Get the free Co-Signer Credit Application - Drive4rail.com - drive4rail

Show details

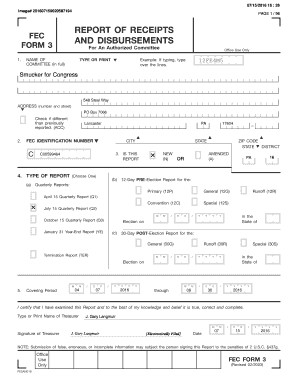

Credit application: RO EHL TRANSPORT INC. Fax: 1-715-591-7505 Amount Requested: $2,800.00 CO SIGNER APPLICATION: Name of person loan is for: *Note: Cosigner cannot be a spouse of the applicant, in

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign co-signer credit application

Edit your co-signer credit application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your co-signer credit application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit co-signer credit application online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit co-signer credit application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out co-signer credit application

How to fill out a co-signer credit application:

01

Gather all necessary information: Before starting the application, make sure you have all the required information handy. This may include personal details such as your full name, date of birth, social security number, contact information, and proof of identification.

02

Understand the responsibilities: As a co-signer, it's crucial to understand the responsibilities involved. Read the terms and conditions carefully, including the borrower's obligations, repayment terms, and consequences for default. Make sure you are comfortable with these terms before proceeding.

03

Provide financial information: Fill out the financial section of the application accurately. This may include providing details about your income, employment history, assets, and liabilities. Be prepared to provide supporting documents such as pay stubs, tax returns, or bank statements to verify your financial status.

04

Include personal references: Many credit applications require you to provide personal references who can vouch for your character and reliability. Choose individuals who are familiar with your financial responsibility, such as employers, landlords, or long-time friends.

05

Review and double-check: Before submitting the application, review all the information you have entered. Ensure there are no errors or missing details. A thorough review will minimize the chances of delays or rejection.

06

Sign and submit the application: Once you are satisfied with the completed application, sign it, and submit it according to the instructions provided. Some applications may be submitted online, while others may require you to mail or hand-deliver the documents.

Who needs a co-signer credit application?

01

Individuals with limited credit history: If you are new to credit or have a limited credit history, lenders may require a co-signer to strengthen your application. Having a co-signer with a good credit history can increase your chances of approval and help you secure better loan terms.

02

Individuals with poor credit: If your credit score is low or you have a history of late payments or defaults, lenders may be hesitant to approve your application. In such cases, having a co-signer with a strong credit profile can increase your chances of getting approved and may result in more favorable loan terms.

03

Students and young adults: Many students or young adults who are entering the world of credit for the first time may need a co-signer to qualify for loans or credit cards. Since they often don't have an established credit history, having a co-signer can provide the necessary assurance to lenders.

04

Individuals with a high debt-to-income ratio: If your income is not sufficient to cover your existing debts, lenders may require a co-signer to mitigate the risk. A co-signer with a healthier debt-to-income ratio can reassure lenders that the loan will be repaid even if you face financial difficulties.

Remember, co-signing a credit application is a serious commitment. Both the borrower and the co-signer are equally responsible for repaying the loan. Prioritize open communication with the borrower and ensure that you are fully aware of the implications before agreeing to co-sign.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is co-signer credit application?

A co-signer credit application is a form that allows someone with a stronger credit history to support a borrower who may have a weaker credit history when applying for a loan or credit.

Who is required to file co-signer credit application?

Someone who needs additional support to qualify for a loan or credit may be required to have a co-signer file a co-signer credit application.

How to fill out co-signer credit application?

To fill out a co-signer credit application, the co-signer typically needs to provide personal information, financial information, and consent to be held responsible for the debt if the borrower defaults.

What is the purpose of co-signer credit application?

The purpose of a co-signer credit application is to provide additional assurance to lenders that the borrower will repay the loan or credit by having someone with a stronger credit history back their application.

What information must be reported on co-signer credit application?

Information such as personal details, financial details, employment information, credit history, and consent for the co-signer to be held responsible for the debt if the borrower defaults must be reported on a co-signer credit application.

How do I modify my co-signer credit application in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your co-signer credit application and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I complete co-signer credit application online?

Easy online co-signer credit application completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit co-signer credit application online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your co-signer credit application to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Fill out your co-signer credit application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Co-Signer Credit Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.