Get the free LONG TERM ESCROW AGREEMENT - Insured Titles

Show details

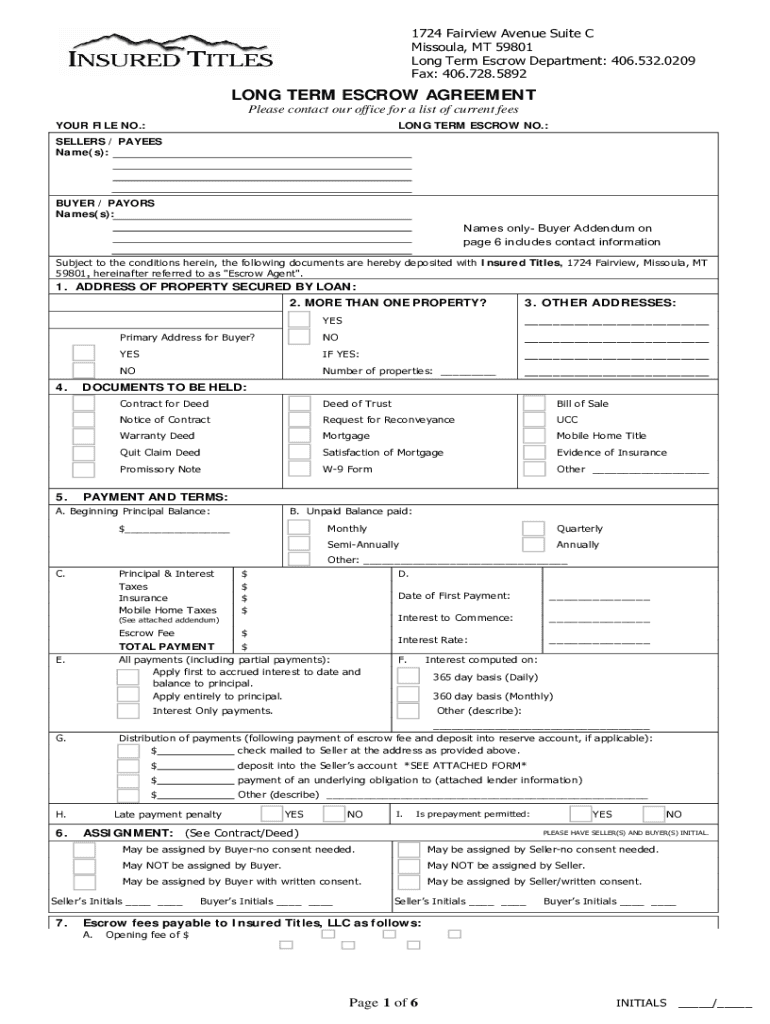

1724 Fairview Avenue Suite C Missoula, MT 59801 Long Term Escrow Department: 406.532.0209 Fax: 406.728.5892LONG TERM ESCROW AGREEMENT Please contact our office for a list of current fees YOUR FILE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign long term escrow agreement

Edit your long term escrow agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your long term escrow agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing long term escrow agreement online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit long term escrow agreement. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

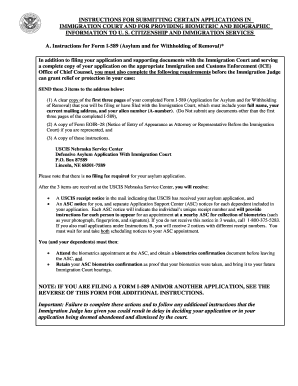

How to fill out long term escrow agreement

How to fill out long term escrow agreement

01

Start by reading the long term escrow agreement thoroughly to understand its terms and conditions.

02

Gather all necessary information and documentation required to complete the agreement, such as identification documents, financial statements, and asset details.

03

Fill out the agreement form legibly and accurately, ensuring that all required fields are completed.

04

Consult with legal professionals or escrow agents if you have any doubts or questions about certain clauses or provisions in the agreement.

05

Review the filled-out agreement carefully to ensure that all information is correct and no errors or omissions are present.

06

Sign the agreement along with any required witnesses or notaries as specified in the document.

07

Make copies of the fully executed agreement for your own records and provide copies to all relevant parties involved in the escrow arrangement.

08

Keep the original agreement in a secure location and share access with trusted individuals or entities.

09

Periodically review and update the agreement as necessary to reflect any changes in circumstances or amendments agreed upon by the parties involved.

Who needs long term escrow agreement?

01

Long term escrow agreements are typically required in situations where there is a need to secure and protect assets or funds over an extended period.

02

Examples of individuals or entities that may need a long term escrow agreement include:

03

- Real estate buyers and sellers who want to ensure the safe transfer of property ownership and funds over a specified period.

04

- Parties involved in business mergers or acquisitions who require a mechanism to safeguard assets and funds until the completion of the transaction.

05

- Individuals planning for retirement or estate planning, who may need an escrow agreement to hold assets or funds until certain conditions are met.

06

- International trade partners or buyers who want to establish a secure arrangement for payment and delivery of goods or services over a long-term contract.

07

- Beneficiaries of trust funds or inheritances, who may require an escrow agreement to ensure the proper transfer and management of assets.

08

- Parties involved in complex legal disputes or settlements, where funds or assets are held in escrow until the resolution of the case.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my long term escrow agreement in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign long term escrow agreement and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Where do I find long term escrow agreement?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific long term escrow agreement and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How can I fill out long term escrow agreement on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your long term escrow agreement, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is long term escrow agreement?

A long term escrow agreement is a legal arrangement where a third party holds funds or assets on behalf of two parties involved in a transaction, typically for an extended period, ensuring that the conditions of the agreement are met before the transaction is completed.

Who is required to file long term escrow agreement?

Parties involved in a transaction that uses an escrow service, such as buyers and sellers in real estate or other financial transactions, are usually required to file a long term escrow agreement.

How to fill out long term escrow agreement?

To fill out a long term escrow agreement, one must provide the details of the parties involved, the terms and conditions of the escrow, the duration of the escrow period, and any specific instructions regarding the release of funds or assets.

What is the purpose of long term escrow agreement?

The purpose of a long term escrow agreement is to protect the interests of both parties in a transaction by ensuring that funds or assets are securely held until agreed-upon conditions are fulfilled.

What information must be reported on long term escrow agreement?

The information that must be reported includes the names and contact details of the parties involved, a description of the transaction, specific terms of the agreement, and instructions for the release of funds or assets.

Fill out your long term escrow agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Long Term Escrow Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.