Get the Get the free Minerals Taxation and GIS Services - Department ...

Show details

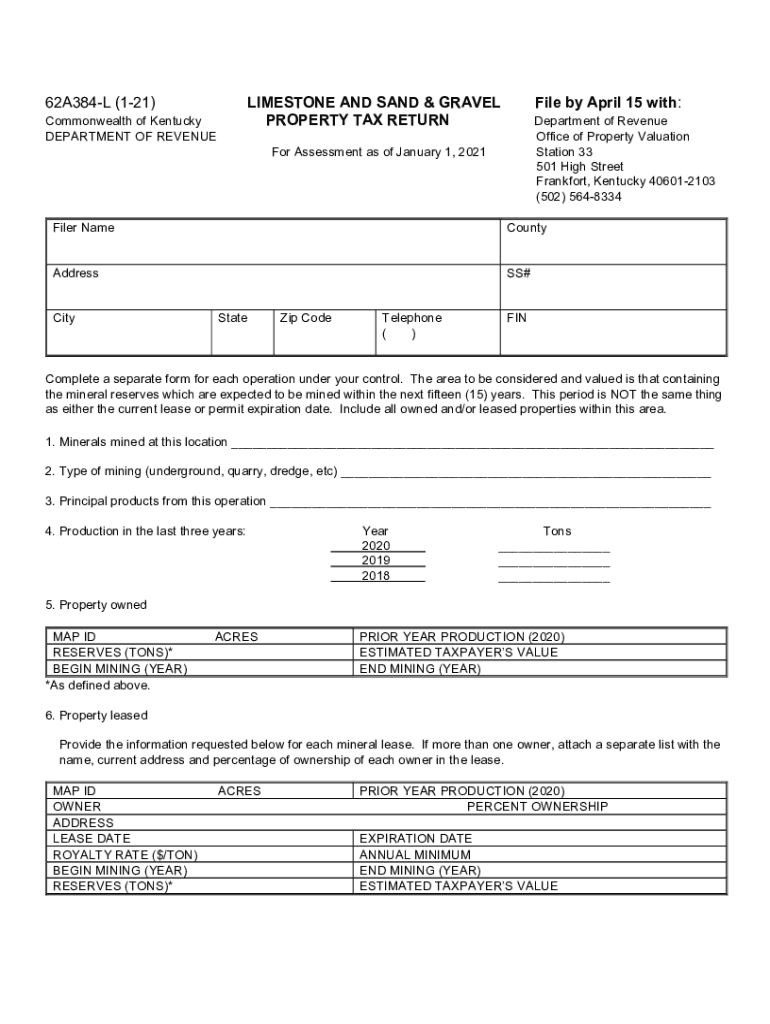

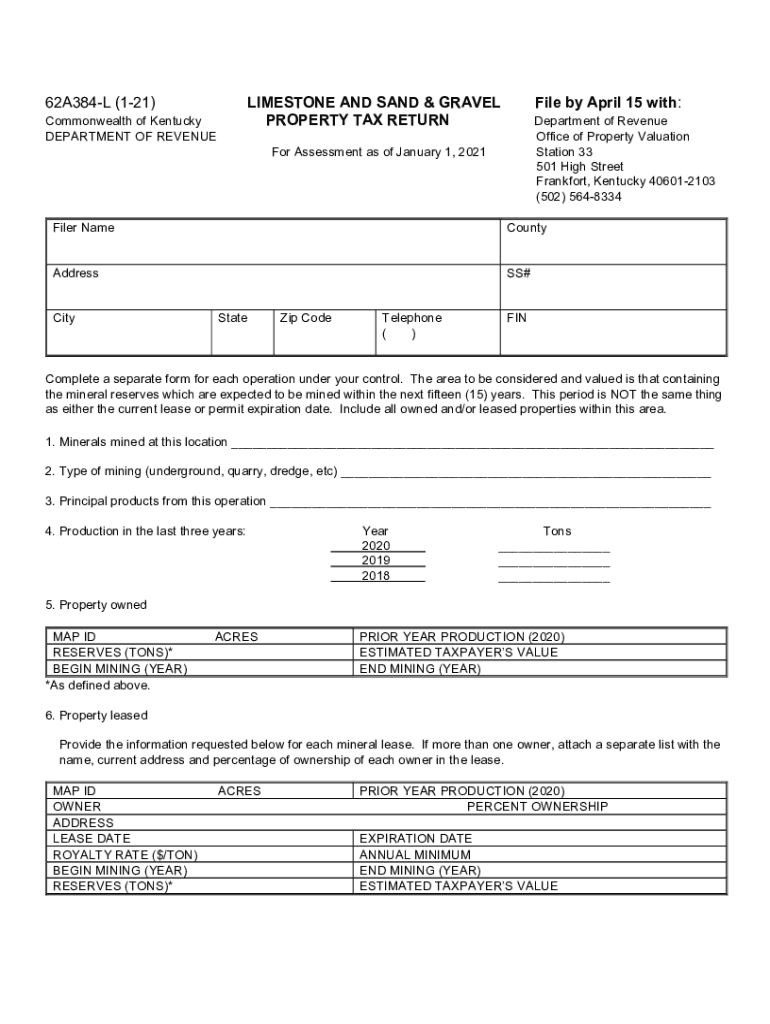

62A384L (121)LIMESTONE AND SAND & GRAVEL PROPERTY TAX RETURN Commonwealth of Kentucky DEPARTMENT OF Revengeful by April 15 with: Department of Revenue Office of Property Valuation Station 33 501 High

We are not affiliated with any brand or entity on this form

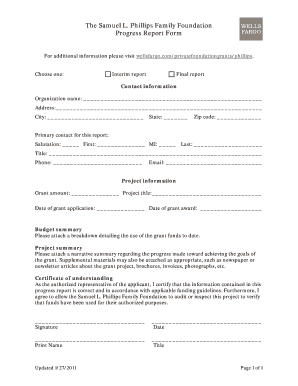

Get, Create, Make and Sign minerals taxation and gis

Edit your minerals taxation and gis form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your minerals taxation and gis form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing minerals taxation and gis online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit minerals taxation and gis. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out minerals taxation and gis

How to fill out minerals taxation and gis

01

To fill out minerals taxation and GIS forms, follow these steps:

02

Collect all relevant information related to the minerals you are taxing. This may include production volume, sales revenue, cost of production, and any applicable deductions or exemptions.

03

Obtain the necessary forms from the appropriate government department or agency. These forms may be available online or in physical copies.

04

Read the instructions provided with the forms carefully to understand the requirements and specific information they ask for.

05

Fill out the forms accurately and completely, providing the requested information in the designated fields or sections.

06

Double-check all calculations and ensure that you have included all required supporting documentation, such as receipts or financial statements.

07

Review the completed forms to ensure accuracy and address any errors or inconsistencies before submitting.

08

Submit the filled-out forms and any supporting documents to the appropriate government department or agency by the specified deadline.

09

Keep a copy of the completed forms and supporting documents for your records.

10

If necessary, follow up with the government department or agency to confirm receipt and address any additional requirements or requests for information.

Who needs minerals taxation and gis?

01

Minerals taxation and GIS are needed by various entities and individuals, including:

02

- Mining companies: They use minerals taxation to calculate and report their tax obligations based on their mineral production and sales.

03

- Government agencies: They require minerals taxation to monitor and manage the collection of taxes and royalties from mineral resources.

04

- Geologists and geoscientists: They use GIS (Geographic Information System) to analyze and visualize geological data and information related to minerals.

05

- Researchers and policymakers: They rely on minerals taxation and GIS data to study and understand the economic and environmental impact of mining activities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send minerals taxation and gis for eSignature?

When you're ready to share your minerals taxation and gis, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an eSignature for the minerals taxation and gis in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your minerals taxation and gis directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I fill out minerals taxation and gis on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your minerals taxation and gis, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is minerals taxation and gis?

Minerals taxation and GIS refer to the process of taxing mineral resources and using geographic information systems to manage and analyze the data.

Who is required to file minerals taxation and gis?

Companies or individuals involved in mineral resource extraction are required to file minerals taxation and GIS.

How to fill out minerals taxation and gis?

Minerals taxation and GIS forms can typically be filled out online or through paper forms provided by the relevant tax authority.

What is the purpose of minerals taxation and gis?

The purpose of minerals taxation and GIS is to ensure that mineral resources are properly taxed and managed for sustainable development.

What information must be reported on minerals taxation and gis?

Information such as the type and quantity of minerals extracted, the location of the extraction sites, and the financial details of the mining operations must be reported on minerals taxation and GIS.

Fill out your minerals taxation and gis online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Minerals Taxation And Gis is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.