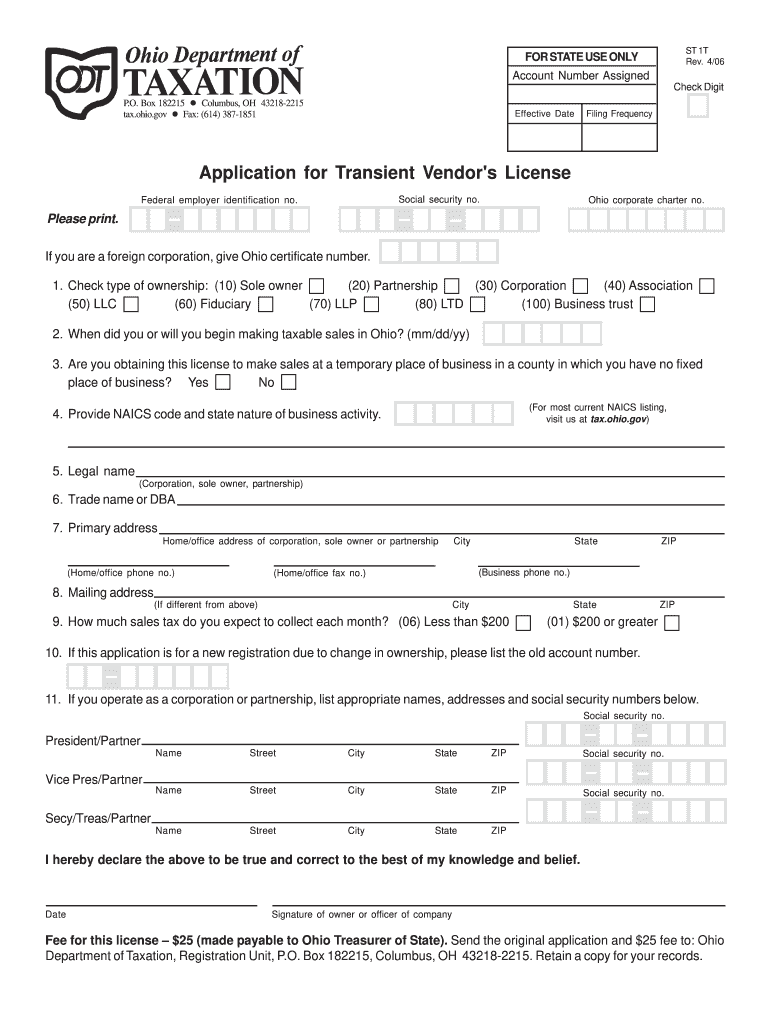

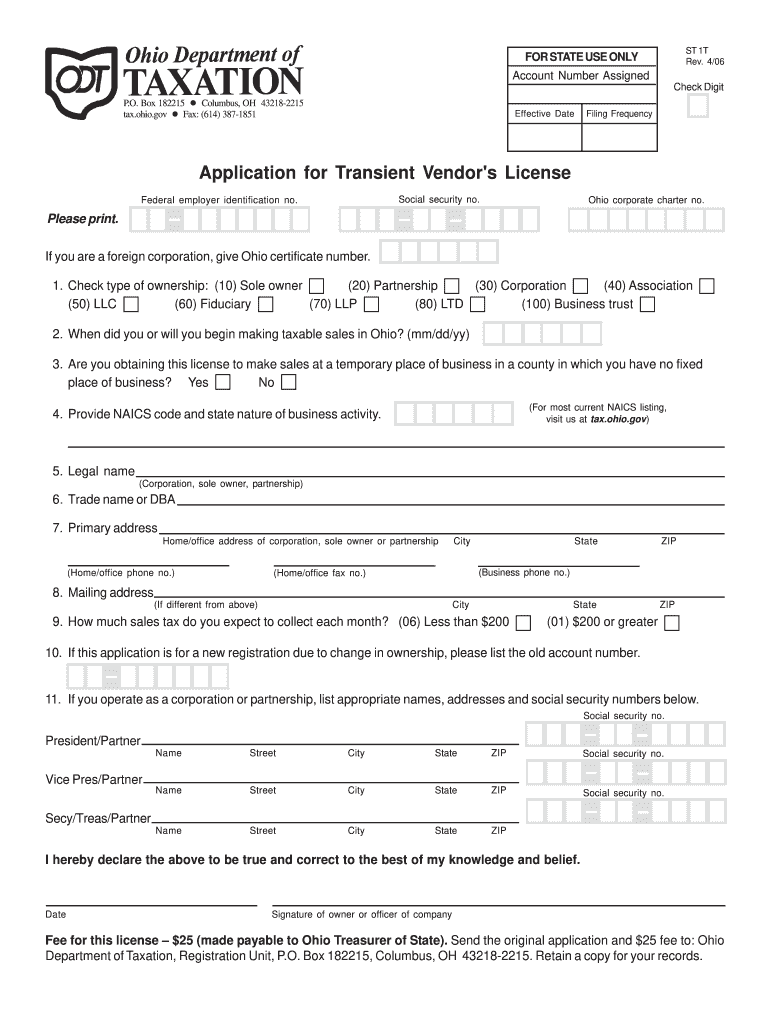

OH ST 1T 2006 free printable template

Show details

FOR STATE USE ONLY Account Number Assigned ST 1T Rev. 4/06 Check Digit P.O. Box 182215 Columbus, OH 43218-2215 Fax: (614) 387-1851 tax.Ohio.gov Effective Date Filing Frequency Application for Transient

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OH ST 1T

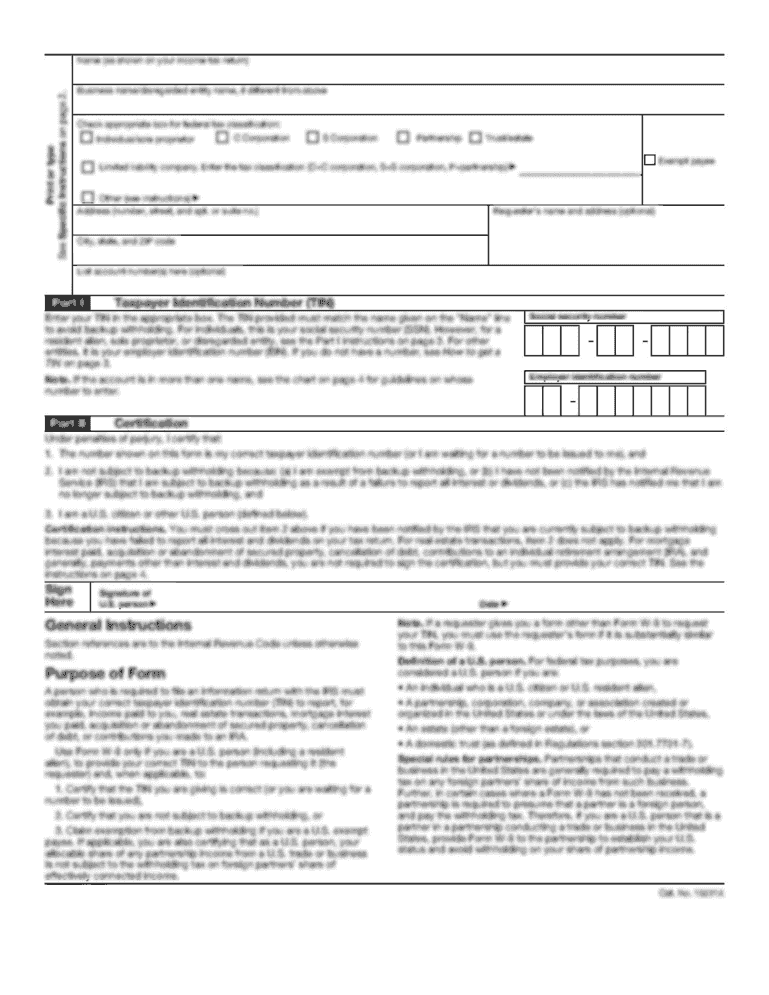

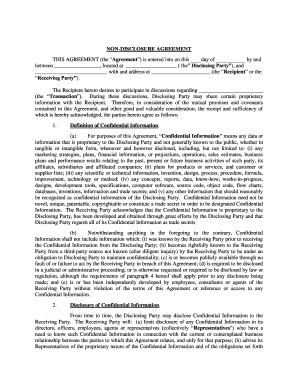

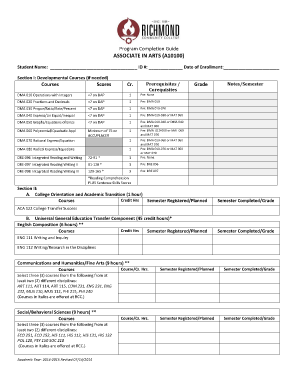

Edit your OH ST 1T form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OH ST 1T form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OH ST 1T online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit OH ST 1T. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH ST 1T Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OH ST 1T

How to fill out OH ST 1T

01

Gather necessary documents: Collect your identification, proof of income, and any other required documentation.

02

Obtain the form: Download the OH ST 1T form from the official website or request a physical copy from the relevant office.

03

Fill out personal information: Enter your full name, address, and contact information at the top of the form.

04

Complete income information: Provide details about your income for the relevant period, including sources and amounts.

05

Indicate deductions: List any deductions that apply to your situation according to the instructions.

06

Review the form: Check all entries for accuracy and completeness before submitting.

07

Sign and date: Ensure you have signed and dated the form where required.

08

Submit the form: Send the completed form to the designated office, either electronically or by mail, as per the instructions.

Who needs OH ST 1T?

01

Individuals applying for tax credits, refunds, or adjustments related to the Ohio State tax system.

02

Taxpayers who need to report changes in income or deductions that affect their tax obligations.

03

Businesses or organizations managing withholding tax responsibilities for employees in Ohio.

Fill

form

: Try Risk Free

People Also Ask about

How do I get my vendors license online in Ohio?

The Ohio vendor license application is easily completed online through the Ohio Department of Taxation. You must create an account to complete the online application process but the entire system is functional and easy to navigate. Alternatively, you can complete the application at your local county auditor office.

How much does it cost to get a vendor's license in Ohio?

How much is a Vendor's License? A County Vendor's License is a one-time $25.00 fee. It will not expire as long as you are reporting taxable sales.

How much is an Ohio vendors license?

License Filing Requirements Type of LicenseCost of LicenseType of ApplicationVendor$25ST-1 (PDF)Transient Vendor$25ST1-T (PDF)Out-of-State SellerNo feeUT 1000 (PDF)Direct Pay Permit HolderNo feeST 900 (PDF)1 more row • Mar 31, 2020

What are the different types of vendors license in Ohio?

There are two different types of vendor's licenses: Retail Vendor and Transient. A Retail (County) Vendor's License is required for selling taxable goods at a fixed location of business. A Transient Vendor's License is for the sale of goods at various shows and markets throughout the State of Ohio.

What do I have to do to get a vendor's license in Ohio?

Registration is available through the following: Ohio Business Gateway — Prospective retailers may obtain a vendor's license immediately through the Ohio Business Gateway. Note: Businesses must first establish an account with Gateway before using it to request a vendor's license.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send OH ST 1T to be eSigned by others?

To distribute your OH ST 1T, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I edit OH ST 1T on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing OH ST 1T, you can start right away.

How do I edit OH ST 1T on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign OH ST 1T. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is OH ST 1T?

OH ST 1T is a form used in Ohio for reporting and collecting sales tax on temporary sales or transactions that are not conducted in traditional business locations.

Who is required to file OH ST 1T?

Individuals or businesses that engage in temporary sales activities, such as flea markets, trade shows, or special events, within Ohio are required to file OH ST 1T.

How to fill out OH ST 1T?

To fill out OH ST 1T, you need to provide information including your business name, address, the dates of the sale, and details of sales made, including item descriptions and total sales amounts. Follow the instructions provided with the form for accurate completion.

What is the purpose of OH ST 1T?

The purpose of OH ST 1T is to ensure that sales tax is collected and reported on temporary sales, allowing the state to track and manage sales tax for these transactions.

What information must be reported on OH ST 1T?

The information that must be reported on OH ST 1T includes the seller's name and address, the type of goods sold, the total sales amount, the sales tax collected, and the dates of the temporary sales event.

Fill out your OH ST 1T online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH ST 1t is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.