Get the free In-Plan Roth Rollover s Doc TemplatePDFfiller

Show details

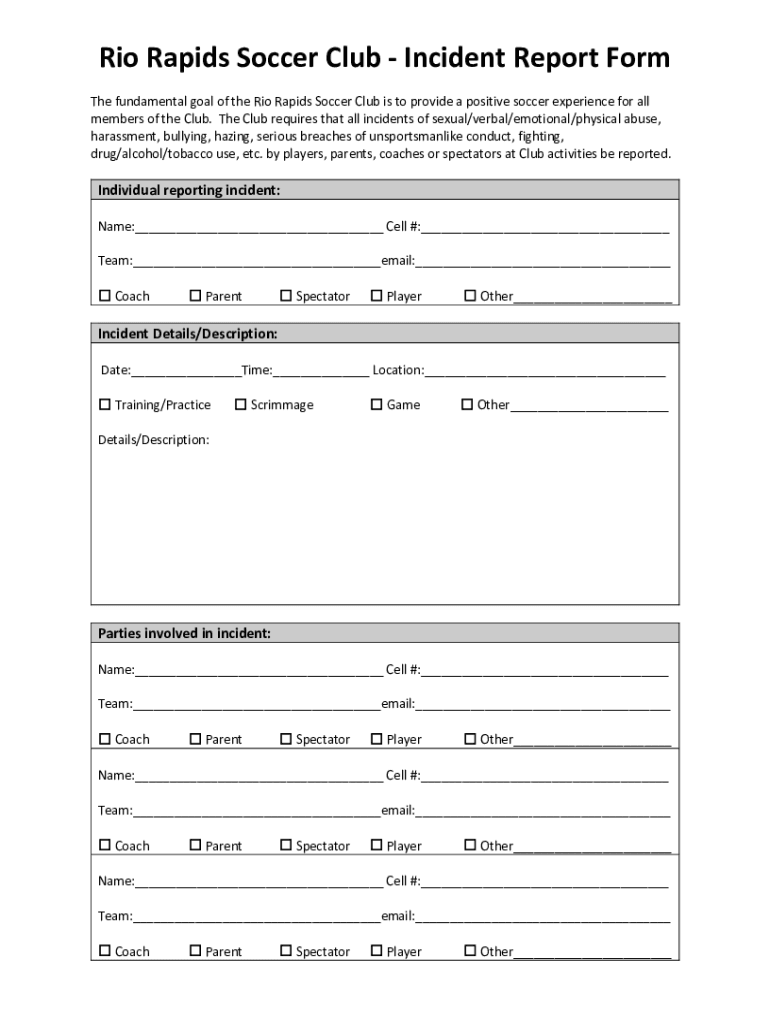

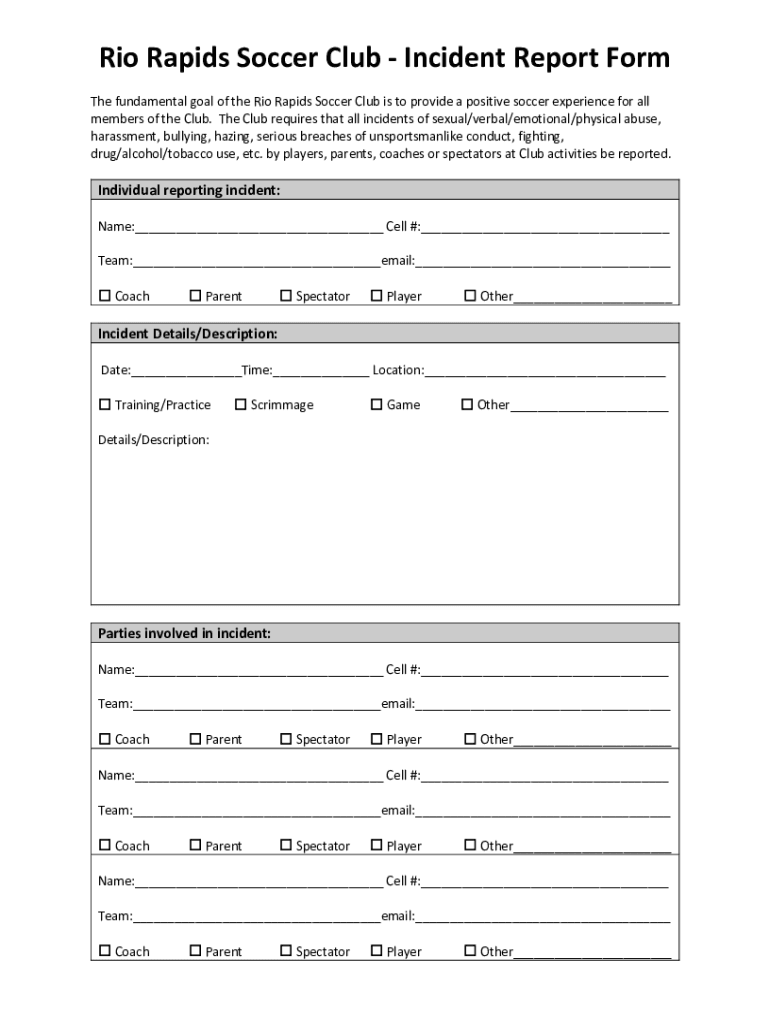

Rio Rapids Soccer Club Incident Report Form The fundamental goal of the Rio Rapids Soccer Club is to provide a positive soccer experience for all members of the Club. The Club requires that all incidents

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign in-plan roth rollover s

Edit your in-plan roth rollover s form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your in-plan roth rollover s form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing in-plan roth rollover s online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit in-plan roth rollover s. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out in-plan roth rollover s

How to fill out in-plan roth rollover s

01

To fill out an in-plan Roth rollover, follow these steps:

02

Determine if your employer offers an in-plan Roth rollover option in your retirement plan.

03

Understand the requirements and limitations of an in-plan Roth rollover.

04

Decide how much you want to convert from your traditional pre-tax retirement account to a Roth account.

05

Contact your plan administrator or human resources department to obtain the necessary forms for the in-plan Roth rollover.

06

Fill out the required forms accurately, providing all the requested information.

07

Review the forms and make sure all the information is correct.

08

Submit the completed forms to your plan administrator or human resources department.

09

Follow up with the administrator to ensure the rollover process is completed successfully.

10

Monitor your account after the in-plan Roth rollover to ensure the conversion was processed correctly and review any tax implications.

Who needs in-plan roth rollover s?

01

In-plan Roth rollovers are suitable for individuals who meet the following criteria:

02

- Employees who have a retirement plan that offers an in-plan Roth rollover option

03

- Individuals who have a traditional pre-tax retirement account and want to convert it to a Roth account

04

- Those who believe they will benefit from paying taxes on the converted amount now rather than in the future

05

- Individuals looking to diversify their retirement savings by having both pre-tax and after-tax contributions

06

- People who want to take advantage of potential tax-free growth and tax-free qualified withdrawals in retirement

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get in-plan roth rollover s?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific in-plan roth rollover s and other forms. Find the template you need and change it using powerful tools.

How do I complete in-plan roth rollover s online?

Easy online in-plan roth rollover s completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I edit in-plan roth rollover s on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign in-plan roth rollover s right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is in-plan roth rollover s?

In-plan Roth rollovers allow participants in 401(k), 403(b), and governmental 457(b) plans to transfer amounts from their pre-tax accounts to designated Roth accounts within the same plan.

Who is required to file in-plan roth rollover s?

Participants in eligible retirement plans who wish to convert pre-tax amounts to Roth accounts are required to file in-plan Roth rollovers.

How to fill out in-plan roth rollover s?

To fill out in-plan Roth rollovers, participants typically need to complete a form provided by their plan administrator, indicating the amount they want to rollover from pre-tax to Roth accounts.

What is the purpose of in-plan roth rollover s?

The purpose of in-plan Roth rollovers is to allow participants to convert pre-tax retirement savings to Roth accounts, potentially offering tax-free withdrawals in retirement.

What information must be reported on in-plan roth rollover s?

In-plan Roth rollovers typically require reporting the amount being transferred, the source account, and the destination Roth account.

Fill out your in-plan roth rollover s online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

In-Plan Roth Rollover S is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.