IRS 941 2021 free printable template

Show details

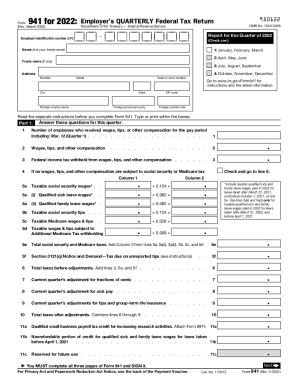

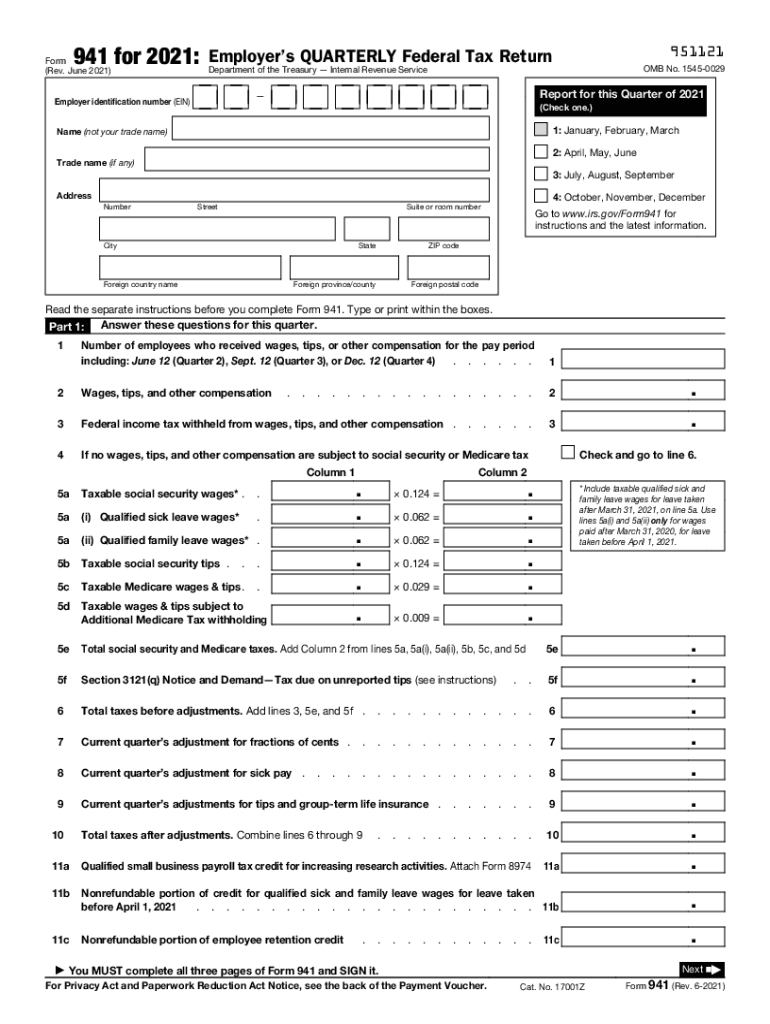

941 for 2021:Form (Rev. June 2021)951121Employers QUARTERLY Federal Tax Return OMB No. 15450029Department of the Treasury Internal Revenue ServiceReport for this Quarter of 2021Employer identification

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 941

How to edit IRS 941

How to fill out IRS 941

Instructions and Help about IRS 941

How to edit IRS 941

To edit IRS 941, use a reliable PDF editing tool such as pdfFiller. This allows you to make necessary corrections or updates to the form before submission. Make sure that all information is accurate to avoid penalties or delays.

How to fill out IRS 941

Filling out IRS 941 is essential for employers reporting payroll taxes. Gather necessary documentation such as payroll records, tax calculations, and employee wages. Complete the form by entering the required information in the designated fields, ensuring all calculations are correct. Review the form thoroughly before submission.

About IRS previous version

What is IRS 941?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS previous version

What is IRS 941?

IRS 941 is the Employer's Quarterly Federal Tax Return. It is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee's paychecks. Additionally, it reports the employer's portion of Social Security and Medicare taxes.

What is the purpose of this form?

The primary purpose of IRS 941 is to keep the IRS informed of the payroll tax obligations of employers. It allows employers to report the federal payroll taxes they have withheld on a quarterly basis, ensuring that they remain compliant with U.S. tax law.

Who needs the form?

Employers who pay wages subject to federal income tax, Social Security tax, or Medicare tax must file IRS 941. This form is required for all businesses that have employees, including corporations and partnerships.

When am I exempt from filling out this form?

You may be exempt from filing IRS 941 if you do not have any employees or if you report and pay taxes based on an annual basis using IRS Form 944. Small employers with a low tax liability may also qualify to file Form 944 instead of Form 941.

Components of the form

IRS 941 contains various components that need to be accurately completed. Key sections include information about the business, details about the wages paid, tax calculation, and any adjustments for the quarter. Ensure that all taxable wages and taxes withheld are accurately reported.

What are the penalties for not issuing the form?

Failing to file IRS 941 on time may result in penalties. These can include a failure-to-file penalty, which is 5% of the amount owed for each month the return is late, up to 25%. Additionally, if taxes are not paid on time, there may be interest and additional penalties applied.

What information do you need when you file the form?

When filing IRS 941, you need essential information such as your Employer Identification Number (EIN), total wages paid, federal income tax withheld, and the total amounts for Social Security and Medicare. Accurate calculations and reporting are crucial for compliance.

Is the form accompanied by other forms?

IRS 941 may need to be accompanied by additional forms depending on specific situations. For example, if adjustments are made, IRS Form 941-X (to amend the form) may need to be submitted. Always check IRS guidelines for specific instructions related to your filing.

Where do I send the form?

Send the completed IRS 941 form to the address provided in the IRS instructions specific to your business's state. Ensure that you use the correct mailing address to avoid delays in processing.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

PDFfiller is perfect and I highly recommend it.

I didn't understand how it worked at first. with talking to support it helped a lot.

See what our users say