Get the free Reverse 1:10 stock split of Service Class Common Stock

Show details

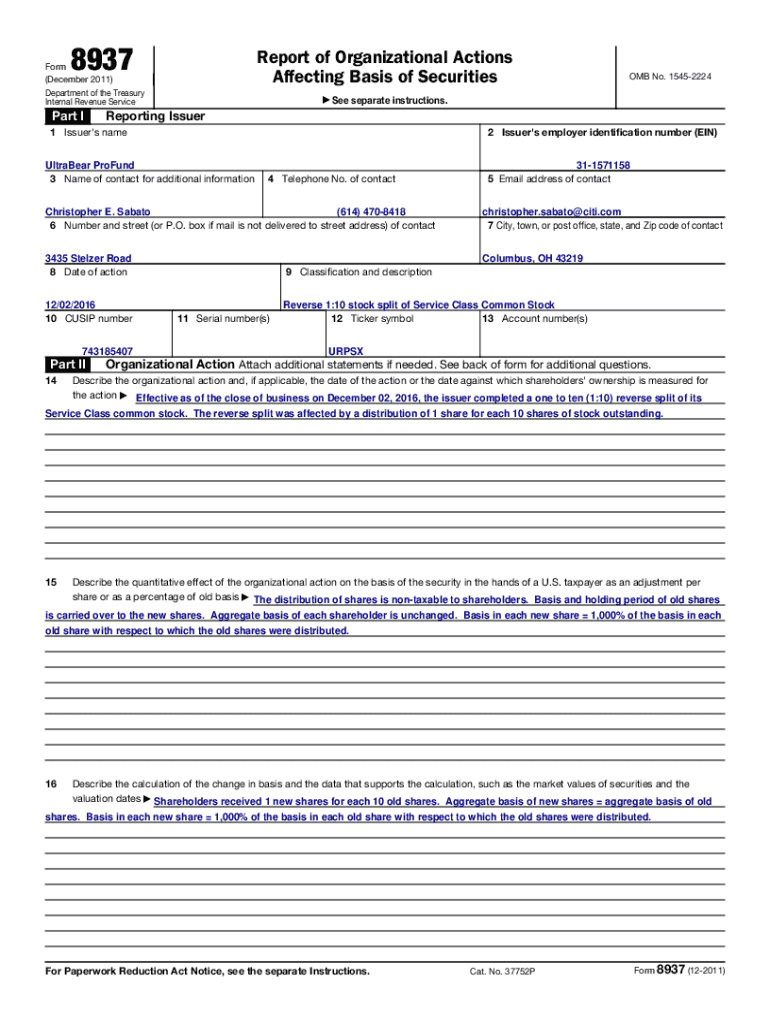

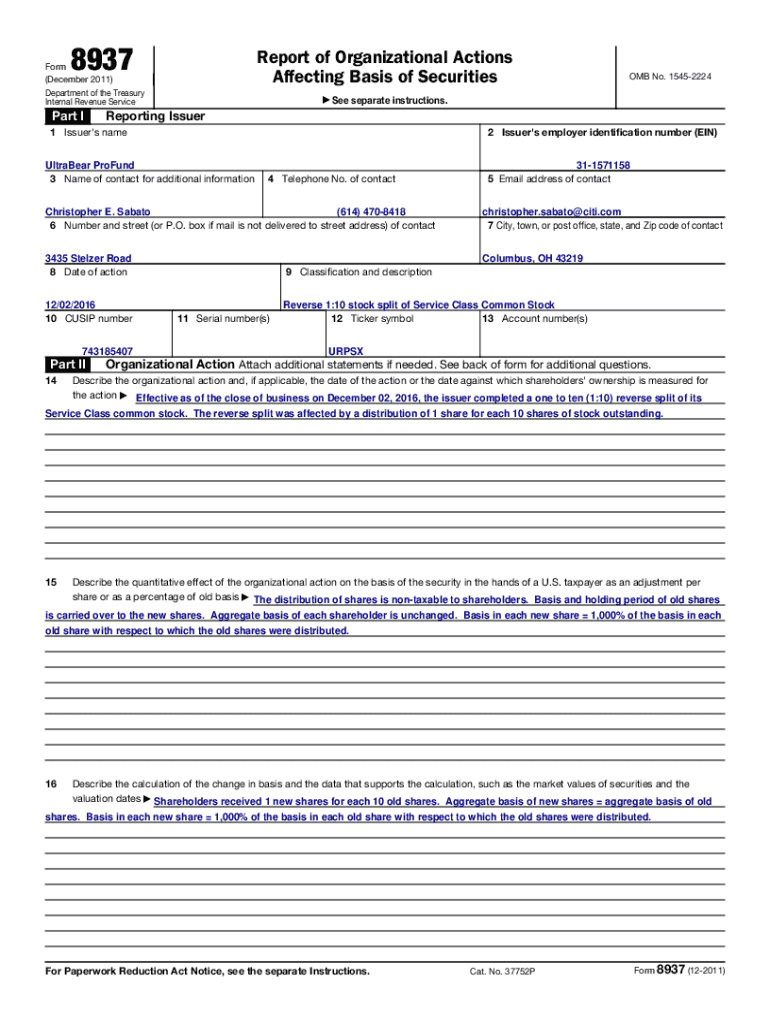

8937Report of Organizational Actions Affecting Basis of SecuritiesForm (December 2011) Department of the Treasury Internal Revenue Serviceman I See OMB No. 15452224separate instructions. Reporting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign reverse 110 stock split

Edit your reverse 110 stock split form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your reverse 110 stock split form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing reverse 110 stock split online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit reverse 110 stock split. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out reverse 110 stock split

How to fill out reverse 110 stock split

01

To fill out a reverse 110 stock split, follow these steps:

02

Calculate the number of shares you currently own. If you own 100 shares, for example, the 110 stock split means you will end up with 100/110 = 0.909 shares after the split.

03

Determine the new share price. If the stock is currently trading at $100 per share, the new share price after the reverse 110 stock split would be $100 * 1.1 = $110.

04

Adjust your portfolio accordingly. Take into account the fractional shares resulting from the reverse stock split. You may need to sell or purchase additional shares to reach whole numbers.

05

Update your stock records and notify your broker if necessary.

06

Please consult with a financial advisor or broker for personalized advice on how to fill out a reverse 110 stock split, as individual circumstances may vary.

Who needs reverse 110 stock split?

01

A reverse 110 stock split is typically conducted by companies whose stock price has significantly declined over time and wants to inflate the stock price to regain compliance with exchange or regulatory requirements.

02

It is also used as a strategy to reduce the number of outstanding shares for various reasons, such as increasing the earnings per share or attracting potential investors who prefer higher-priced stocks.

03

Companies facing financial difficulties, delisting threats, or struggling with low stock prices often consider reverse stock splits as a means to improve their market perception and attract more investors.

04

Please note that the decision to conduct a reverse 110 stock split would be made by the company's board of directors and management, and it may not be suitable or available to individual retail investors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my reverse 110 stock split directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign reverse 110 stock split and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I get reverse 110 stock split?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific reverse 110 stock split and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for the reverse 110 stock split in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your reverse 110 stock split in seconds.

What is reverse 110 stock split?

A reverse 110 stock split is a corporate action in which a company reduces the total number of its outstanding shares, typically by consolidating shares, thereby increasing the nominal value of each share without changing the overall market capitalization.

Who is required to file reverse 110 stock split?

Companies that undertake a reverse 110 stock split are required to file the relevant paperwork with the appropriate regulatory body, often including the Securities and Exchange Commission (SEC) in the United States.

How to fill out reverse 110 stock split?

To fill out a reverse 110 stock split, the company must complete the designated forms from the regulatory authority, ensuring that all required information about the split ratio, effective date, and other pertinent details are accurately provided.

What is the purpose of reverse 110 stock split?

The purpose of a reverse 110 stock split is often to increase the share price in order to meet minimum listing requirements for stock exchanges, improve the perception of the company's stock, or consolidate shareholder equity.

What information must be reported on reverse 110 stock split?

Information that must be reported typically includes the new share price post-split, the share consolidation ratio, the effective date of the split, and any adjustments to existing shareholder equity.

Fill out your reverse 110 stock split online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Reverse 110 Stock Split is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.