Get the free Moratorium on loans due to Covid-19 disruptionVinod Kothari ConsulMoratorium on loan...

Show details

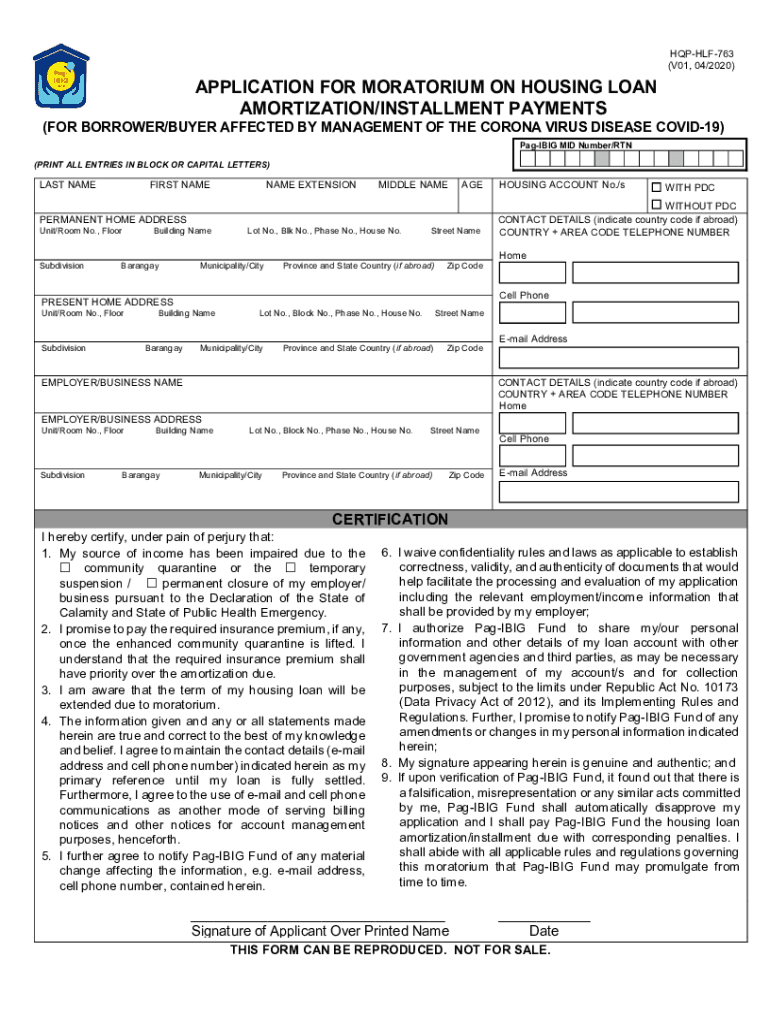

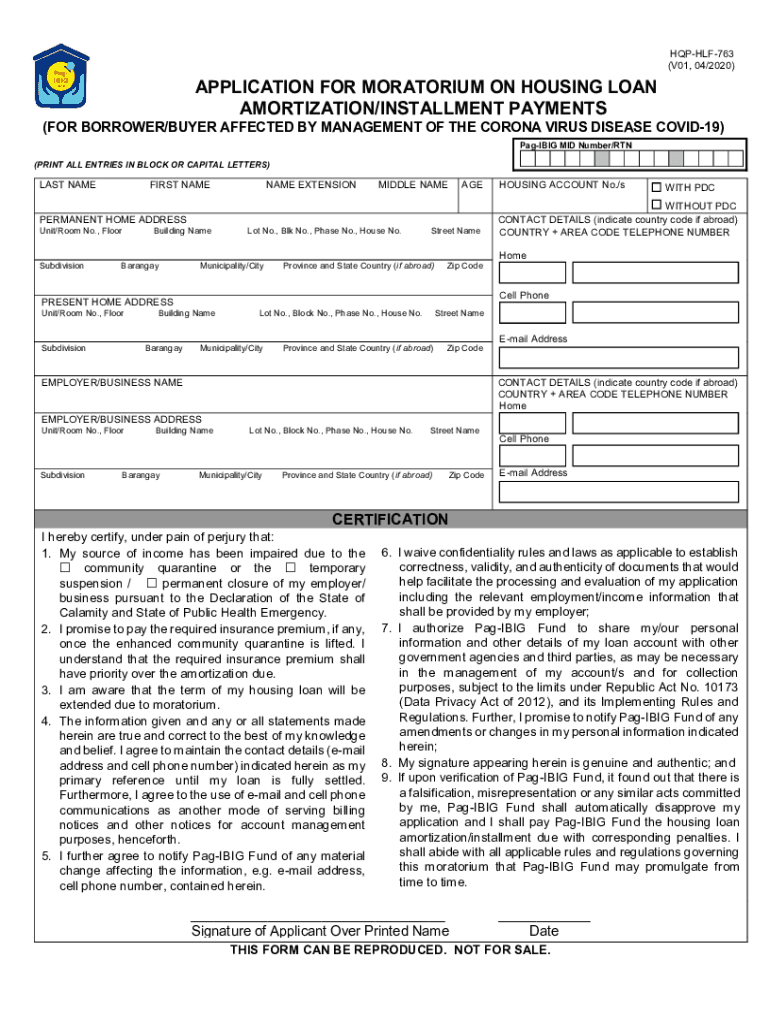

HQPHLF763 (V01, 04/2020)APPLICATION FOR MORATORIUM ON HOUSING LOAN AMORTIZATION/INSTALLMENT PAYMENTS (FOR BORROWER/BUYER AFFECTED BY MANAGEMENT OF THE CORONAvirus DISEASE COVID-19) Paging MID Number/RTN

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign moratorium on loans due

Edit your moratorium on loans due form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your moratorium on loans due form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit moratorium on loans due online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit moratorium on loans due. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out moratorium on loans due

How to fill out moratorium on loans due

01

Step 1: Gather all the necessary documentation required for filling out the moratorium on loans due. This may include loan agreement, identification documents, proof of income, and any other relevant paperwork.

02

Step 2: Contact your loan provider or financial institution either through phone, email, or in person to inquire about the process of filling out the moratorium on loans due. They will guide you through the specific steps and provide you with the necessary forms.

03

Step 3: Carefully read and fill out the provided forms, ensuring that all the required information is accurately provided. Double-check for any errors or missing information before submitting.

04

Step 4: Attach any supporting documentation as requested by your loan provider. This may include proof of financial hardship or any other documents they require to assess your eligibility for the moratorium.

05

Step 5: Submit the completed forms along with all the supporting documents to your loan provider through the preferred method of submission. Be sure to retain copies of all the submitted documents for your records.

06

Step 6: Wait for the confirmation and acknowledgment from your loan provider regarding the acceptance of your moratorium application. They will inform you about the duration of the moratorium as well as any terms and conditions associated with it.

07

Step 7: Follow any further instructions provided by your loan provider during the moratorium period. It is important to fulfill any obligations or requirements mentioned by them to maintain the moratorium status.

08

Step 8: Keep track of the moratorium period and ensure timely payments or actions once the moratorium period ends. Stay in communication with your loan provider to avoid any potential complications.

Who needs moratorium on loans due?

01

Individuals who are facing financial hardship or have been affected by unforeseen circumstances such as job loss, medical emergencies, or natural disasters may need a moratorium on loans due.

02

Small businesses that are struggling or experiencing a significant decline in revenue due to economic challenges or market conditions may also require a moratorium on loans.

03

People who are unable to meet their loan repayment obligations due to factors beyond their control and are at risk of defaulting on their loans can benefit from a moratorium.

04

It is important to note that eligibility for a moratorium on loans due may vary depending on the policies and criteria set by the loan provider or financial institution.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get moratorium on loans due?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific moratorium on loans due and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How can I edit moratorium on loans due on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing moratorium on loans due.

How can I fill out moratorium on loans due on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your moratorium on loans due. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is moratorium on loans due?

Moratorium on loans due is a temporary suspension of loan payments.

Who is required to file moratorium on loans due?

Lenders are required to file moratorium on loans due.

How to fill out moratorium on loans due?

You can fill out the moratorium on loans due form provided by the loan issuer.

What is the purpose of moratorium on loans due?

The purpose of moratorium on loans due is to provide relief to borrowers facing financial difficulties.

What information must be reported on moratorium on loans due?

Information such as borrower's name, loan account number, reason for requesting moratorium, and duration of requested moratorium must be reported.

Fill out your moratorium on loans due online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Moratorium On Loans Due is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.