IRS Publication 1179 2021 free printable template

Show details

Revenue Procedure 202127Reprinted from IR Bulletin 202126 Dated June 28, 2021Publication 1179 General Rules and Specifications for Substitute Forms 1096, 1098, 1099, 5498, and Certain Other Information

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Publication 1179

Edit your IRS Publication 1179 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Publication 1179 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS Publication 1179 online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IRS Publication 1179. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Publication 1179 Form Versions

Version

Form Popularity

Fillable & printabley

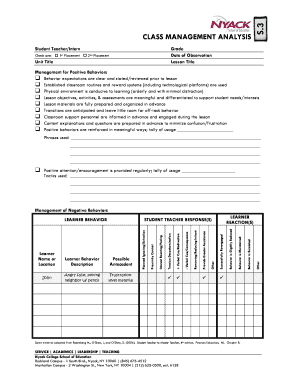

How to fill out IRS Publication 1179

How to fill out IRS Publication 1179

01

Obtain a copy of IRS Publication 1179 from the IRS website or your local tax office.

02

Review the instructions at the beginning of the publication to understand its purpose.

03

Gather the necessary information regarding the type of tax-exempt entity you are applying for.

04

Complete the required sections of the form, entering accurate information as prompted.

05

Include your Employer Identification Number (EIN) if applicable.

06

List the relevant details regarding the type of paper you will be printing (i.e., Form 1099, W-2, etc.).

07

Specify the number of forms you intend to print.

08

Ensure all required signatures are present at the end of the document.

09

Submit the completed IRS Publication 1179 to the IRS according to the guidelines provided within the publication.

Who needs IRS Publication 1179?

01

Businesses and tax-exempt organizations that need to print tax forms for the IRS.

02

Entities that require a waiver from the IRS to print certain forms on paper that is different from the standard.

03

Tax professionals filing forms on behalf of clients who qualify for exemptions.

Instructions and Help about IRS Publication 1179

Fill

form

: Try Risk Free

People Also Ask about

How long does the IRS have to file a substitute tax return?

Substitute Return This return might not give you credit for deductions and exemptions you may be entitled to receive. We will send you a Notice of Deficiency CP3219N (90-day letter) proposing a tax assessment. You will have 90 days to file your past due tax return or file a petition in Tax Court.

What is the abbreviations for IRS?

Helpful Definitions and Acronyms | Internal Revenue Service.

What does spec mean with IRS?

Stakeholder Partnerships, Education & Communication (SPEC) is the Outreach and Education arm of the Wage and Investment Division of the IRS.

What is an IRS specified student?

(C) Specified student For purposes of this paragraph, the term “specified student” means, with respect to any taxable year, an individual who is an eligible student (as defined in section 25A(b)(3) ) during at least 5 calendar months during the taxable year.

How do I know if the IRS filed a substitute return?

The Substitute for Return Process When the IRS begins the substitute return process, they'll send a letter informing you they have not received a return for the applicable year(s) and proposing a tax liability assessment (plus additional penalties and interest) based on your income from those years.

What is a substitute form IRS?

Form 4852 serves as a substitute for Form W-2, Form W-2c, and Form 1099-R (original or corrected), and is completed by taxpayers or their representatives when: Their employer or payer does not give them a Form W-2 or Form 1099-R. An employer or payer has issued an incorrect Form W-2 or Form 1099-R.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete IRS Publication 1179 online?

pdfFiller has made it simple to fill out and eSign IRS Publication 1179. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make changes in IRS Publication 1179?

The editing procedure is simple with pdfFiller. Open your IRS Publication 1179 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out IRS Publication 1179 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign IRS Publication 1179 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is IRS Publication 1179?

IRS Publication 1179 provides guidelines for the preparation of Form 1099 series information returns for reporting payments to individuals and entities.

Who is required to file IRS Publication 1179?

Any entity that issues Form 1099 series information returns, such as businesses and organizations that make payments to independent contractors or other persons, is required to file according to the guidelines in IRS Publication 1179.

How to fill out IRS Publication 1179?

To fill out IRS Publication 1179, taxpayers should follow the instructions provided in the publication, including filling out the required forms accurately, providing necessary payment information, and adhering to submission deadlines.

What is the purpose of IRS Publication 1179?

The purpose of IRS Publication 1179 is to offer guidance on the proper reporting of various types of payments made throughout the tax year, ensuring compliance with IRS requirements.

What information must be reported on IRS Publication 1179?

Information such as the type of payment made, the recipient's taxpayer identification number, the total amount paid, and any tax withheld must be reported on IRS Publication 1179.

Fill out your IRS Publication 1179 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Publication 1179 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.