Get the free Partnership and unincorporated bodies online banking applications

Show details

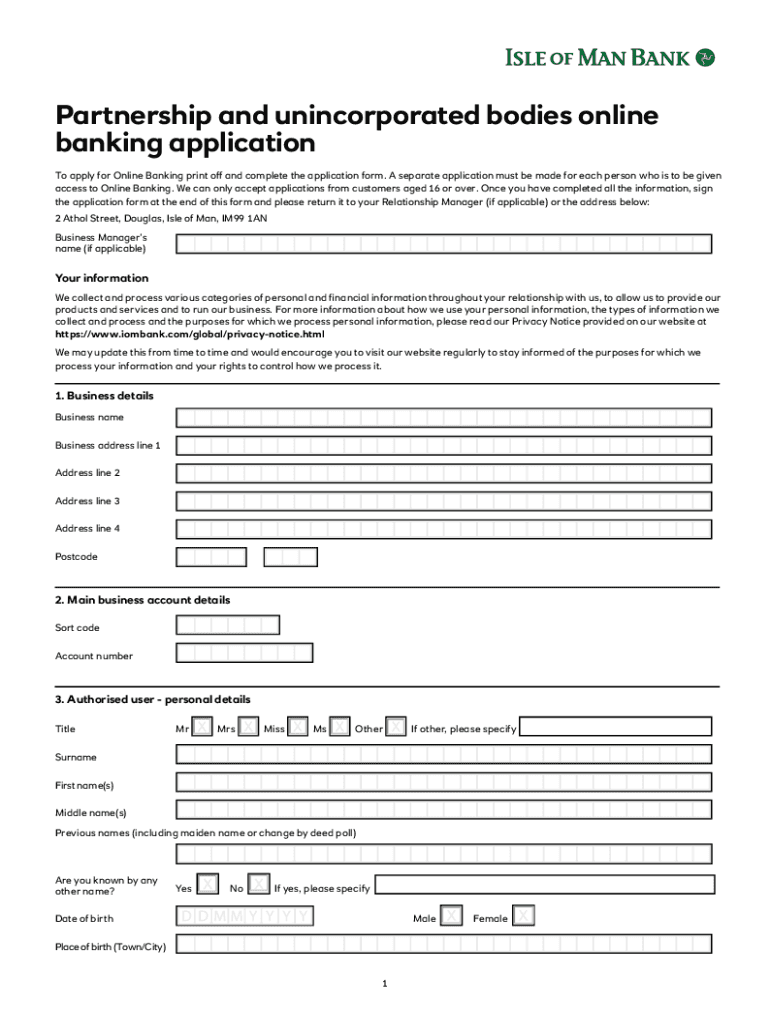

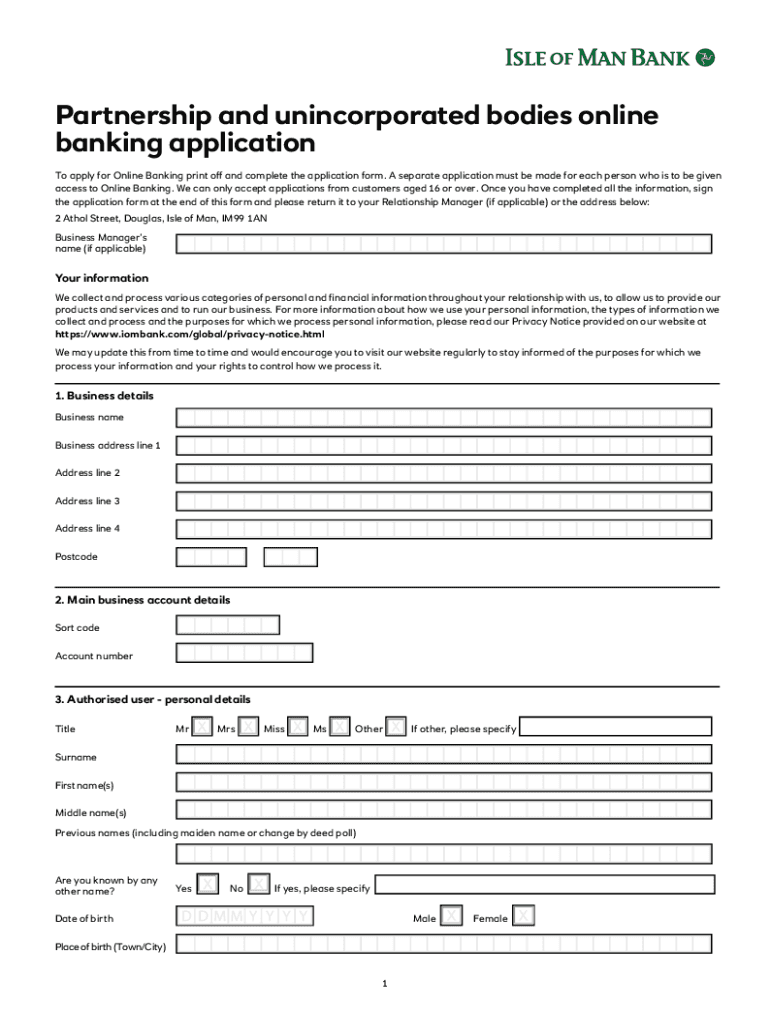

Partnership and unincorporated bodies online banking application To apply for Online Banking print off and complete the application form. A separate application must be made for each person who is

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign partnership and unincorporated bodies

Edit your partnership and unincorporated bodies form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your partnership and unincorporated bodies form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing partnership and unincorporated bodies online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit partnership and unincorporated bodies. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out partnership and unincorporated bodies

How to fill out partnership and unincorporated bodies

01

Start by gathering all the necessary information about your partnership or unincorporated body. This includes the names of all the partners or members, their contact information, and their contributions to the partnership or body.

02

Choose a name for your partnership or unincorporated body. Make sure to check if the name is already in use by conducting a search in the relevant business registry.

03

Decide on the type of partnership or unincorporated body you want to form. There are several types available, such as general partnerships, limited partnerships, and unincorporated associations. Each type has its own advantages and requirements.

04

Prepare the necessary legal documents for your partnership or unincorporated body. This typically includes a partnership agreement or a constitution that outlines the rights, responsibilities, and profit-sharing arrangements among the partners or members.

05

Register your partnership or unincorporated body with the appropriate government authorities. This may involve submitting the completed legal documents, paying registration fees, and providing any additional requested information.

06

Obtain any required licenses or permits based on the nature of your partnership or unincorporated body's activities. This may vary depending on your location and the industry you operate in.

07

Establish a system for managing the partnership or unincorporated body's finances, including opening a bank account in the name of the partnership or body and maintaining accurate financial records.

08

Comply with any ongoing reporting and compliance requirements imposed by the government authorities. This may include submitting annual financial statements, tax returns, and other relevant documents.

09

Regularly review and update your partnership or unincorporated body's legal documents and agreements to ensure they remain relevant and reflect any changes in the partnership or body's activities or membership.

10

Consider seeking professional legal and financial advice to navigate the complexities of forming and managing a partnership or unincorporated body.

Who needs partnership and unincorporated bodies?

01

Partnerships and unincorporated bodies are typically ideal for small businesses and organizations.

02

Entrepreneurs and professionals who want to pool their resources, skills, and expertise to pursue a common goal can benefit from forming a partnership or unincorporated body.

03

Nonprofit organizations, clubs, and associations often choose to operate as unincorporated bodies to enjoy the flexibility and simplicity of this legal structure.

04

Partnerships and unincorporated bodies are also suitable for joint ventures and collaborative projects between individuals or companies.

05

It is important to consult with legal professionals and consider the specific needs and goals of your business or organization to determine if a partnership or unincorporated body is the right choice.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit partnership and unincorporated bodies on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign partnership and unincorporated bodies. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How can I fill out partnership and unincorporated bodies on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your partnership and unincorporated bodies, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I fill out partnership and unincorporated bodies on an Android device?

On Android, use the pdfFiller mobile app to finish your partnership and unincorporated bodies. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is partnership and unincorporated bodies?

Partnership is a type of business structure where two or more individuals manage and operate a business in accordance with the terms and objectives set out in a Partnership Deed. An unincorporated body is a group of individuals acting together as a single entity, without being registered as a company or corporation.

Who is required to file partnership and unincorporated bodies?

Partnerships and unincorporated bodies are required to file their annual tax returns with the appropriate tax authority.

How to fill out partnership and unincorporated bodies?

Partnerships and unincorporated bodies can fill out their tax returns by providing information about their income, expenses, deductions, and partners' shares of profits and losses.

What is the purpose of partnership and unincorporated bodies?

The purpose of partnerships and unincorporated bodies is to report their financial activities to the tax authorities and determine the amount of tax payable.

What information must be reported on partnership and unincorporated bodies?

Partnerships and unincorporated bodies must report their income, expenses, deductions, and partners' shares of profits and losses.

Fill out your partnership and unincorporated bodies online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Partnership And Unincorporated Bodies is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.