Get the free publication 1281

Show details

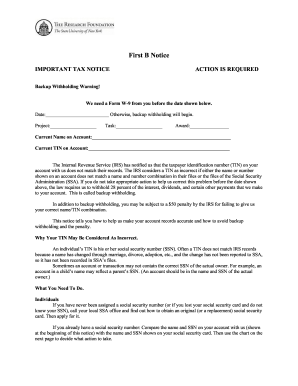

BACKUP WITHHOLDING

FOR MISSING AND

INCORRECT NAME/TIN(S)

(Including instructions for reading tape cartridges and CD/DVD Formats)Publication 1281 (Rev. 52021) Catalog Number 63327A Department of the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign publication 1281

Edit your publication 1281 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your publication 1281 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit publication 1281 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit publication 1281. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out publication 1281

How to fill out IRS Publication 1281

01

Start by downloading IRS Publication 1281 from the IRS website.

02

Review the publication to understand its purpose and requirements.

03

Gather necessary information about your tax situation and relevant financial data.

04

Fill out the form by following the instructions in the publication, ensuring you complete each section accurately.

05

Double-check your entries for any errors or omissions.

06

Sign and date the form if required.

07

Submit the completed form to the appropriate IRS office as indicated in the instructions.

Who needs IRS Publication 1281?

01

Businesses or individuals who pay certain types of income to foreign persons may need IRS Publication 1281.

02

It is primarily for those who want to claim withholding exemptions or determine tax rates.

Fill

form

: Try Risk Free

People Also Ask about

What are B notices from the IRS?

B Notices are sent to IRS Form 1099 filers who've submitted a name and taxpayer identification number (TIN) combination that doesn't match the IRS database. Filers have a 15-day window to take action on the notices, and send updated TIN solicitations.

How do I remit withholding tax?

The person making the payment deducts tax prior to paying the amount due. The tax withheld/deducted is then remitted to the KRA. The payer is required to generate a withholding tax certificate on iTax which is automatically sent to the payee once the payer remits the withholding tax to KRA.

How do you submit backup withholding?

Employers that withhold taxes from certain payments must file a Form 945. For example, you'd have to file Form 945 if the IRS required you to make backup withholdings on an independent contractor's pay.

What happens with backup withholding?

What is backup withholding? There are situations when the payer is required to withhold at the current rate of 24 percent. This 24 percent tax is taken from any future payments to ensure the IRS receives the tax due on this income.

What accounts are subject to backup withholding?

Payments subject to backup withholding Attorney's fees (Form 1099-NEC) and gross proceeds such as settlements paid to an attorney (Form 1099-MISC) Interest payments (Form 1099-INT) Dividends (Form 1099-DIV) Payment Card and Third Party Network Transactions (Form 1099-K)

Who qualifies for exemption from withholding?

Exemption From Withholding To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year. A Form W-4 claiming exemption from withholding is valid for only the calendar year in which it's furnished to the employer.

How do I know if Im backup withholding?

Am I subject to federal backup withholding? You received specific notification from the IRS stating that you are subject to backup withholding. You fail to furnish your taxpayer identification number on Form W9. You provide the wrong taxpayer identification number.

Under which circumstance would a payer not be subject to backup withholding?

Upon opening a new investment account or making an investment at a bank for the first time, it's important that you provide them with your name and TIN or SSN. As long as you provide an accurate W-9 to the institution you're investing through, you don't have to worry about backup withholding tax.

What is a TIN notice?

The TIN Notice is sent by the IRS when the taxpayer identification number (TIN) is not correct. The 2nd TIN Notice is the second notice sent by the IRS in three calendar years. When the 2nd TIN Notice checkbox is selected, the IRS will stop sending you TIN notices on the current account.

How do I know if I'm exempt from backup withholding?

Who Is Exempt from Backup Withholding? Most American citizens are exempted from backup withholding so long as their tax identification number (TIN) or social security number is on file with their broker, and corresponds with their legal name. Retirement accounts and unemployment income are also exempted.

How do I know if I have backup withholding?

Most people are not subject to federal backup withholding. The IRS notifies taxpayers if they are subject to backup withholding. Any of the following reasons may cause your account to be subject to backup withholding: You received specific notification from the IRS stating that you are subject to backup withholding.

Why is my bank asking about backup withholding?

This is known as Backup Withholding (BWH) and may be required: Under the BWH-B program because you failed to provide a correct taxpayer identification number (TIN) to the payer for reporting on the required information return.

How does the IRS notify you of backup withholding?

The IRS notifies the payer to start withholding on interest or dividends because you have underreported interest or dividends on your income tax return. The IRS will do this only after it has mailed you four notices over at least a 120-day period.

How do I submit a backup withholding to the IRS?

If you withhold or are required to withhold federal income tax (including backup withholding) from nonpayroll payments, you must file Form 945. See Purpose of Form 945, earlier. You don't have to file Form 945 for those years in which you don't have a nonpayroll tax liability.

What is a notice CP2100A?

CP2100 and CP2100A notices are sent twice a year; an initial mailing in September and October and a second mailing in April of the following year. The notices inform payers that the information return is missing a Taxpayer Identification Number (TIN), has an incorrect name or a combination of both.

How do you know if you're exempt from backup withholding?

Who Is Exempt from Backup Withholding? Most American citizens are exempted from backup withholding so long as their tax identification number (TIN) or social security number is on file with their broker, and corresponds with their legal name. Retirement accounts and unemployment income are also exempted.

What is a CP2100 b notice?

Payer information The IRS will issue a CP2100 or CP2100A Notice if the payee's TIN is missing or obviously incorrect (not 9 digits or contains something other than a number) or their name and TIN on the information return filed does not match the IRS's records.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find publication 1281?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the publication 1281 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit publication 1281 online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your publication 1281 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I complete publication 1281 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your publication 1281. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is IRS Publication 1281?

IRS Publication 1281 explains the requirements for filing information returns for certain reporting agents, specifically focusing on the penalties for not properly reporting backup withholding and offering guidance on related forms.

Who is required to file IRS Publication 1281?

Generally, businesses and organizations that pay out certain types of income and are required to withhold backup withholding on those payments must file IRS Publication 1281.

How to fill out IRS Publication 1281?

To fill out IRS Publication 1281, report the required details regarding income payments, backup withholding amounts, and any other pertinent information on the designated forms, ensuring accuracy and completeness to avoid penalties.

What is the purpose of IRS Publication 1281?

The purpose of IRS Publication 1281 is to provide guidance and instructions for taxpayers on how to report backup withholding information and ensure compliance with IRS regulations.

What information must be reported on IRS Publication 1281?

The information that must be reported on IRS Publication 1281 includes the name, address, taxpayer identification number of the payee, total amount paid, total amount withheld, and other details regarding the income type and withholding.

Fill out your publication 1281 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Publication 1281 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.