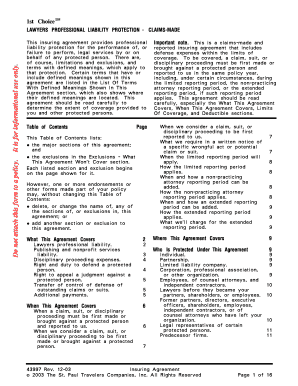

Get the free Investment for Pension Schemes Final Artwork

Show details

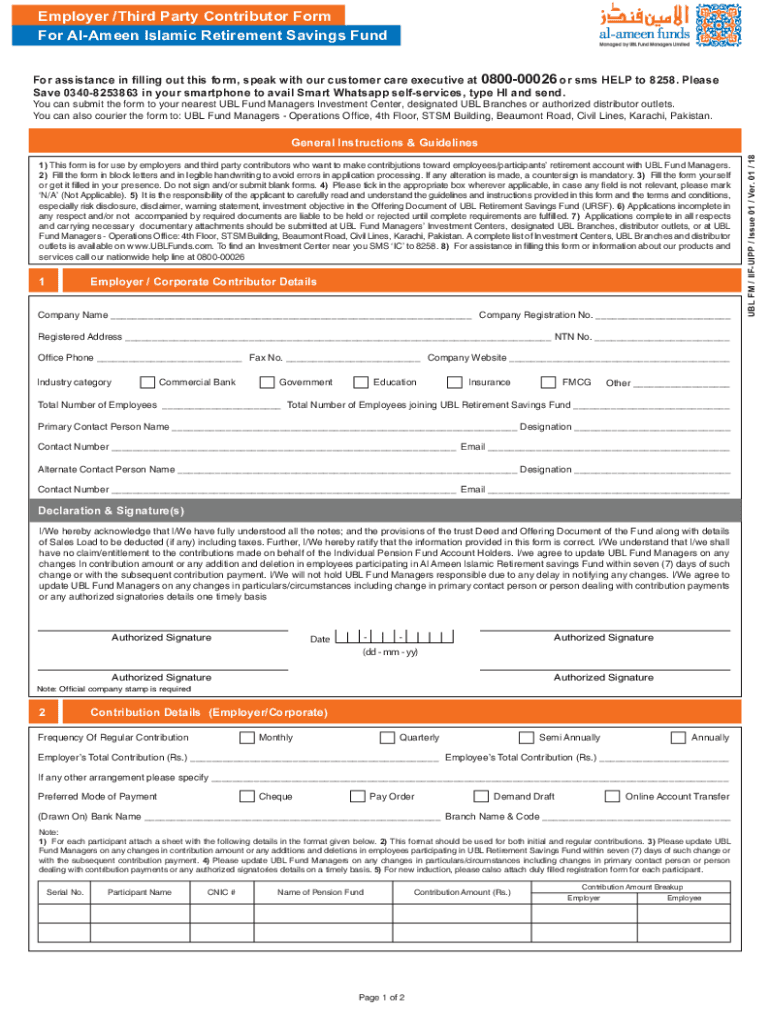

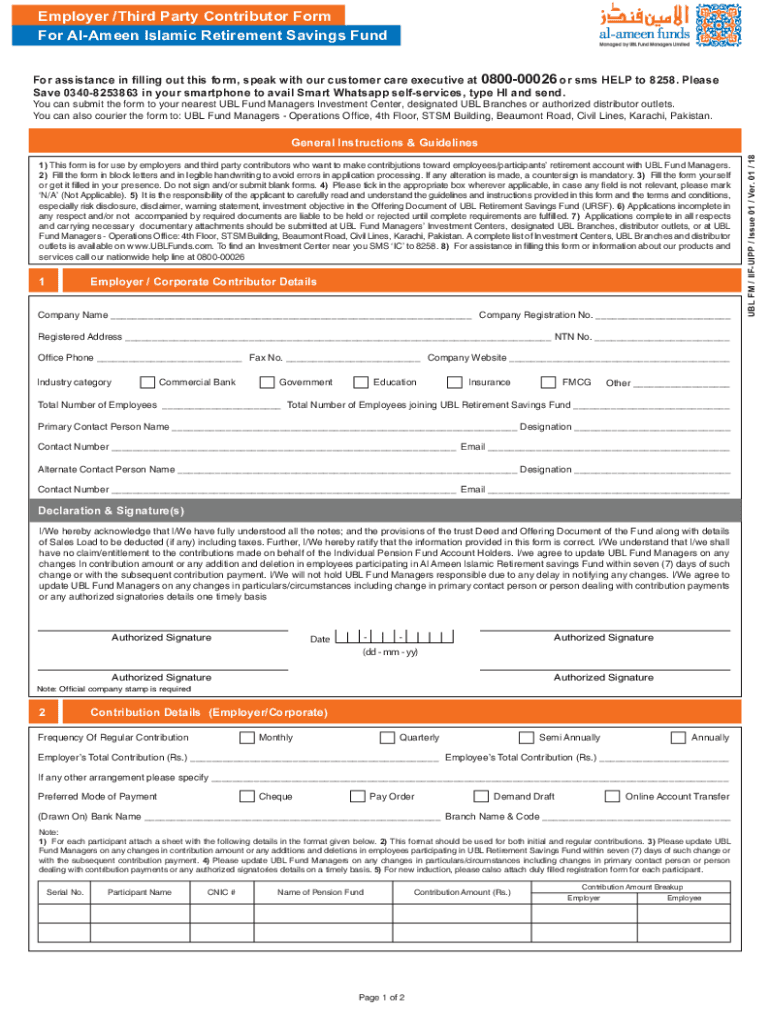

Employer /Third Party Contributor Form For Alameda Islamic Retirement Savings Fund For assistance in lying out this form, speak with our customer care executive at 080000026 or SMS HELP to 8258. Please,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign investment for pension schemes

Edit your investment for pension schemes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your investment for pension schemes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit investment for pension schemes online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit investment for pension schemes. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out investment for pension schemes

How to fill out investment for pension schemes

01

Research and understand the different types of investment options available for pension schemes such as stocks, bonds, mutual funds, and annuities.

02

Evaluate your risk tolerance and investment goals to determine the appropriate investment strategy for your pension scheme.

03

Consult with a financial advisor or investment professional who specializes in retirement planning to get personalized advice and recommendations.

04

Decide how much of your pension fund you want to allocate towards investments and create a diversified portfolio to spread out the risk.

05

Monitor the performance of your investments regularly and make adjustments as needed to ensure that your pension fund continues to grow over time.

06

Keep track of any changes in tax laws or regulations that may affect the taxation of your pension scheme investments.

07

Review your pension scheme periodically and make any necessary updates or changes to your investment strategy based on your changing financial situation or retirement goals.

Who needs investment for pension schemes?

01

Individuals who want to enhance the growth potential of their pension fund beyond what traditional savings or fixed interest options can provide.

02

People who have a longer investment horizon before retirement and are comfortable with taking on market risk in exchange for potential higher returns.

03

Individuals who have sufficient knowledge or are willing to seek professional advice in managing their investments for retirement.

04

Pension scheme participants who have specific financial goals or retirement objectives that require a more active approach to investment management.

05

Individuals who are not solely reliant on a state or employer pension and want to supplement their retirement income through additional investments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my investment for pension schemes in Gmail?

Create your eSignature using pdfFiller and then eSign your investment for pension schemes immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit investment for pension schemes straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing investment for pension schemes right away.

How do I fill out investment for pension schemes on an Android device?

Complete investment for pension schemes and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is investment for pension schemes?

Investment for pension schemes refers to the allocation of funds into various financial vehicles such as stocks, bonds, and real estate with the goal of providing income in retirement.

Who is required to file investment for pension schemes?

Employers or administrators of pension schemes are typically required to file investment reports for pension schemes.

How to fill out investment for pension schemes?

Investment for pension schemes can be filled out by providing details of the assets held within the pension scheme, including their value and performance.

What is the purpose of investment for pension schemes?

The purpose of investment for pension schemes is to grow the funds within the pension scheme over time, in order to provide a source of income for retirement.

What information must be reported on investment for pension schemes?

Information such as the types of assets held, their value, and any income or gains generated from the investments must be reported on investment for pension schemes.

Fill out your investment for pension schemes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Investment For Pension Schemes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.