NY ES 161.5 2021-2025 free printable template

Show details

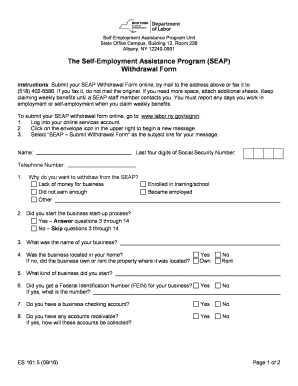

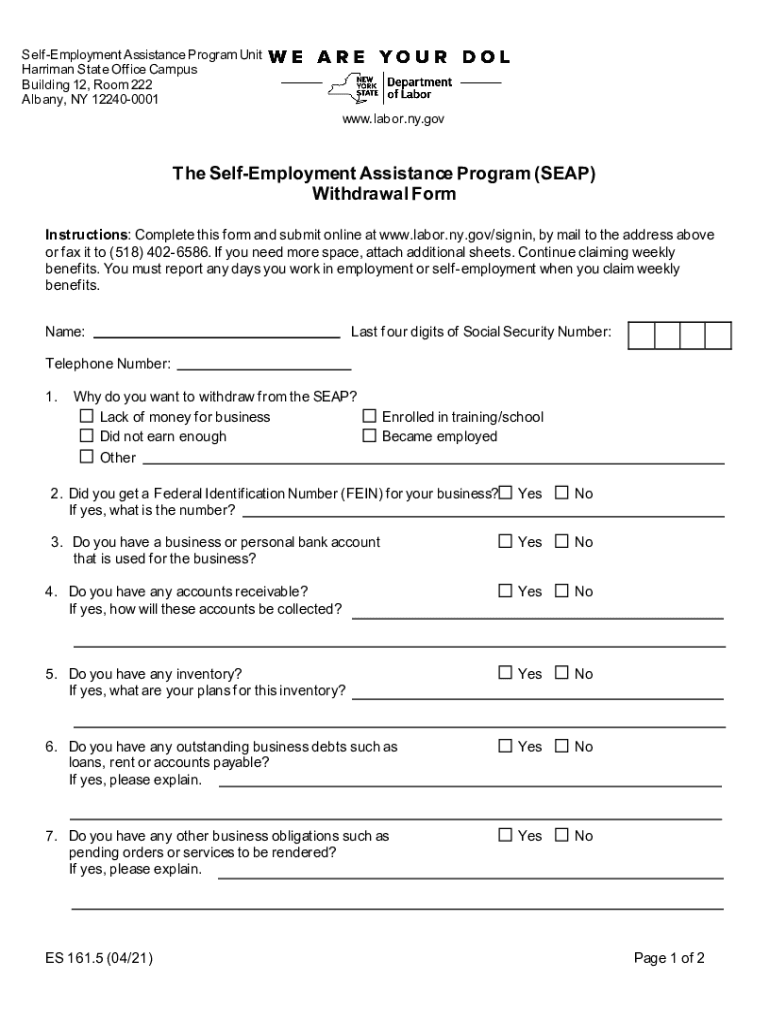

Self Employment Assistance Program Unit Harriman State Office Campus Building 12, Room 222 Albany, NY 122400001 www.labor.ny.govThe Reemployment Assistance Program (SEA) Withdrawal Form Instructions:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign new york assistance withdrawal pdf form

Edit your ny self assistance program form download form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 5 self assistance program online form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit self assistance program form pdf online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ny self assistance program print form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY ES 161.5 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ny assistance withdrawal fill form

How to fill out NY ES 161.5

01

Obtain the NY ES 161.5 form from the New York State Department of Taxation and Finance website or your local tax office.

02

Fill in your name, address, and Social Security number in the designated fields at the top of the form.

03

Indicate the tax year for which you are filing the form.

04

Provide details of your income, including any wages, self-employment income, and other sources of income.

05

Complete the deduction section by listing any qualifying deductions you are claiming.

06

Calculate your total tax liability based on the instructions provided on the form.

07

Review your form for accuracy and completeness.

08

Submit the completed form by the specified due date, either electronically or by mail.

Who needs NY ES 161.5?

01

NY ES 161.5 is needed by individuals who are required to report estimated tax payments for the state of New York.

02

Taxpayers who expect to owe tax of $300 or more when filing their New York State tax return should complete this form.

03

Self-employed individuals and those with income that isn't subject to withholding should also file this form to properly calculate and submit their estimated taxes.

Fill

es self assistance withdrawal make

: Try Risk Free

People Also Ask about new york program withdrawal form

What is self employment assistance program NY?

The Self-Employment Assistance Program (SEAP) allows people who are out of work and meet certain requirements to start their own business while collecting Unemployment Insurance benefits.

What is the self employment assistance program in New Jersey?

The Self Employment Assistance (SEA) Program helps qualified, unemployed individuals with starting a business in New Jersey. One-Stop resources can help you identify the skills you can bring to a new job. This can help you focus your resume and target your job search.

How many weeks of unemployment in NY?

You can get up to 26 weeks of benefits while you are unemployed. A typical range of weekly UI benefits, depending on past wages, is about $100-$500 per week. Income from unemployment benefits is taxable on your federal and state tax returns. Requires a valid Social Security Number and government-issued ID card.

Can self-employed still collect unemployment in NJ?

Pandemic Unemployment Assistance (PUA): Expanded Unemployment Eligibility During the Coronavirus Emergency. Pandemic Unemployment Assistance (PUA) provides benefits for NJ workers who are: not eligible for unemployment benefits in any state, including self-employed workers (independent workers, “gig” workers)

How do I file for unemployment if I am self employed in NY?

Call our Telephone Claim Center, toll-free during business hours to file a claim. 1-888-209-8124. Telephone filing hours are as follows: Monday through Friday, 8 am to 5 pm.

What is a self-employed individual?

Generally, you are self-employed if any of the following apply to you. You carry on a trade or business as a sole proprietor or an independent contractor. You are a member of a partnership that carries on a trade or business. You are otherwise in business for yourself (including a part-time business or a gig worker).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ny seap online?

With pdfFiller, the editing process is straightforward. Open your new york 5 employment assistance in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out the new york assistance withdrawal fill form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign new york assistance withdrawal blank. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I edit es self assistance program withdrawal on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as ny 5 self employment assistance printable. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is NY ES 161.5?

NY ES 161.5 is a form used by New York State taxpayers to report estimated income taxes.

Who is required to file NY ES 161.5?

Individuals and businesses that expect to owe more than a certain amount in taxes and are required to make estimated tax payments must file NY ES 161.5.

How to fill out NY ES 161.5?

To fill out NY ES 161.5, taxpayers must provide their personal and financial information, estimate their tax liability, and enter the amount of estimated tax payments.

What is the purpose of NY ES 161.5?

The purpose of NY ES 161.5 is to ensure that taxpayers make timely estimated tax payments to avoid penalties and interest on unpaid taxes.

What information must be reported on NY ES 161.5?

Information that must be reported on NY ES 161.5 includes the taxpayer's identification details, estimated income, deductions, credits, and the calculated estimated tax liability.

Fill out your self employment program seap online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ny Seap Withdrawal is not the form you're looking for?Search for another form here.

Keywords relevant to new york assistance withdrawal fillable

Related to ny self assistance program form pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.