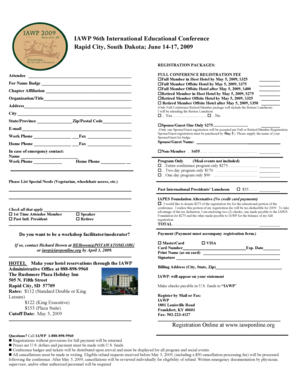

CA CDTFA-269-A (Formerly BOE-269-A) 2012-2025 free printable template

Show details

BOE-269-A FRONT REV. 9 8-12 STATE OF CALIFORNIA BEER AND WINE IMPORTED INTO CALIFORNIA BOARD OF EQUALIZATION Please read the instructions on the reverse before preparing this report. O. Box 942879 Sacramento CA 94279-0088. CLEAR SPARKLING PURCHASED FROM I. Totals for Current Month to Date Brought Forward of e ADDRESS street city state and zip code PRINT BOE-269-A BACK REV. 9 8-12 INSTRUCTIONS Pursuant to Alcoholic Beverage Tax Regulation 2538 every beer and wine importer shall on or before...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA CDTFA-269-A Formerly BOE-269-A

Edit your CA CDTFA-269-A Formerly BOE-269-A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA CDTFA-269-A Formerly BOE-269-A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA CDTFA-269-A Formerly BOE-269-A online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CA CDTFA-269-A Formerly BOE-269-A. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out CA CDTFA-269-A Formerly BOE-269-A

How to fill out CA CDTFA-269-A (Formerly BOE-269-A)

01

Obtain the CA CDTFA-269-A form from the California Department of Tax and Fee Administration (CDTFA) website.

02

Enter your personal information in the designated fields, including your name, address, and contact information.

03

Provide your account information or the registration number associated with your business.

04

Fill in the details about the specific transaction or item for which you are claiming a refund or credit.

05

Include any relevant documentation, such as proof of purchase or previous tax payments, to support your claim.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the form via mail or electronically, as instructed on the form or the CDTFA website.

Who needs CA CDTFA-269-A (Formerly BOE-269-A)?

01

Anyone who has overpaid sales tax or is seeking a refund for sales tax paid on purchases.

02

Businesses that have made exempt sales and need to report and claim an exemption.

03

Individuals or entities who are correcting previously reported sales tax liabilities.

Instructions and Help about CA CDTFA-269-A Formerly BOE-269-A

Fill

form

: Try Risk Free

People Also Ask about

What is the welfare exemption in California?

To be eligible for the Welfare Exemption, Revenue and Taxation Code section 214(a)(6) requires both that (1) property is irrevocably dedicated to religious, hospital, scientific, or charitable purposes, and (2) upon liquidation, dissolution or abandonment by the owner, property will not inure to the benefit of any

How can I lower my property taxes in California?

If you own a home and occupy it as your principal place of residence, you may apply for a Homeowners' Exemption. This exemption will reduce your annual assessed value by $7,000. Exemption becomes ineligible for the exemption. Homeowners' Exemptions are not automatically transferred between properties.

Does California offer a senior discount on property taxes?

The State of California offers three senior citizen property tax relief programs: Property Tax Assistance offers tax relief to qualifying low-income seniors. This program includes a cash reimbursement for a certain portion of property taxes.

How do I get over 65 property tax exemption in California?

The State Controller's Property Tax Postponement Program allows homeowners who are seniors, are blind, or have a disability to defer current-year property taxes on their principal residence if they meet certain criteria, including at least 40 percent equity in the home and an annual household income of $51,762 or less

Who qualifies for California homeowners property tax exemption?

You must be a property owner, co-owner or a purchaser named in a contract of sale. You must occupy your home as your principal place of residence as of 12:01 a.m., January 1 each year. Principal place of residence generally means where: You return at the end of the day.

Who qualifies for property tax exemption California?

You must be a property owner, co-owner or a purchaser named in a contract of sale. You must occupy your home as your principal place of residence as of 12:01 a.m., January 1 each year. Principal place of residence generally means where: You return at the end of the day.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send CA CDTFA-269-A Formerly BOE-269-A to be eSigned by others?

Once your CA CDTFA-269-A Formerly BOE-269-A is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I execute CA CDTFA-269-A Formerly BOE-269-A online?

pdfFiller makes it easy to finish and sign CA CDTFA-269-A Formerly BOE-269-A online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit CA CDTFA-269-A Formerly BOE-269-A in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your CA CDTFA-269-A Formerly BOE-269-A, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is CA CDTFA-269-A (Formerly BOE-269-A)?

CA CDTFA-269-A is a form used by the California Department of Tax and Fee Administration (CDTFA) to report the sale and use tax liabilities for businesses operating in California.

Who is required to file CA CDTFA-269-A (Formerly BOE-269-A)?

Businesses in California that have sales or use tax obligations are required to file CA CDTFA-269-A. This includes retailers, wholesalers, and those who make taxable sales or purchases.

How to fill out CA CDTFA-269-A (Formerly BOE-269-A)?

To fill out CA CDTFA-269-A, gather all relevant sales and use tax information, provide detailed information about your business, report sales amounts, apply appropriate tax rates, and ensure all calculations are accurate before submitting the form.

What is the purpose of CA CDTFA-269-A (Formerly BOE-269-A)?

The purpose of CA CDTFA-269-A is to facilitate the accurate reporting and payment of sales and use taxes owed to the state of California, ensuring compliance with tax laws.

What information must be reported on CA CDTFA-269-A (Formerly BOE-269-A)?

Information that must be reported on CA CDTFA-269-A includes the total sales and purchases, applicable tax rates, exempt sales, and other necessary details regarding the business's tax liabilities.

Fill out your CA CDTFA-269-A Formerly BOE-269-A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA CDTFA-269-A Formerly BOE-269-A is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.