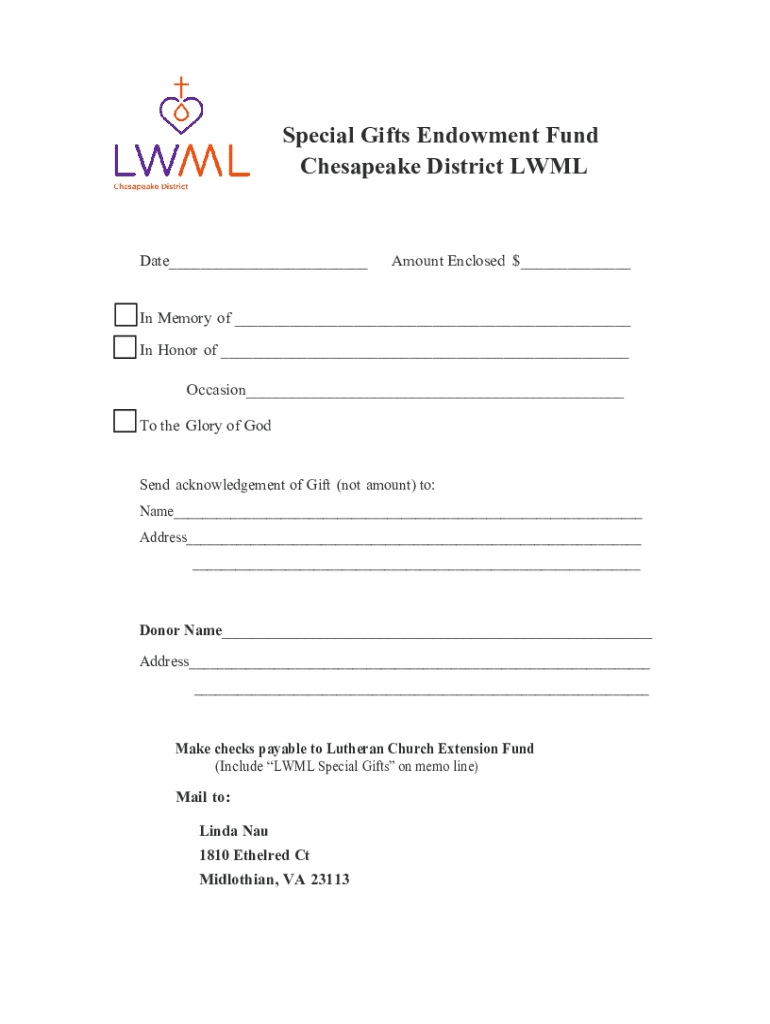

Special Gifts Endowment Fund Chesapeake District Laminate Amount Enclosed $ In Memory of In Honor of Occasion To the Glory of God Send acknowledgement of Gift (not amount) to: Name Address Donor Name

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign endowments and planned gifts

Edit your endowments and planned gifts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your endowments and planned gifts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing endowments and planned gifts online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit endowments and planned gifts. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out endowments and planned gifts

How to fill out endowments and planned gifts

01

To fill out endowments and planned gifts, follow these steps:

02

Research and understand the purpose and benefits of endowments and planned gifts.

03

Determine the type of gift you want to make: whether it is a cash donation, real estate, stocks, or other assets.

04

Consult with a financial advisor or estate planning professional to assess your financial situation and plan the gift accordingly.

05

Select a charity or organization that aligns with your values and mission.

06

Review the endowment or planned giving options provided by the chosen charity.

07

Determine the amount or value of the gift you wish to make.

08

Prepare the necessary documents, including wills, trusts, or other legal forms.

09

Consult with an attorney to ensure all legal requirements are met.

10

Communicate your intentions to the charity or organization, and provide them with the necessary documentation.

11

Keep track of your gift and follow up with the charity to ensure it is being utilized as intended.

Who needs endowments and planned gifts?

01

Endowments and planned gifts are beneficial for various individuals and organizations, including:

02

- Individuals who wish to leave a lasting legacy and support a cause or charity they deeply care about.

03

- Philanthropists who want to maximize the impact of their charitable contributions.

04

- Non-profit organizations and educational institutions that rely on endowments and planned gifts to ensure long-term financial stability.

05

- Donors who want to receive potential tax benefits through planned giving.

06

- Families and individuals who want to ensure their assets are distributed according to their wishes after their passing.

07

- Anyone looking to make a substantial and meaningful charitable donation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get endowments and planned gifts?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the endowments and planned gifts in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit endowments and planned gifts online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your endowments and planned gifts and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I fill out endowments and planned gifts using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign endowments and planned gifts and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is endowments and planned gifts?

Endowments are funds donated to an institution that are intended to be invested to provide a permanent source of income. Planned gifts are contributions that are arranged in the present and allocated at a future date, often as part of a donor's estate planning.

Who is required to file endowments and planned gifts?

Non-profit organizations, charities, and institutions that receive endowments and planned gifts are required to file them.

How to fill out endowments and planned gifts?

Endowments and planned gifts are typically reported on a organization's financial statements, tax returns, and donor acknowledgments.

What is the purpose of endowments and planned gifts?

The purpose of endowments and planned gifts is to provide long-term financial stability and support for non-profit organizations and institutions.

What information must be reported on endowments and planned gifts?

Information such as the amount of the gift, donor information, intended use of the funds, and any restrictions on the gift must be reported on endowments and planned gifts.

Fill out your endowments and planned gifts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Endowments And Planned Gifts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.