Get the free Protecting your credit during the coronavirus pandemic ...

Show details

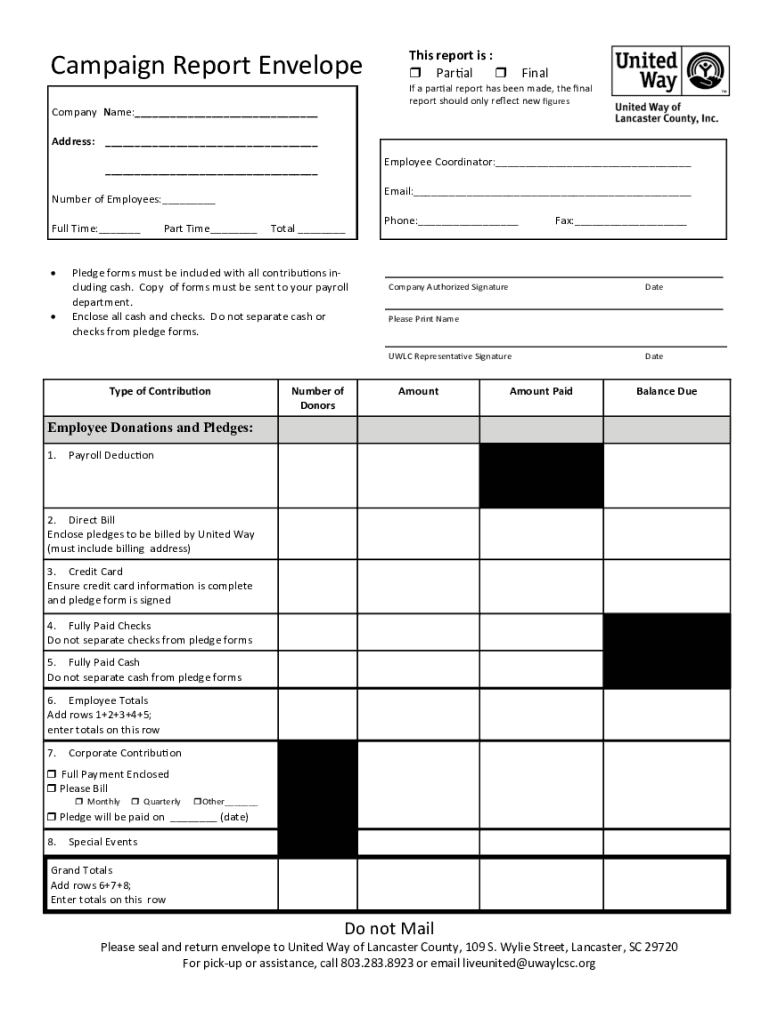

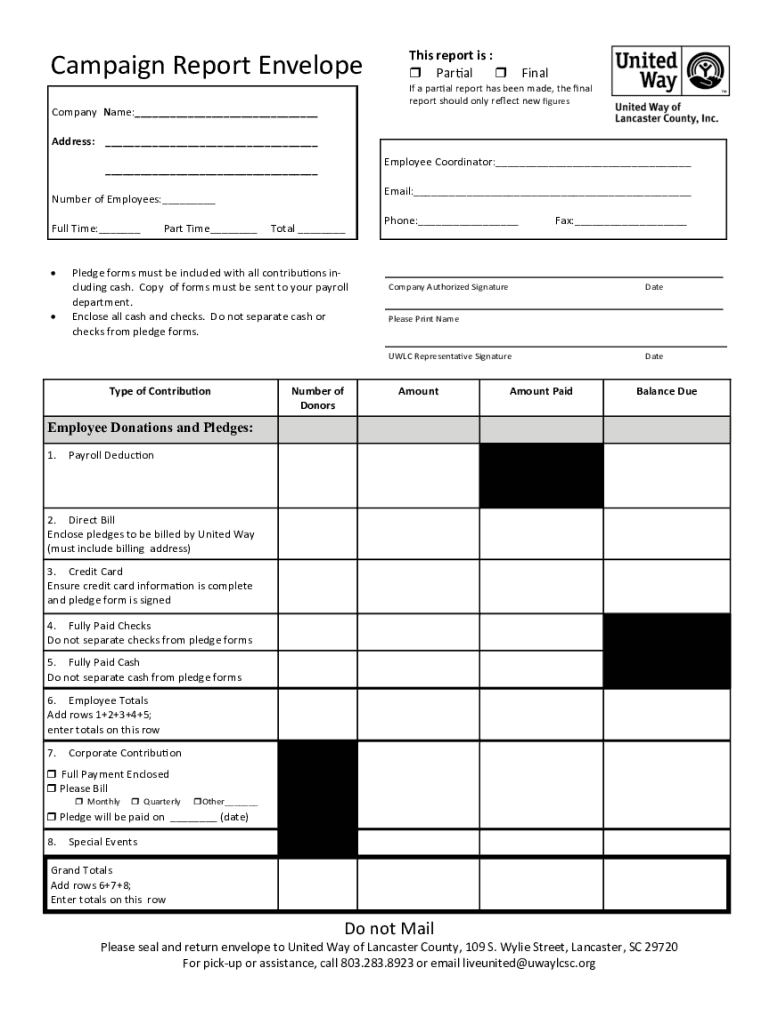

Campaign Report Envelopes report is : Partial Final If a partial report has been made, the final report should only reflect new figuresCompany Name: Address: Employee Coordinator: Email: Number of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign protecting your credit during

Edit your protecting your credit during form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your protecting your credit during form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit protecting your credit during online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit protecting your credit during. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out protecting your credit during

How to fill out protecting your credit during

01

Check your credit reports regularly: Review your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) to ensure that all the information is accurate. Look for any errors or signs of fraudulent activity.

02

Monitor your credit score: Keep an eye on your credit score to track any changes. A sudden drop in your score could be an indication of identity theft or fraudulent activity.

03

Protect your personal information: Safeguard your personal information such as Social Security number, credit card details, and bank account information. Be cautious about sharing sensitive information online or over the phone.

04

Use strong and unique passwords: Create strong passwords for your online accounts and avoid using the same password for multiple accounts. This reduces the risk of unauthorized access to your financial information.

05

Be wary of phishing attempts: Be cautious of suspicious emails, phone calls, or messages that request your personal or financial information. Avoid clicking on links or downloading attachments from unknown sources.

06

Secure your devices: Use up-to-date antivirus and antispyware software on your computer and mobile devices. Enable strong passwords or biometric authentication methods on your devices.

07

Regularly review your financial statements: Check your bank and credit card statements regularly for any unauthorized transactions. Report any discrepancies to your bank or credit card issuer immediately.

08

Consider credit monitoring services: Consider enrolling in credit monitoring services that can alert you to any suspicious activity on your credit reports.

09

Act quickly if you suspect fraud: If you believe that your identity has been compromised or you notice any fraudulent activity, act quickly by contacting your creditors, filing a report with the Federal Trade Commission (FTC), and placing a fraud alert or security freeze on your credit files.

10

Educate yourself about credit protection: Stay informed about the latest scams and techniques used by identity thieves. Regularly educate yourself about credit protection best practices.

Who needs protecting your credit during?

01

Anyone who has a credit history: Protecting your credit during is important for anyone who has a credit history, as it helps prevent identity theft and financial fraud.

02

Individuals with high credit scores: People with high credit scores are often targeted by identity thieves, as their good credit can be exploited for fraudulent activities. Protecting their credit is crucial to maintaining their financial well-being.

03

Individuals who have experienced identity theft in the past: If you have been a victim of identity theft in the past, it is essential to take proactive measures to protect your credit and minimize the risk of future incidents.

04

Those who frequently use online financial services: Online banking, shopping, and other financial services have become common, making individuals who frequently use these services more susceptible to online scams and identity theft.

05

Individuals with credit cards or loans: If you have credit cards or loans, protecting your credit during is vital to prevent unauthorized use and fraudulent activities. Monitoring your accounts can help you catch any suspicious activities before they cause significant damage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute protecting your credit during online?

pdfFiller has made filling out and eSigning protecting your credit during easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit protecting your credit during in Chrome?

protecting your credit during can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I edit protecting your credit during on an iOS device?

Create, edit, and share protecting your credit during from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is protecting your credit during?

Protecting your credit during involves monitoring your credit report and taking steps to prevent identity theft and fraud.

Who is required to file protecting your credit during?

Everyone who has a credit history and wants to safeguard their personal information is encouraged to protect their credit.

How to fill out protecting your credit during?

You can protect your credit by regularly checking your credit report, setting up fraud alerts, and freezing your credit if necessary.

What is the purpose of protecting your credit during?

The purpose of protecting your credit is to ensure that your personal and financial information is secure and prevent unauthorized access to your accounts.

What information must be reported on protecting your credit during?

You must report any suspicious activity on your credit report, unauthorized transactions, or any signs of identity theft.

Fill out your protecting your credit during online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Protecting Your Credit During is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.