MA State Tax Form 128 2000 free printable template

Show details

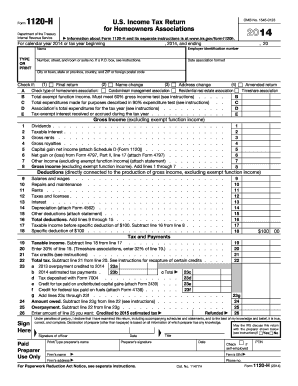

State Tax Form 128 ... You may file an application if you are: ... In some cases, you must pay all or a portion of the tax before you can file. ... On-site inspection.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA State Tax Form 128

Edit your MA State Tax Form 128 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA State Tax Form 128 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MA State Tax Form 128 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MA State Tax Form 128. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA State Tax Form 128 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MA State Tax Form 128

How to fill out MA State Tax Form 128

01

Obtain a copy of MA State Tax Form 128 from the Massachusetts Department of Revenue website or local offices.

02

Fill in your name, address, and Social Security number at the top of the form.

03

Enter your business entity type (if applicable) and tax year.

04

Input your gross receipts or sales amount in the appropriate box.

05

Deduct any allowable expenses and calculate your taxable income.

06

Review your credits and enter any that apply to your situation.

07

Calculate your total tax due based on the tax guidelines.

08

Fill out the 'Signature' section, including date and title if applicable.

09

Attach any required documents and schedules as instructed.

10

Submit the completed form by the filing deadline, either electronically or by mail.

Who needs MA State Tax Form 128?

01

Any taxpayer who is a business entity in Massachusetts and has taxable income must fill out MA State Tax Form 128.

02

Partnerships, limited liability companies (LLCs), and corporations that operate in Massachusetts need this form to report their tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a property tax abatement in MA?

Taxpayers seeking to obtain an abatement of a tax or penalty that has been assessed by DOR should use MassTaxConnect (MTC) and follow the instructions provided for disputing a tax or penalty. Alternatively, taxpayers may file a paper Form ABT, Application for Abatement.

How much is real estate transfer tax in Massachusetts?

The basic transfer tax rate in Massachusetts is $2.28 per $500 of property value. However, some counties charge additional transfer taxes.

Who pays the real estate transfer tax in MA?

The excise is based upon the consideration given for the property and applies whenever the consideration, exclusive of any lien or encumbrance remaining on the property, is greater than $100. The tax is paid by the person making or signing the deed and is evidenced by an affixed stamp.

What is the transfer tax on real estate in Massachusetts?

The basic transfer tax rate in Massachusetts is $2.28 per $500 of property value. However, some counties charge additional transfer taxes.

At what age do you stop paying property tax in Massachusetts?

Eligibility. You may be eligible for this exemption if you meet the following requirements: You are 65 years old or older as of July 1 of the fiscal year. You owned and occupied your current property as your domicile as of July 1 of the fiscal year.

Who pays the transfer tax in Massachusetts?

The home seller will typically pay the transfer tax when they transfer the property's deeds, certificates, and titles to the property that is being sold. While the responsibility to pay the real estate transfer tax falls on the seller in Massachusetts, it's a matter that can be negotiated by both parties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get MA State Tax Form 128?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific MA State Tax Form 128 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I execute MA State Tax Form 128 online?

pdfFiller has made filling out and eSigning MA State Tax Form 128 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How can I fill out MA State Tax Form 128 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your MA State Tax Form 128. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is MA State Tax Form 128?

MA State Tax Form 128 is a tax form used for reporting the income and tax obligations of certain business entities operating in Massachusetts, specifically for corporations.

Who is required to file MA State Tax Form 128?

Corporations that are doing business in Massachusetts or deriving income from Massachusetts sources are required to file MA State Tax Form 128.

How to fill out MA State Tax Form 128?

To fill out MA State Tax Form 128, obtain the form from the Massachusetts Department of Revenue website, enter your corporation’s identifying information, report all income and deductions, and calculate your tax liability according to the instructions provided.

What is the purpose of MA State Tax Form 128?

The purpose of MA State Tax Form 128 is to calculate and report the state income tax owed by corporations based on their income earned in Massachusetts.

What information must be reported on MA State Tax Form 128?

The information that must be reported on MA State Tax Form 128 includes the corporation's income, deductions, tax credits, and other financial details relevant to calculating the state tax liability.

Fill out your MA State Tax Form 128 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA State Tax Form 128 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.