Get the free BTL Lending Criteria - Shawbrook Bank

Show details

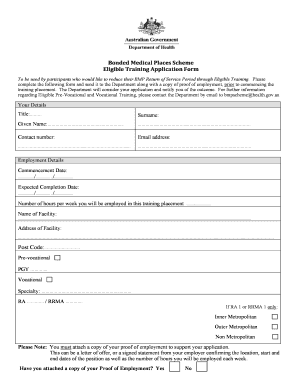

BTL Lending CriteriaTHIS GUIDE IS FOR INTERMEDIARY USE ONLY AND SHOULD NOT BE SHOWN TO POTENTIAL CLIENTSLoan Refinance Purchase Customers Landlord Type ID and Residence Affordability Security Flats

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign btl lending criteria

Edit your btl lending criteria form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your btl lending criteria form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing btl lending criteria online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit btl lending criteria. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out btl lending criteria

How to fill out btl lending criteria

01

Gather all necessary documents, such as proof of income, bank statements, and credit history.

02

Review the specific lending criteria provided by the BTL lender.

03

Complete the application form accurately and provide all requested information.

04

Ensure that the property being considered meets the BTL lending criteria.

05

Submit the completed application along with the required documents to the lender.

06

Wait for the lender's decision and be prepared to provide any additional information if requested.

07

If approved, carefully review the terms and conditions of the BTL lending offer before accepting it.

08

Fulfill any additional requirements set by the lender, such as property valuation or insurance.

09

Complete the necessary legal and contractual procedures, including signing the BTL lending agreement.

10

Follow the lender's instructions regarding disbursement of funds and repayment of the loan.

Who needs btl lending criteria?

01

Individuals or businesses who intend to invest in properties to generate rental income.

02

Property developers or investors looking to expand their rental property portfolio.

03

Real estate professionals who want to provide financing options to their clients.

04

People who wish to purchase a second home and let it out for rental purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send btl lending criteria for eSignature?

When you're ready to share your btl lending criteria, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an electronic signature for the btl lending criteria in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your btl lending criteria in seconds.

How do I edit btl lending criteria straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit btl lending criteria.

What is btl lending criteria?

BTL lending criteria refers to the requirements that a borrower must meet in order to qualify for a buy-to-let mortgage.

Who is required to file btl lending criteria?

Lenders who offer buy-to-let mortgages are required to disclose their lending criteria.

How to fill out btl lending criteria?

Borrowers must provide the necessary financial information and meet the outlined requirements as per the lender's criteria.

What is the purpose of btl lending criteria?

The purpose of btl lending criteria is to assess the risk associated with lending money for buy-to-let properties and ensure that borrowers are financially capable of repaying the mortgage.

What information must be reported on btl lending criteria?

Information such as credit score, income, employment details, property value, and rental income may need to be reported on btl lending criteria.

Fill out your btl lending criteria online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Btl Lending Criteria is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.