Get the free Mortgages For Dummies, 3rd Edition - SILO.PUB

Show details

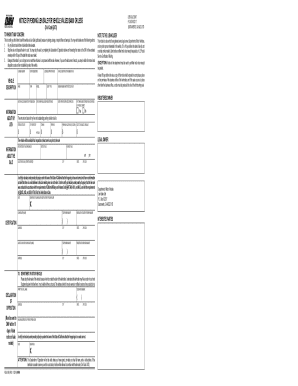

MORTGAGES LR004 Basis of Factors Mortgages in Good Standing The pretax factors for commercial mortgages were developed based on analysis using the Commercial Mortgage Metrics model of Moody's Analytics

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgages for dummies 3rd

Edit your mortgages for dummies 3rd form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgages for dummies 3rd form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgages for dummies 3rd online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mortgages for dummies 3rd. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgages for dummies 3rd

How to fill out mortgages for dummies 3rd

01

Start by gathering all the necessary documents, such as income statements, tax returns, and credit reports.

02

Research different mortgage options and choose the one that best suits your needs and financial situation.

03

Fill out the mortgage application form accurately and provide all required information

04

Calculate your monthly mortgage payments using an online mortgage calculator or seek help from a mortgage professional.

05

Submit the completed application along with the required documents to the mortgage lender.

06

Review and sign all the legal documents related to the mortgage.

07

Follow up with the mortgage lender to ensure the processing of your application and address any additional requirements.

08

Once approved, carefully review the terms and conditions of the mortgage agreement before signing it.

09

Coordinate with the lender to complete the mortgage closing process and transfer the funds for the purchase.

10

Keep track of your mortgage payments and stay informed about any changes in interest rates or options for refinancing.

Who needs mortgages for dummies 3rd?

01

First-time homebuyers who are new to the mortgage process and want a simplified guide.

02

Individuals who want to expand their knowledge about mortgages and make informed decisions.

03

People who prefer self-learning and want to understand the basics of mortgages without complex jargon.

04

Those who are looking to improve their financial literacy and understand the factors involved in home financing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute mortgages for dummies 3rd online?

Completing and signing mortgages for dummies 3rd online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make edits in mortgages for dummies 3rd without leaving Chrome?

mortgages for dummies 3rd can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an eSignature for the mortgages for dummies 3rd in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your mortgages for dummies 3rd and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is mortgages for dummies 3rd?

Mortgages for Dummies 3rd is a book that provides simplified explanations and advice for individuals looking to understand mortgages.

Who is required to file mortgages for dummies 3rd?

Any individual interested in learning more about mortgages can benefit from reading Mortgages for Dummies 3rd.

How to fill out mortgages for dummies 3rd?

To read Mortgages for Dummies 3rd, simply purchase or borrow a copy of the book and follow along with the content provided.

What is the purpose of mortgages for dummies 3rd?

The purpose of Mortgages for Dummies 3rd is to educate individuals on the basics of mortgages and provide guidance on navigating the mortgage process.

What information must be reported on mortgages for dummies 3rd?

Mortgages for Dummies 3rd does not require any information to be reported, as it is a book for educational purposes.

Fill out your mortgages for dummies 3rd online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgages For Dummies 3rd is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.