Get the free Retirement income stream

Show details

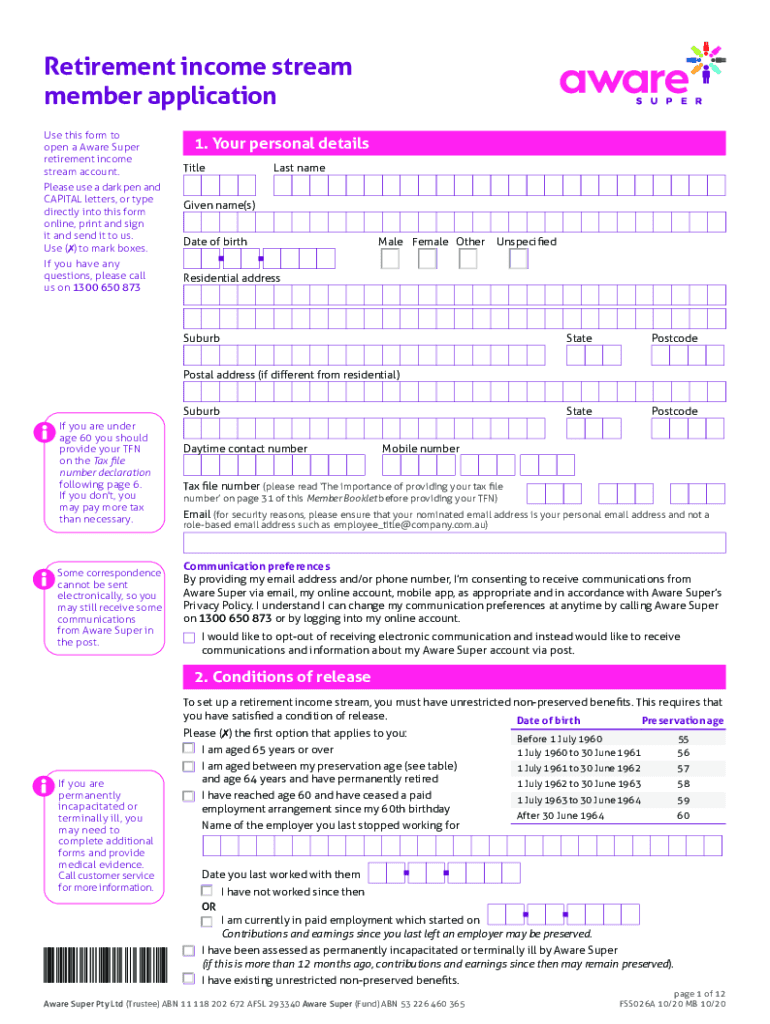

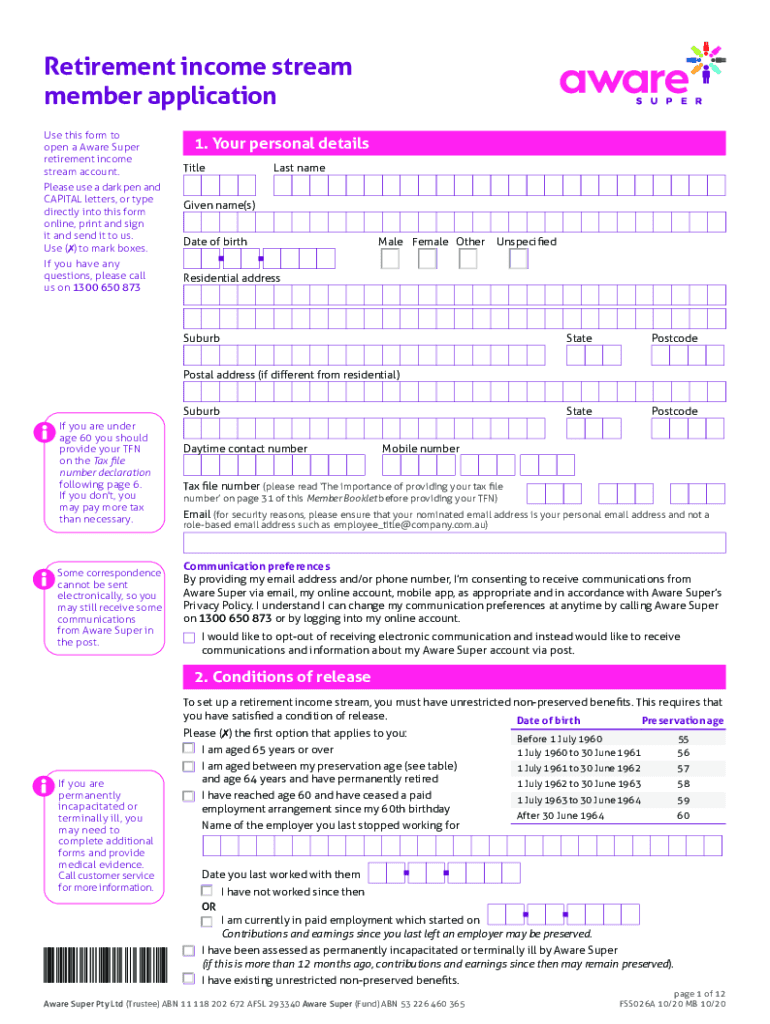

Retirement income stream member application Use this form to open an Aware Super retirement income stream account. Please use a dark pen and CAPITAL letters, or type directly into this form online,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign retirement income stream

Edit your retirement income stream form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retirement income stream form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing retirement income stream online

To use the professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit retirement income stream. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out retirement income stream

How to fill out retirement income stream

01

Start by gathering all essential financial documents such as bank statements, investment statements, pension statements, and any other relevant retirement income sources.

02

Calculate your total retirement income from various sources, including social security benefits, pension plans, annuities, etc.

03

Determine your expenses during retirement, including regular living expenses, healthcare costs, travel plans, and other discretionary spending.

04

Assess your risk tolerance and investment preferences to decide on the appropriate retirement income stream option such as fixed-income annuities, systematic withdrawal plans, or investment portfolios.

05

Consult with a financial advisor or retirement planner to discuss your goals, preferences, and risk tolerance.

06

Evaluate the tax implications and consider strategies to optimize your retirement income stream from a tax perspective.

07

Create a retirement income plan by selecting the most suitable retirement income stream option that aligns with your goals and financial situation.

08

Implement the chosen retirement income stream option by following the necessary steps, such as completing application forms, opening accounts, or setting up automatic transfers.

09

Regularly review and reassess your retirement income stream to ensure it aligns with your changing circumstances, financial goals, and market conditions.

10

Seek professional advice periodically to make any necessary adjustments or refinements to your retirement income stream strategy.

Who needs retirement income stream?

01

Individuals who are approaching retirement and want to ensure a steady income stream to cover their living expenses.

02

Individuals who do not have a pension plan or significant retirement savings and need to create an alternative income source for their retirement years.

03

Individuals who want to supplement their existing retirement income sources, such as social security benefits or pension plans, to maintain their desired standard of living.

04

Individuals who desire financial security during retirement and want to minimize the risks associated with market volatility and investment uncertainty.

05

Individuals who have specific retirement goals, such as traveling extensively or pursuing hobbies, which require additional income beyond their regular savings.

06

Individuals who want to ensure their spouse or dependents are financially taken care of after their retirement or in case of their death.

07

Individuals who want to reduce the stress and uncertainty associated with managing investments and market fluctuations during retirement.

08

Individuals who value the peace of mind and simplicity offered by a regular and predictable retirement income stream.

09

Individuals who understand the importance of long-term financial planning and want to establish a reliable source of income for their retirement years.

10

Individuals who want to optimize their retirement income from a tax perspective by utilizing strategies and retirement income streams that maximize tax efficiency.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my retirement income stream in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your retirement income stream along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send retirement income stream for eSignature?

retirement income stream is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an electronic signature for the retirement income stream in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is retirement income stream?

Retirement income stream is a regular payment received by retirees from their pension, superannuation fund, or other retirement savings.

Who is required to file retirement income stream?

Individuals who receive retirement income stream payments are required to report this income on their tax return.

How to fill out retirement income stream?

Retirement income stream is typically reported on tax forms such as the 1099-R or the income section of the tax return.

What is the purpose of retirement income stream?

The purpose of retirement income stream is to provide retirees with a source of income to support their livelihood during retirement.

What information must be reported on retirement income stream?

The amount of income received from the retirement income stream and any taxes withheld must be reported on the tax return.

Fill out your retirement income stream online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Retirement Income Stream is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.