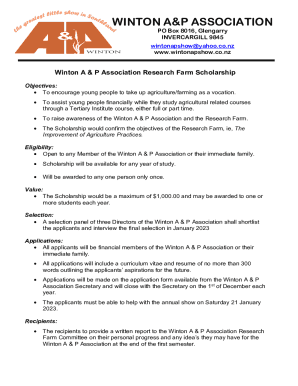

Get the free Reverse 1:5 stock split of Investor Class Common Stock

Show details

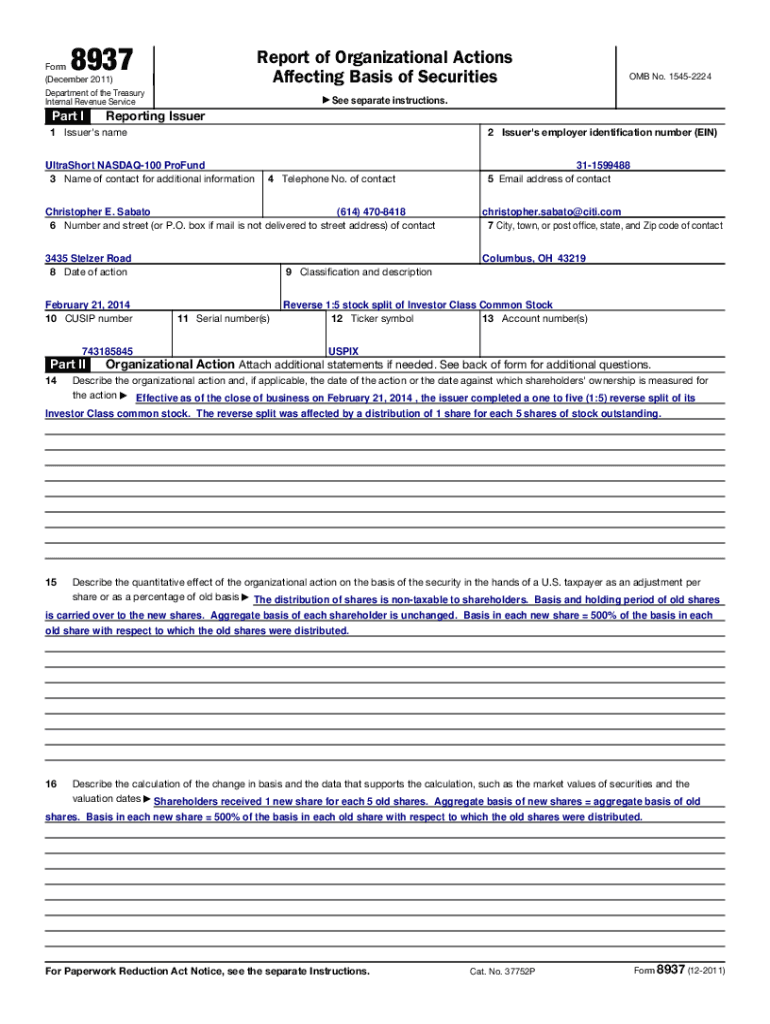

8937Report of Organizational Actions Affecting Basis of SecuritiesForm (December 2011) Department of the Treasury Internal Revenue Serviceman I See OMB No. 15452224separate instructions. Reporting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign reverse 15 stock split

Edit your reverse 15 stock split form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your reverse 15 stock split form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit reverse 15 stock split online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit reverse 15 stock split. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out reverse 15 stock split

How to fill out reverse 15 stock split

01

Step 1: Gather the necessary information. This includes the stock split ratio (in this case, a reverse 15 stock split), the number of shares you currently own, and any documentation provided by the company announcing the reverse split.

02

Step 2: Calculate the new number of shares you will have after the reverse stock split. To do this, divide your current number of shares by the stock split ratio. For example, if you currently own 100 shares, divide 100 by 15 to get 6.67 shares.

03

Step 3: Determine if fractional shares will be issued. Some companies may choose to issue fractional shares, while others may round up or down. Consult the documentation provided by the company to understand how fractional shares are handled.

04

Step 4: Update your stock portfolio or brokerage account with the new number of shares. This can typically be done online through your brokerage platform or by contacting your broker directly.

05

Step 5: Monitor the value of your shares after the reverse stock split. Keep in mind that the overall value of your investment should remain the same, as the stock price will generally adjust accordingly.

06

Step 6: Stay informed about any additional instructions or updates provided by the company regarding the reverse split. This may include notifications about any necessary paperwork or changes to your shareholder rights.

Who needs reverse 15 stock split?

01

Companies may choose to implement a reverse 15 stock split for various reasons, such as boosting the per-share price of their stock to meet exchange listing requirements, reducing the number of outstanding shares to increase earnings per share, or attracting potential investors who may perceive a higher stock price as more valuable.

02

Investors who are already shareholders of a particular company may need to be aware of a reverse 15 stock split to understand how it may impact their investment. It is important for shareholders to follow any instructions provided by the company and consult with their financial advisor or broker if they have any questions or concerns.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get reverse 15 stock split?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific reverse 15 stock split and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit reverse 15 stock split straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit reverse 15 stock split.

How do I fill out reverse 15 stock split using my mobile device?

Use the pdfFiller mobile app to complete and sign reverse 15 stock split on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is reverse 15 stock split?

A reverse 15 stock split is a corporate action where a company reduces the number of its outstanding shares, typically at a ratio of 1-for-15, in order to increase the price per share.

Who is required to file reverse 15 stock split?

Companies that have decided to implement a reverse 15 stock split must file the necessary paperwork with the appropriate regulatory authorities and shareholders.

How to fill out reverse 15 stock split?

To fill out a reverse 15 stock split, companies need to follow the guidelines provided by regulatory authorities, which may include submitting a formal request, providing details of the split ratio and effective date, and obtaining shareholder approval.

What is the purpose of reverse 15 stock split?

The purpose of a reverse 15 stock split is to increase the price per share of a company's stock, which can make it more attractive to investors and improve the perceived value of the company.

What information must be reported on reverse 15 stock split?

Companies must report details of the split ratio, effective date, reasons for the split, and any impact on the company's financial position in the filings for reverse 15 stock split.

Fill out your reverse 15 stock split online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Reverse 15 Stock Split is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.