Get the free CPA App Form Resident & Visitor Permit.doc

Show details

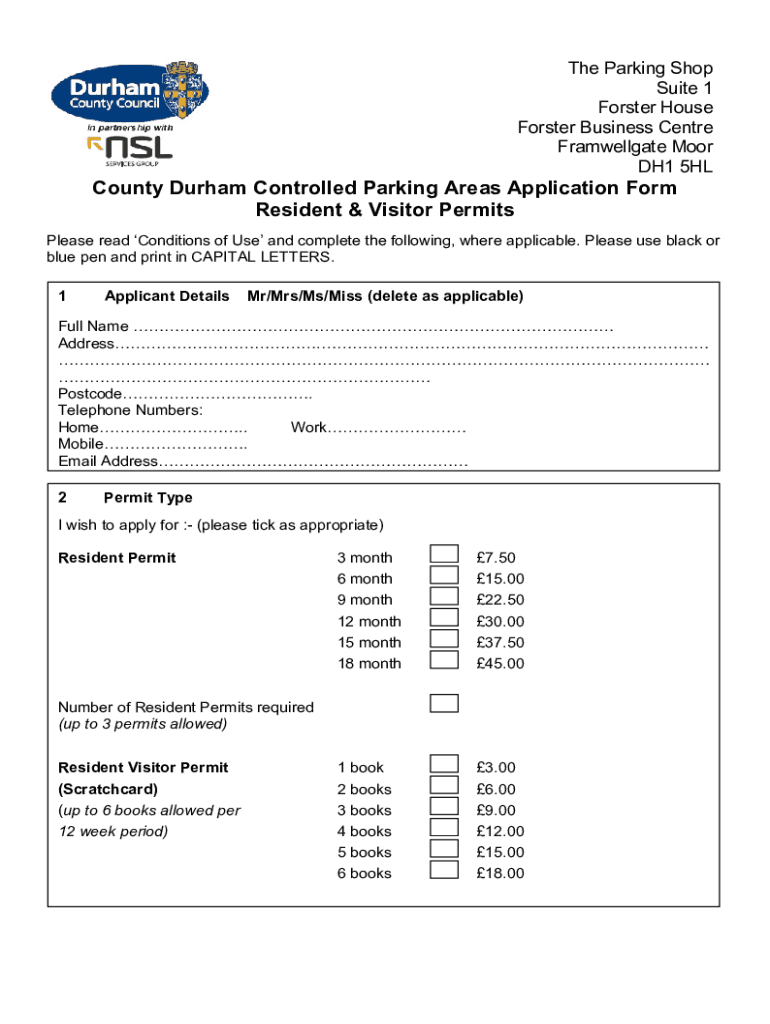

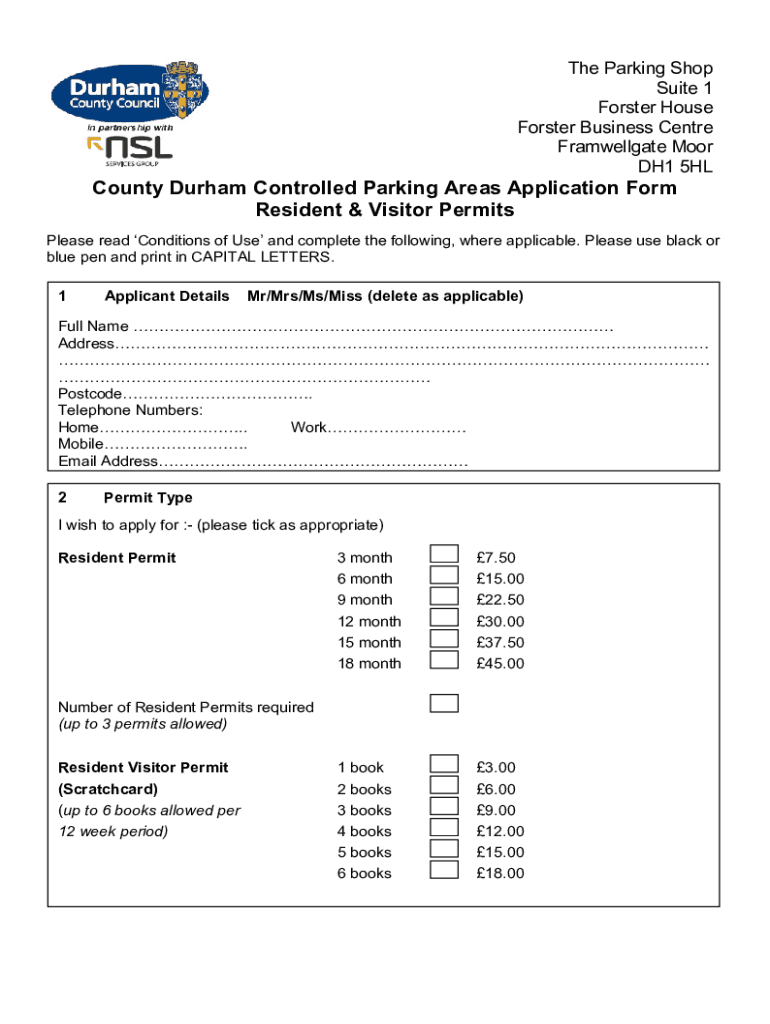

The Parking Shop Suite 1 Forster House Forster Business Center Framwellgate Moor DH1 5HLCounty Durham Controlled Parking Areas Application Form Resident & Visitor Permits Please read Conditions of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cpa app form resident

Edit your cpa app form resident form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cpa app form resident form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cpa app form resident online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit cpa app form resident. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cpa app form resident

How to fill out cpa app form resident

01

To fill out a CPA app form resident, follow these steps:

02

Obtain a copy of the CPA application form for residents.

03

Read the instructions carefully and gather all the required documents.

04

Fill in your personal information accurately, including your full name, address, contact details, and social security number.

05

Provide your educational background, including the schools you attended, degrees earned, and any relevant certifications.

06

List your work experience, starting with the most recent job, including the employer's name, duration of employment, and your job responsibilities.

07

Disclose any criminal convictions or disciplinary actions taken against you by any professional organization.

08

Complete the financial information section, including your income, assets, and liabilities.

09

Sign and date the application form.

10

Attach all the necessary supporting documents, such as transcripts, certificates, and letters of recommendation.

11

Review the completed form and supporting documents for accuracy and completeness.

12

Submit the filled-out form and supporting documents to the appropriate CPA licensing authority.

13

Pay the required application fee, if applicable.

14

Wait for the licensing authority to process your application and notify you of the outcome.

15

Note: The specific requirements and procedures may vary depending on the jurisdiction you are applying in. It is important to refer to the instructions provided with the application form or contact the licensing authority for further guidance.

Who needs cpa app form resident?

01

Anyone who wishes to become a Certified Public Accountant (CPA) and is a resident of the relevant jurisdiction needs to fill out the CPA app form resident.

02

This form is required to apply for a CPA license, which is necessary to practice as a CPA and provide accounting services to the public.

03

CPAs are professionals who have met specific education and experience requirements and have passed the Uniform CPA Examination.

04

Different jurisdictions may have their own specific application forms and requirements, so it is essential to check the regulations of the relevant licensing authority.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send cpa app form resident for eSignature?

When your cpa app form resident is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for the cpa app form resident in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your cpa app form resident and you'll be done in minutes.

How can I edit cpa app form resident on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing cpa app form resident.

What is cpa app form resident?

The CPA app form resident is a document used by individuals residing in a specific jurisdiction to apply for certain tax benefits or to report financial information required by local tax authorities.

Who is required to file cpa app form resident?

Residents who have income that is subject to local taxation or individuals who are eligible for certain tax credits or deductions must file the CPA app form resident.

How to fill out cpa app form resident?

To fill out the CPA app form resident, complete the required personal information sections, report all relevant income sources, claim any applicable deductions or credits, and ensure all fields are accurate and complete before submission.

What is the purpose of cpa app form resident?

The purpose of the CPA app form resident is to facilitate the assessment of a resident's tax liability and eligibility for tax benefits, ensuring compliance with local tax regulations.

What information must be reported on cpa app form resident?

The form typically requires personal identification details, income amounts, tax deductions, previous filing statuses, and any relevant documentation to support claims made.

Fill out your cpa app form resident online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cpa App Form Resident is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.