Get the free Purchase of Business Assets Sales Tax Return Form(PDF, 583KB)

Show details

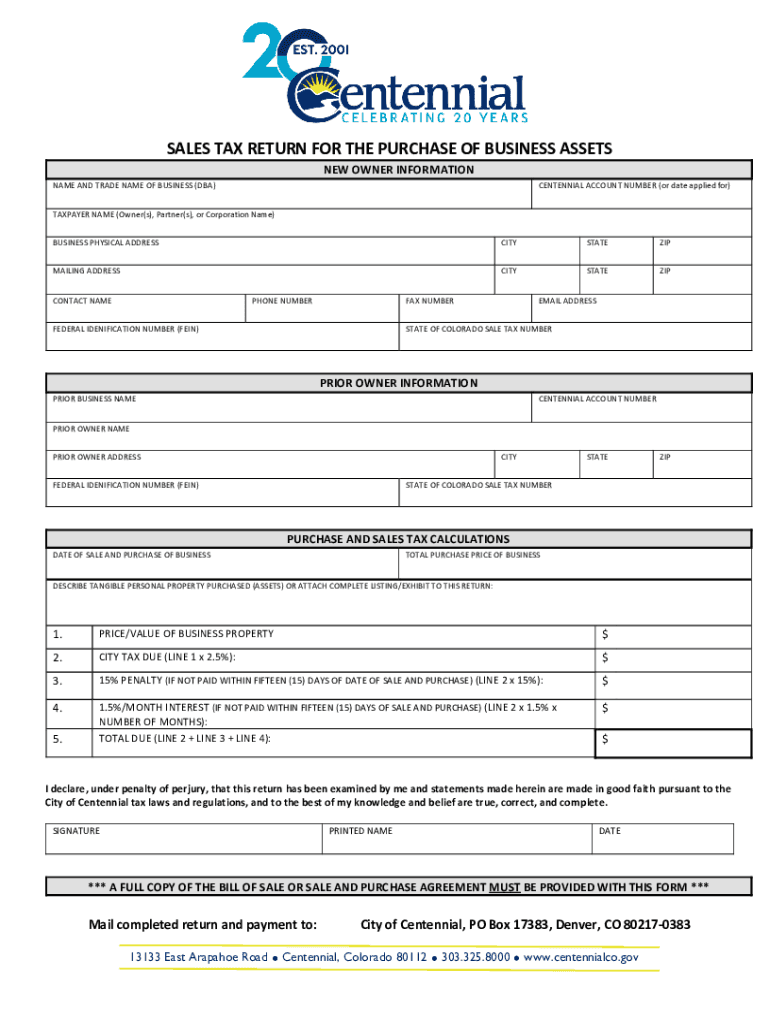

SALES TAX RETURN FOR THE PURCHASE OF BUSINESS ASSETS NEW OWNER INFORMATION NAME AND TRADE NAME OF BUSINESS (DBA)CENTENNIAL ACCOUNT NUMBER (or date applied for)TAXPAYER NAME (Owner(s), Partner(s),

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign purchase of business assets

Edit your purchase of business assets form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your purchase of business assets form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing purchase of business assets online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit purchase of business assets. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out purchase of business assets

How to fill out purchase of business assets

01

Determine the budget and financing options for the purchase.

02

Identify the specific business assets you intend to purchase, such as equipment, inventory, or property.

03

Conduct thorough due diligence on the assets, including their condition, legal ownership, and any outstanding liabilities.

04

Negotiate the terms and purchase price with the seller, considering factors like fair market value and potential future returns.

05

Draft a purchase agreement that outlines the details of the transaction, including the asset description, payment terms, and any warranties or guarantees.

06

Seek legal and financial advice to ensure compliance with applicable laws and regulations.

07

Arrange for the transfer of ownership by completing the necessary paperwork and obtaining any required approvals or permits.

08

Execute the purchase by making the agreed-upon payment and taking possession of the acquired assets.

09

Update relevant records, such as financial statements and tax documents, to reflect the new assets.

10

Consider integrating the purchased assets into your existing business operations or developing a strategic plan to maximize their value.

Who needs purchase of business assets?

01

Entrepreneurs or individuals looking to start a new business and require essential assets to operate.

02

Existing business owners who want to expand their operations by acquiring additional assets.

03

Investors or companies seeking to diversify their portfolio by investing in tangible business assets.

04

Companies undergoing mergers or acquisitions that involve the transfer of business assets.

05

Financial institutions or lenders who may need to take ownership of assets as part of loan collateral.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify purchase of business assets without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including purchase of business assets, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I fill out the purchase of business assets form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign purchase of business assets and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How can I fill out purchase of business assets on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your purchase of business assets. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is purchase of business assets?

Purchase of business assets refers to the acquisition of tangible or intangible assets belonging to a business entity, such as equipment, inventory, intellectual property, or real estate.

Who is required to file purchase of business assets?

Any individual or entity acquiring business assets is required to file a purchase of business assets form with the appropriate regulatory authority.

How to fill out purchase of business assets?

To fill out a purchase of business assets form, you will need to provide detailed information about the assets being acquired, the parties involved, and the terms of the transaction.

What is the purpose of purchase of business assets?

The purpose of filing a purchase of business assets form is to inform regulators and other stakeholders about changes in ownership of business assets.

What information must be reported on purchase of business assets?

The purchase of business assets form typically requires information such as a description of the assets, the purchase price, the parties involved, and any relevant agreements.

Fill out your purchase of business assets online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Purchase Of Business Assets is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.