Get the free Co U N T Y

Show details

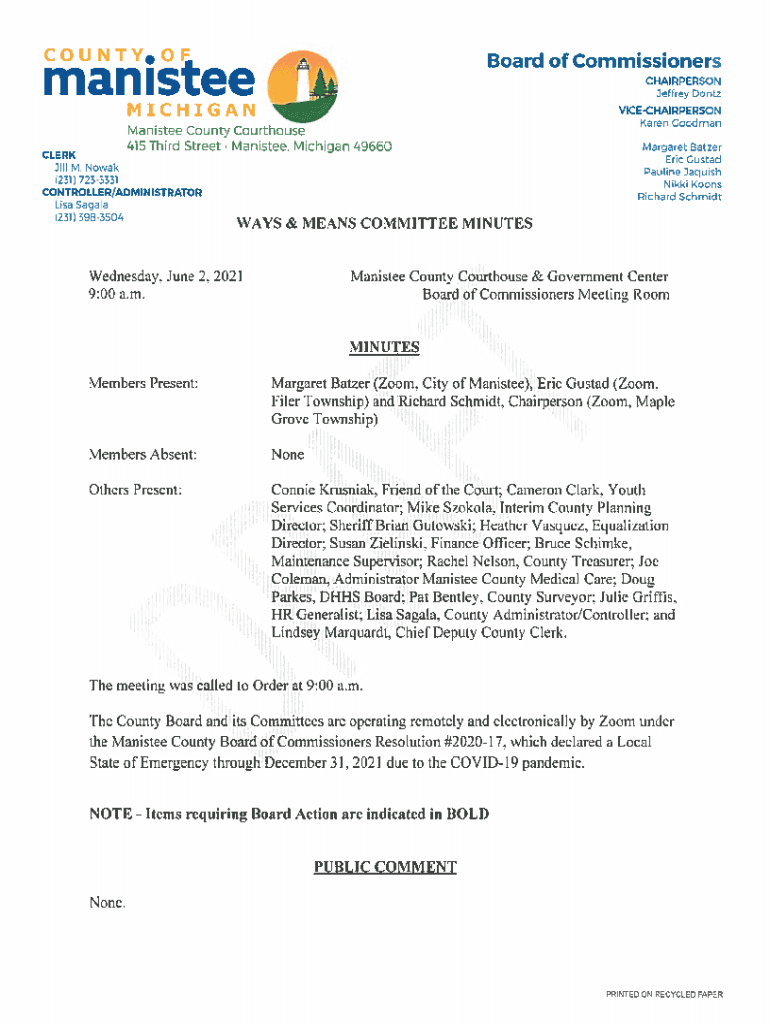

Co U N T Y. 0CBoard of Commissioners man isteeMICHIGANManistee County Courthouse 415 Third Streets Minister, Michigan 49660CLERK Jill M. Noway (231) 7233331 CONTROLLER/ADMINISTRATOR Lisa Saga la (231)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign co u n t

Edit your co u n t form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your co u n t form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing co u n t online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit co u n t. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out co u n t

How to fill out co u n t

01

To fill out co u n t, follow these steps:

02

- Step 1: Start by obtaining the co u n t form. This can usually be found on the official website of the organization or government agency requiring the co u n t.

03

- Step 2: Carefully read the instructions provided with the form to ensure you understand the requirements and any specific guidelines for filling it out.

04

- Step 3: Gather all the necessary information and documents required to complete the co u n t. This may include personal identification details, financial information, or other relevant data.

05

- Step 4: Begin filling out the form by entering the requested information in the designated fields. Make sure to double-check the accuracy of your responses before moving on to the next section.

06

- Step 5: If there are any sections or questions that you are unsure about, don't guess. Seek clarification from the organization or agency responsible for the co u n t or consult with a professional for guidance.

07

- Step 6: Once you have completed all the required sections of the co u n t form, review it one final time to ensure all information is accurate and nothing has been omitted.

08

- Step 7: Sign and date the form as instructed. If applicable, have any necessary witnesses or notaries also complete the required sections.

09

- Step 8: Make a copy of the completed co u n t form for your records before submitting it. Follow the specified submission instructions, whether it's mailing the form or submitting it online.

10

- Step 9: Keep track of any confirmation or reference numbers provided after submitting the co u n t form. This can be useful for future reference or inquiries regarding your submission.

11

- Step 10: If required, follow up with the organization or agency after a reasonable period to ensure the co u n t form has been processed and received successfully.

Who needs co u n t?

01

Various individuals or entities may need to fill out co u n t forms, including:

02

- Individuals applying for government benefits or assistance programs that require verification of personal information and financial status.

03

- Taxpayers who need to report their income, deductions, and other relevant details to fulfill their tax obligations.

04

- Employers or business owners who are required to report their employees' wages, taxes withheld, and other employment-related information to the government.

05

- Students or parents applying for financial aid or scholarships that require documentation of their financial circumstances.

06

- Organizations or nonprofits seeking funding or grants that require detailed reporting of their activities, finances, and impact.

07

- Individuals involved in legal or court proceedings where accurate and complete information is necessary for proper legal representation and decision-making.

08

- Researchers or statisticians gathering data for academic studies or social surveys to understand and analyze specific populations or phenomena.

09

- Many other situations and contexts where documentation and verification of information are essential.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit co u n t from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your co u n t into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I complete co u n t online?

Filling out and eSigning co u n t is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit co u n t on an iOS device?

Create, edit, and share co u n t from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is count?

Count is a numerical value used to represent the quantity or total of something.

Who is required to file count?

Individuals, businesses, or organizations may be required to file count depending on the specific requirements of the governing body. It is important to check with the relevant authorities for specific filing requirements.

How to fill out count?

Count can be filled out manually on paper forms or electronically through online platforms provided by the governing body. Detailed instructions are usually provided with the forms to guide the filer.

What is the purpose of count?

The purpose of count is to accurately report and record the quantity or total of specific items or information.

What information must be reported on count?

The specific information required to be reported on count can vary depending on the nature of the count being filed. Commonly reported information includes quantities, totals, and relevant details about the items being counted.

Fill out your co u n t online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Co U N T is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.