Get the free FINANCIAL STATEMENTS AND INDEPENDENT AUDITORS REPORT - Knox

Show details

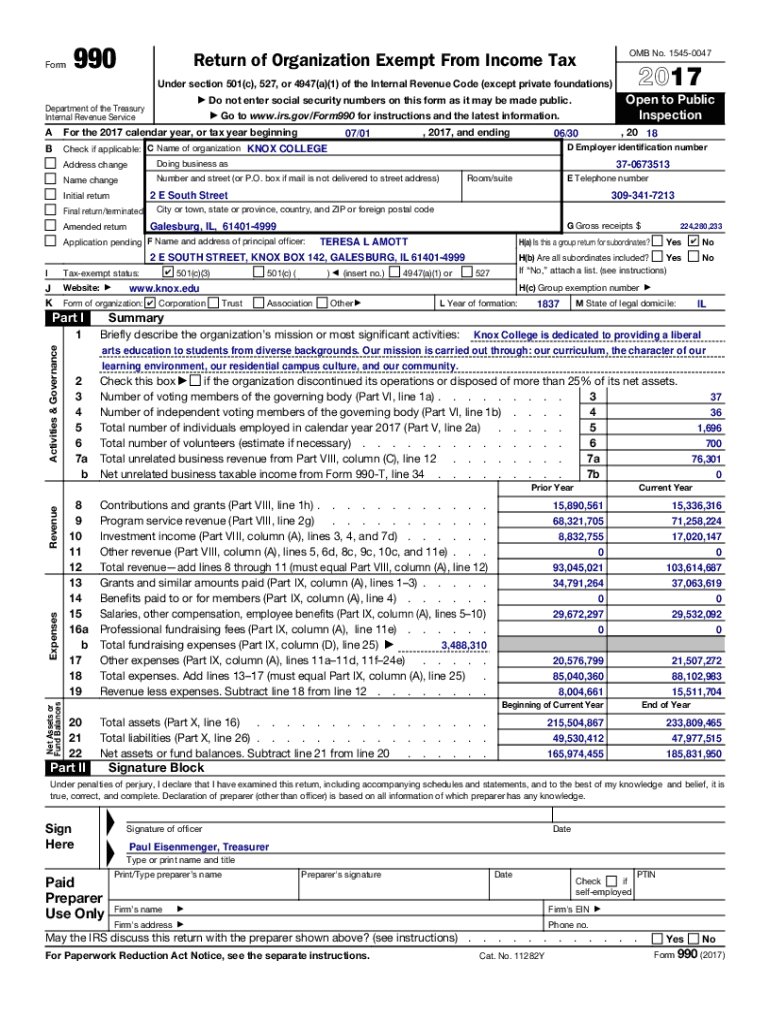

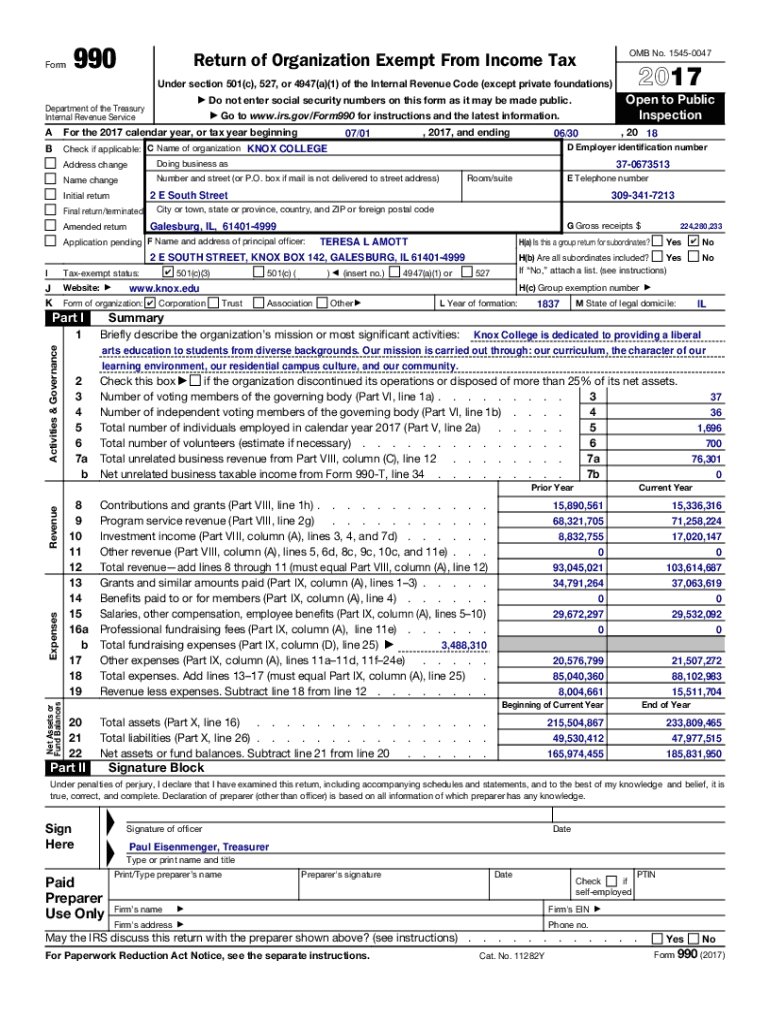

Form990OMB No. 15450047Return of Organization Exempt From Income Tax2017Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations) Department of the Treasury

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial statements and independent

Edit your financial statements and independent form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial statements and independent form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit financial statements and independent online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit financial statements and independent. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial statements and independent

How to fill out financial statements and independent

01

To fill out financial statements, follow these steps:

02

Gather all relevant financial information, including income, expenses, assets, and liabilities.

03

Classify and organize the information into appropriate categories such as revenue, expenses, current assets, fixed assets, current liabilities, long-term liabilities, etc.

04

Calculate the totals for each category and ensure that they balance.

05

Prepare the income statement by listing all revenue and expenses, and calculate the net income or loss.

06

Prepare the balance sheet by listing all assets, liabilities, and equity, and calculate the total equity.

07

Prepare the cash flow statement by analyzing the inflow and outflow of cash during a specific period.

08

Review and verify all calculations, ensuring accuracy.

09

Present the financial statements in a clear, concise, and organized manner.

10

Update the financial statements regularly to reflect changes in financial position and performance.

Who needs financial statements and independent?

01

Financial statements and independent audits are needed by various stakeholders such as:

02

- Shareholders and Investors: They use financial statements to assess the financial health and performance of a company before making investment decisions.

03

- Lenders and Creditors: They rely on financial statements to evaluate the creditworthiness and repayment capacity of a borrower or debtor.

04

- Government Agencies: They use financial statements to ensure compliance with tax laws, regulations, and reporting requirements.

05

- Employees: They may refer to financial statements to gauge the stability and profitability of their employer.

06

- Management: Financial statements provide essential information for strategic planning, decision-making, and performance evaluation.

07

- Potential Buyers: When acquiring a business, potential buyers analyze financial statements to determine its value and potential risks.

08

- Regulatory Bodies: Financial statements are often required to ensure compliance with accounting standards and regulations.

09

- General Public: Financial statements may be of interest to the general public, offering insights into the financial position and performance of a company.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my financial statements and independent in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your financial statements and independent and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I make changes in financial statements and independent?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your financial statements and independent and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I sign the financial statements and independent electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your financial statements and independent in minutes.

What is financial statements and independent?

Financial statements are reports that provide information about a company's financial performance and position. An independent audit of financial statements is a review conducted by an outside party to ensure the information is accurate and reliable.

Who is required to file financial statements and independent?

Companies that are publicly traded or have a large number of shareholders are typically required to file financial statements and independent audits.

How to fill out financial statements and independent?

Financial statements can be filled out by the company's accounting department using financial information from the company's records. Independent audits are conducted by a third-party audit firm.

What is the purpose of financial statements and independent?

The purpose of financial statements is to provide stakeholders with information about a company's financial performance and position. Independent audits help ensure the accuracy and reliability of this information.

What information must be reported on financial statements and independent?

Financial statements typically include a balance sheet, income statement, cash flow statement, and notes to the financial statements. Independent audits provide an opinion on the accuracy of this information.

Fill out your financial statements and independent online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Statements And Independent is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.