Get the free Not-for-profit organizations and charitable giving ...

Show details

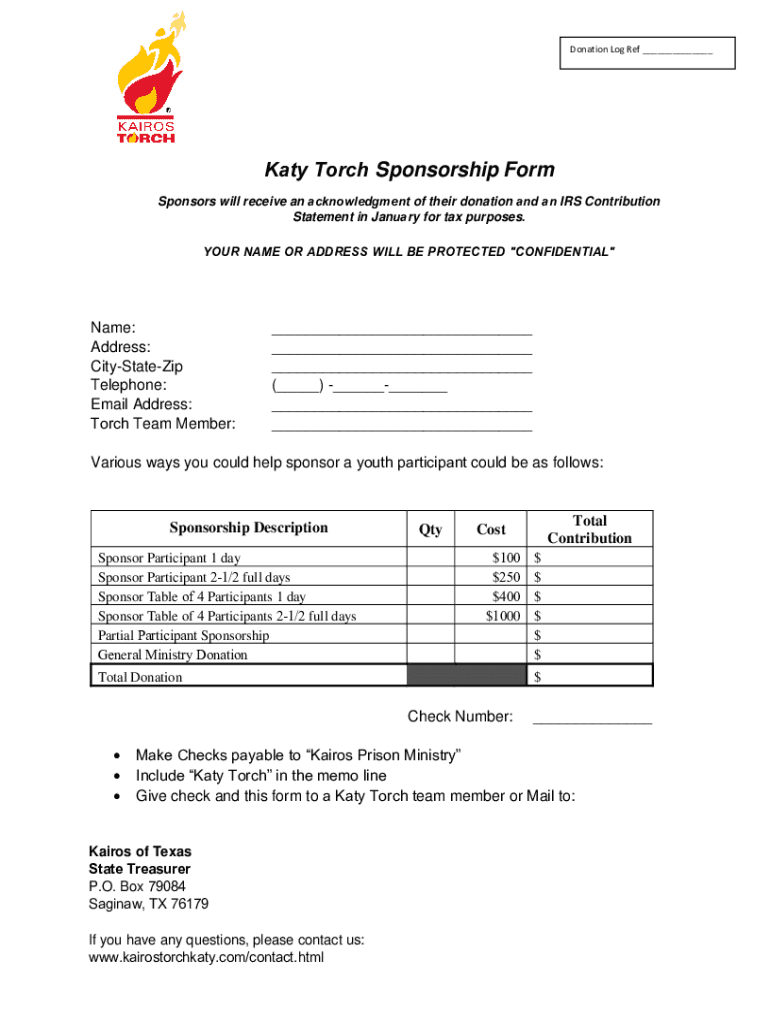

Donation Log Ref Katy Torch Sponsorship Form Sponsors will receive an acknowledgment of their donation and an IRS Contribution Statement in January for tax purposes. YOUR NAME OR ADDRESS WILL BE PROTECTED

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign not-for-profit organizations and charitable

Edit your not-for-profit organizations and charitable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your not-for-profit organizations and charitable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing not-for-profit organizations and charitable online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit not-for-profit organizations and charitable. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out not-for-profit organizations and charitable

How to fill out not-for-profit organizations and charitable

01

Start by gathering all the necessary documents and information such as the organization's name, mission statement, and contact details.

02

Determine the legal structure of the organization, whether it will be a non-profit corporation, association, or trust.

03

Complete the required legal forms for registering a not-for-profit organization, such as the application for tax-exempt status from the Internal Revenue Service (IRS) in the United States.

04

Develop a board of directors or trustees who will oversee the organization's operations and ensure compliance with applicable laws.

05

Create bylaws that outline the organization's purpose, governance structure, and operating procedures.

06

Apply for any necessary licenses or permits required to carry out the organization's activities, such as fundraising or working with vulnerable populations.

07

Establish a system for financial management and reporting, including opening a bank account in the organization's name and implementing accounting procedures.

08

Develop a fundraising plan and implement strategies to generate revenue to support the organization's activities.

09

Recruit volunteers or employees to assist with the organization's work and develop appropriate policies and procedures for their recruitment, training, and management.

10

Continuously evaluate the organization's performance and make necessary adjustments to ensure its effectiveness and compliance with regulatory requirements.

Who needs not-for-profit organizations and charitable?

01

Non-profit organizations and charitable organizations are needed by individuals or communities facing social, economic, or environmental challenges.

02

Non-profit organizations can provide essential services and support in areas such as education, healthcare, poverty alleviation, disaster relief, and environmental conservation.

03

Individuals or groups with a specific cause or mission, such as animal welfare, human rights, or cultural preservation, may also benefit from forming a not-for-profit organization or charitable entity.

04

Non-profit organizations and charitable entities allow individuals to come together and pool their resources to address societal issues and make a positive impact in their communities.

05

Donors or philanthropic individuals often seek out not-for-profit organizations and charitable entities to support causes they care about and make a meaningful difference in the world.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete not-for-profit organizations and charitable online?

Filling out and eSigning not-for-profit organizations and charitable is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I sign the not-for-profit organizations and charitable electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I create an eSignature for the not-for-profit organizations and charitable in Gmail?

Create your eSignature using pdfFiller and then eSign your not-for-profit organizations and charitable immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is not-for-profit organizations and charitable?

Not-for-profit organizations and charities are organizations that operate without the goal of making a profit. They are typically focused on serving a specific mission or cause.

Who is required to file not-for-profit organizations and charitable?

Not-for-profit organizations and charities are required to file with the appropriate government agency to maintain their tax-exempt status.

How to fill out not-for-profit organizations and charitable?

Not-for-profit organizations and charities can typically fill out their required forms online or by mail. It is important to provide accurate and detailed information about the organization's activities and finances.

What is the purpose of not-for-profit organizations and charitable?

The purpose of not-for-profit organizations and charities is to serve the community or a specific cause without the goal of making a profit. They often rely on donations and grants to fund their operations.

What information must be reported on not-for-profit organizations and charitable?

Not-for-profit organizations and charities are typically required to report on their activities, finances, and governance structure. This may include details on revenue, expenses, programs, and board members.

Fill out your not-for-profit organizations and charitable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not-For-Profit Organizations And Charitable is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.